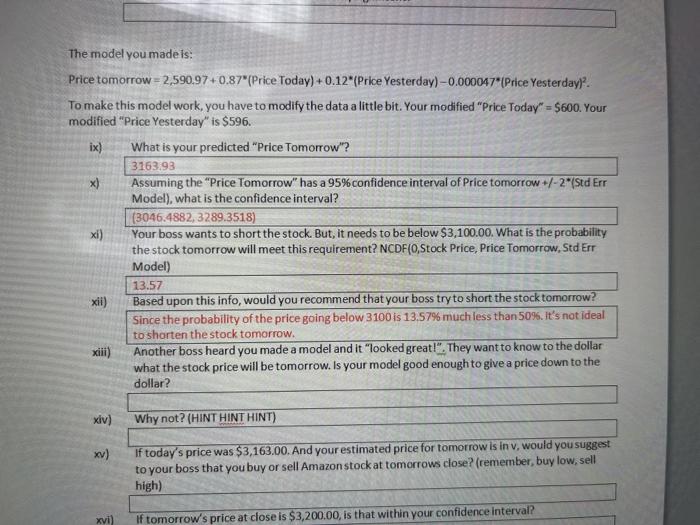

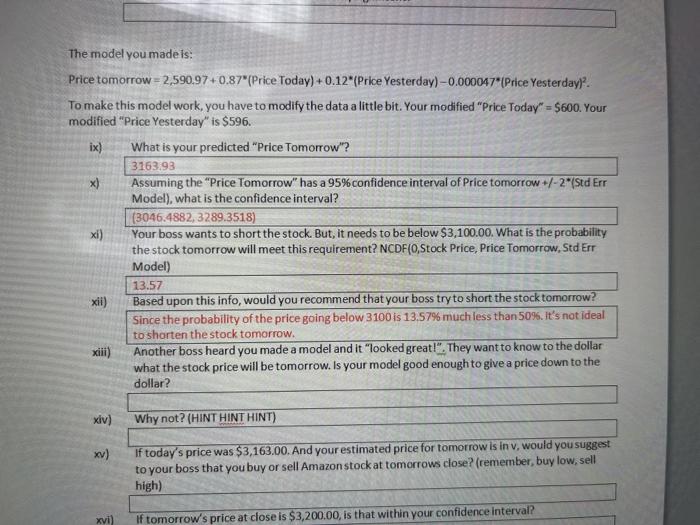

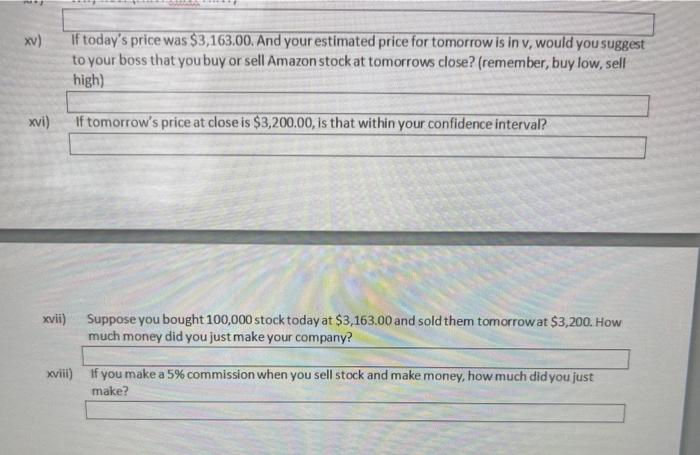

only xiii, xiv, xv, xvi, xvii, xviii please.!!!

The model you madels: Price tomorrow = 2,590.97+0.87"(Price Today) +0.12"(Price Yesterday) - 0.000047"Price Yesterday). To make this model work, you have to modify the data a little bit. Your modified "Price Today" = $600. Your modified "Price Yesterday" is $596. ix) What is your predicted "Price Tomorrow"? 3163.93 x) Assuming the "Price Tomorrow" has a 95% confidence interval of Price tomorrow +/-2*(Std Err Model), what is the confidence interval? (3046.4882, 3289.3518) xi) Your boss wants to short the stock. But, it needs to be below $3,100.00. What is the probability the stock tomorrow will meet this requirement? NCDF(0,Stock Price Price Tomorrow, Std Err Model) 13.57 xii) Based upon this info, would you recommend that your boss try to short the stock tomorrow? Since the probability of the price going below 3100 is 13.57% much less than 50%. It's not ideal to shorten the stock tomorrow. xiii) Another boss heard you made a model and it "looked great!". They want to know to the dollar what the stock price will be tomorrow. Is your model good enough to give a price down to the dollar? xiv) Why not? (HINT HINT HINT) xv) If today's price was $3,163.00. And your estimated price for tomorrow is in v, would you suggest to your boss that you buy or sell Amazon stock at tomorrows close?(remember, buy low, sell high) xvi) If tomorrow's price at close is $3,200.00, is that within your confidence interval? xv) If today's price was $3,163.00. And your estimated price for tomorrow is in v, would you suggest to your boss that you buy or sell Amazon stock at tomorrows close? (remember, buy low, sell high) xvi) If tomorrow's price at close is $3,200.00, is that within your confidence interval? xvii) Suppose you bought 100,000 stock today at $3,163.00 and sold them tomorrow at $3,200. How much money did you just make your company? xviil) if you make a 5% commission when you sell stock and make money, how much did you just make? The model you madels: Price tomorrow = 2,590.97+0.87"(Price Today) +0.12"(Price Yesterday) - 0.000047"Price Yesterday). To make this model work, you have to modify the data a little bit. Your modified "Price Today" = $600. Your modified "Price Yesterday" is $596. ix) What is your predicted "Price Tomorrow"? 3163.93 x) Assuming the "Price Tomorrow" has a 95% confidence interval of Price tomorrow +/-2*(Std Err Model), what is the confidence interval? (3046.4882, 3289.3518) xi) Your boss wants to short the stock. But, it needs to be below $3,100.00. What is the probability the stock tomorrow will meet this requirement? NCDF(0,Stock Price Price Tomorrow, Std Err Model) 13.57 xii) Based upon this info, would you recommend that your boss try to short the stock tomorrow? Since the probability of the price going below 3100 is 13.57% much less than 50%. It's not ideal to shorten the stock tomorrow. xiii) Another boss heard you made a model and it "looked great!". They want to know to the dollar what the stock price will be tomorrow. Is your model good enough to give a price down to the dollar? xiv) Why not? (HINT HINT HINT) xv) If today's price was $3,163.00. And your estimated price for tomorrow is in v, would you suggest to your boss that you buy or sell Amazon stock at tomorrows close?(remember, buy low, sell high) xvi) If tomorrow's price at close is $3,200.00, is that within your confidence interval? xv) If today's price was $3,163.00. And your estimated price for tomorrow is in v, would you suggest to your boss that you buy or sell Amazon stock at tomorrows close? (remember, buy low, sell high) xvi) If tomorrow's price at close is $3,200.00, is that within your confidence interval? xvii) Suppose you bought 100,000 stock today at $3,163.00 and sold them tomorrow at $3,200. How much money did you just make your company? xviil) if you make a 5% commission when you sell stock and make money, how much did you just make