Answered step by step

Verified Expert Solution

Question

1 Approved Answer

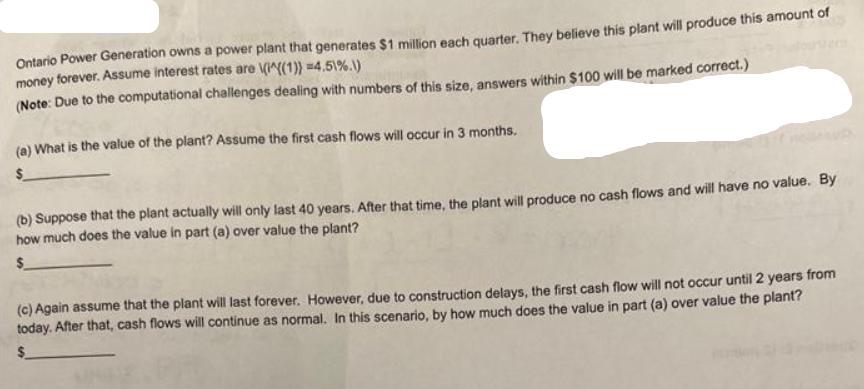

Ontario Power Generation owns a power plant that generates $1 million each quarter. They believe this plant will produce this amount of money forever.

Ontario Power Generation owns a power plant that generates $1 million each quarter. They believe this plant will produce this amount of money forever. Assume interest rates are \(^((1)) #4.51 %.1) (Note: Due to the computational challenges dealing with numbers of this size, answers within $100 will be marked correct.) (a) What is the value of the plant? Assume the first cash flows will occur in 3 months. (b) Suppose that the plant actually will only last 40 years. After that time, the plant will produce no cash flows and will have no value. By how much does the value in part (a) over value the plant? $ (c) Again assume that the plant will last forever. However, due to construction delays, the first cash flow will not occur until 2 years from today. After that, cash flows will continue as normal. In this scenario, by how much does the value in part (a) over value the plant? $

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started