Answered step by step

Verified Expert Solution

Question

1 Approved Answer

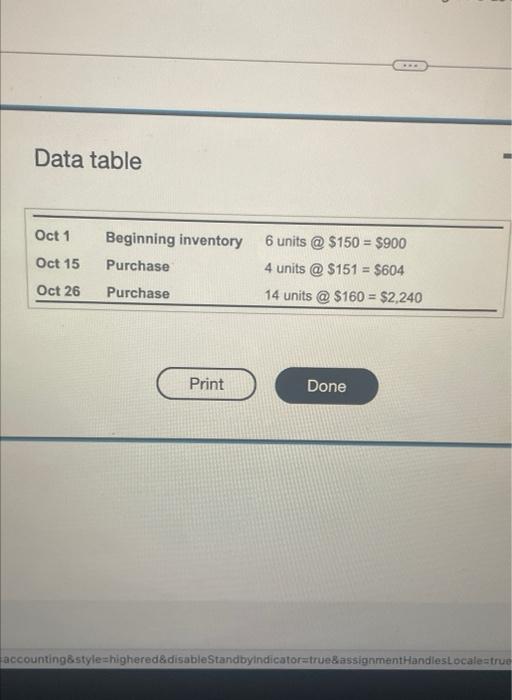

Ontario Company's inventory records for its retail division show the following at October 31: (Click the icon to view the accounting records.) At October

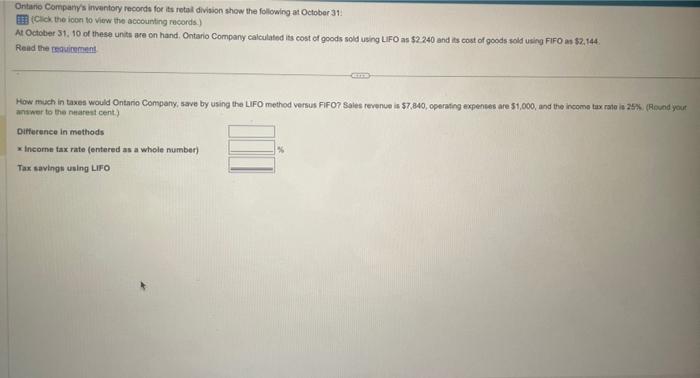

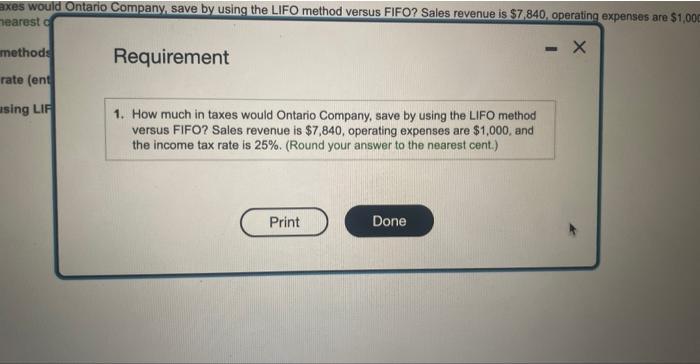

Ontario Company's inventory records for its retail division show the following at October 31: (Click the icon to view the accounting records.) At October 31, 10 of these units are on hand. Ontario Company calculated its cost of goods sold using LIFO as $2.240 and its cost of goods sold using FIFO as $2.144. Read the requirement How much in taxes would Ontario Company, save by using the LIFO method versus FIFO? Sales revenue is $7,840, operating expenses are $1,000, and the income tax rate is 25% (Round your answer to the nearest cent.) Difference in methods Income tax rate (entered as a whole number) Tax savings using LIFO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started