Answered step by step

Verified Expert Solution

Question

1 Approved Answer

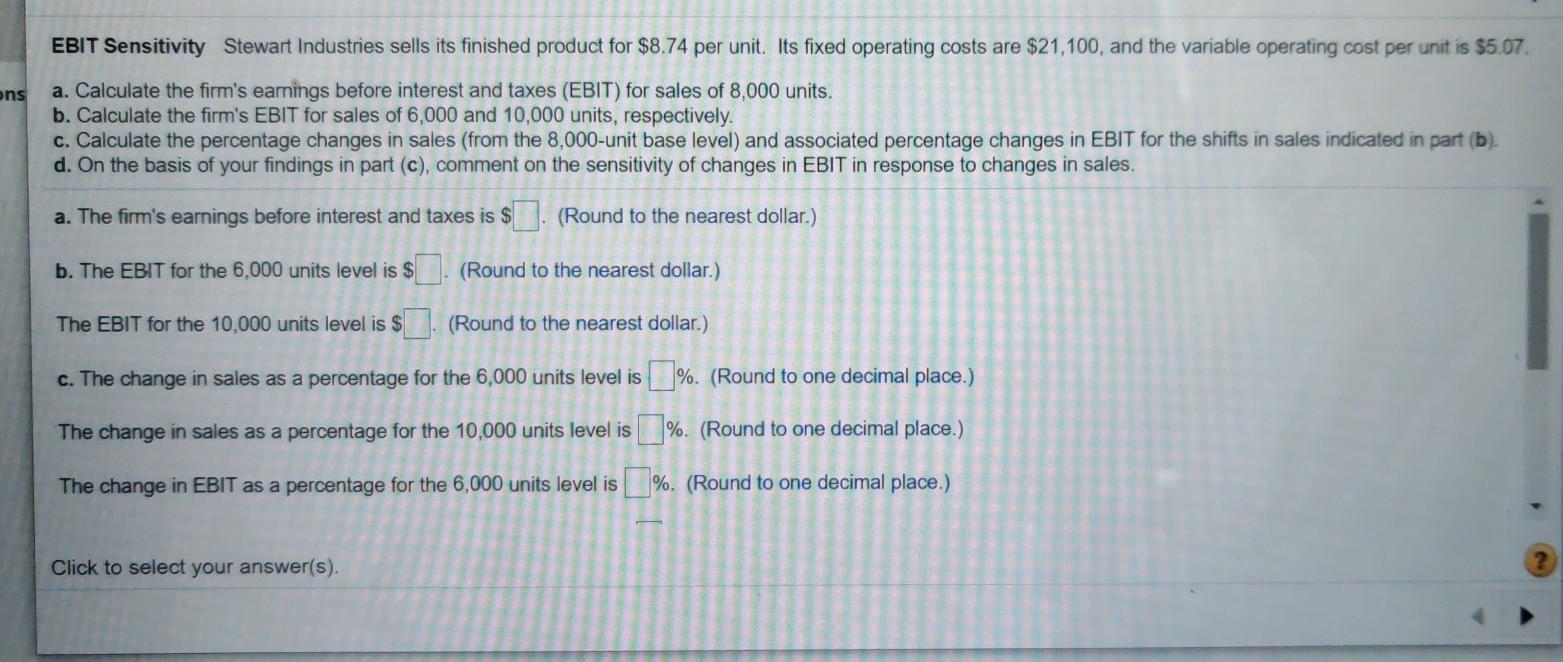

ons EBIT Sensitivity Stewart Industries sells its finished product for $8.74 per unit. Its fixed operating costs are $21,100, and the variable operating cost per

ons EBIT Sensitivity Stewart Industries sells its finished product for $8.74 per unit. Its fixed operating costs are $21,100, and the variable operating cost per unit is $5.07 a. Calculate the firm's earnings before interest and taxes (EBIT) for sales of 8,000 units. b. Calculate the firm's EBIT for sales of 6,000 and 10,000 units, respectively. c. Calculate the percentage changes in sales (from the 8,000-unit base level) and associated percentage changes in EBIT for the shifts in sales indicated in part (b). d. On the basis of your findings in part (c), comment on the sensitivity of changes in EBIT in response to changes in sales. a. The firm's earnings before interest and taxes is $ (Round to the nearest dollar.) b. The EBIT for the 6.000 units level is $ (Round to the nearest dollar.) The EBIT for the 10,000 units level is $ (Round to the nearest dollar.) C. The change in sales as a percentage for the 6,000 units level is %. (Round to one decimal place.) The change in sales as a percentage for the 10,000 units level is %. (Round to one decimal place.) The change in EBIT as a percentage for the 6,000 units level is %. (Round to one decimal place.) Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started