Answered step by step

Verified Expert Solution

Question

1 Approved Answer

onsel statemsent f The following sa Chapters 18, 7 and 8 th tice test to help you idA t above, The sample es III. Accounts

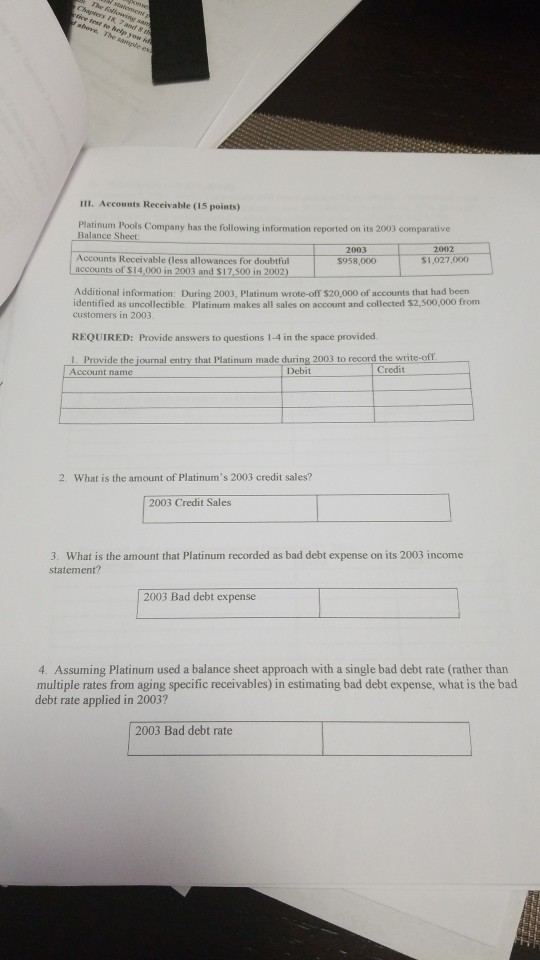

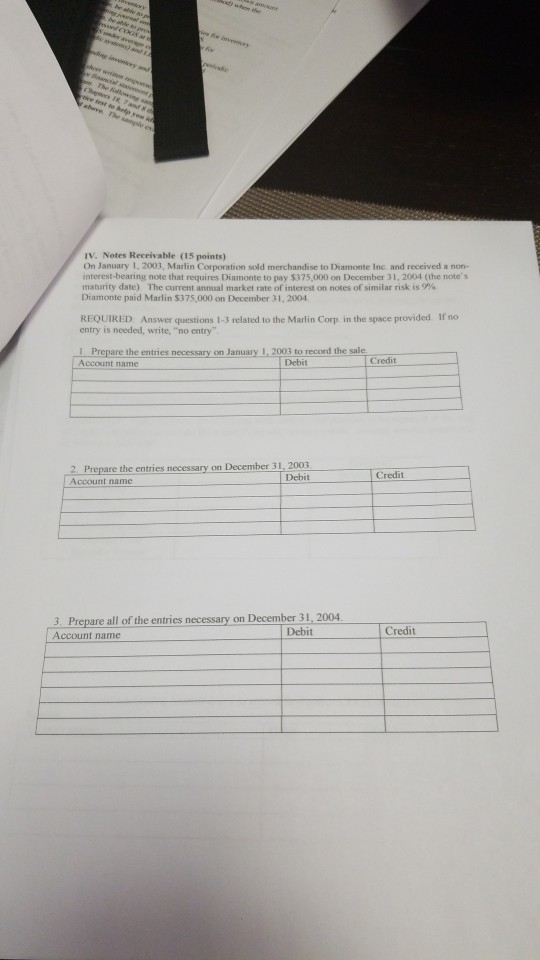

onsel statemsent f The following sa Chapters 18, 7 and 8 th tice test to help you idA t above, The sample es III. Accounts Receivable (15 points) Platinum Pools Company has the following information reported on its 2003 comparative Balance Sheet 2002 2003 $1,027,000 $958,000 Accounts Receivable (less allowances for doubtful accounts of S14,000 in 2003 and $17,500 in 2002) Additional information: During 2003, Platinum wrote-off $20,000 of accounts that had been identified as uncollectible. Platinum makes all sales on account and collected $2,500,000 from customers in 2003 REQUIRED: Provide answers to questions 1-4 in the space provided. 1 Provide the journal entry that Platinum made during 2003 to record the write-off Account name Credit Debit 2. What is the amount of Platinum's 2003 credit sales? 2003 Credit Sales 3. What is the amount that Platinum recorded as bad debt expense on its 2003 income statement? 2003 Bad debt expense 4. Assuming Platinum used a balance sheet approach with a single bad debt rate (rather than multiple rates from aging specific receivables) in estimating bad debt expense, what is the bad debt rate applied in 2003? 2003 Bad debt rate ano ody whor the venesry be able to p jnaf beable Ro p es for iove y nder averae c so)and 1 igg inventy and Lowiode hor wn nepons fnancial stanmont The following sam Chers 1 7 and 8 wwice test to hrip vew f above The smle es IV. Notes Receivable (15 points) On January 1, 2003, Marlin Corporation sold merchandise to Diamonte Inc and received a non- interest-bearing note that requires Diamonte to pay $375,000 on December 31, 2004 (the note's maturity date) The current annual market rate of interest on notes of similar risk is 9% Diamonte paid Marlin $375,000 on December 31, 2004 REQUIRED Answer questions 1-3 related to the Marlin Corp. in the space provided 1If no entry is needed, write, "no entry" Prepare the entries necessary on January 1, 2003 to record the sale Account name Credit Debit Credit Debit 2. Prepare the entries necessary on December 31, 2003 Account name 3. Prepare all of the entries necessary on December 31, 2004. Account name Credit Debit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started