Answered step by step

Verified Expert Solution

Question

1 Approved Answer

onter 111% ac 111 I Paper size Determine whether the common stock has increased or decreased in attractiveness during the past year. The stock's attractiveness

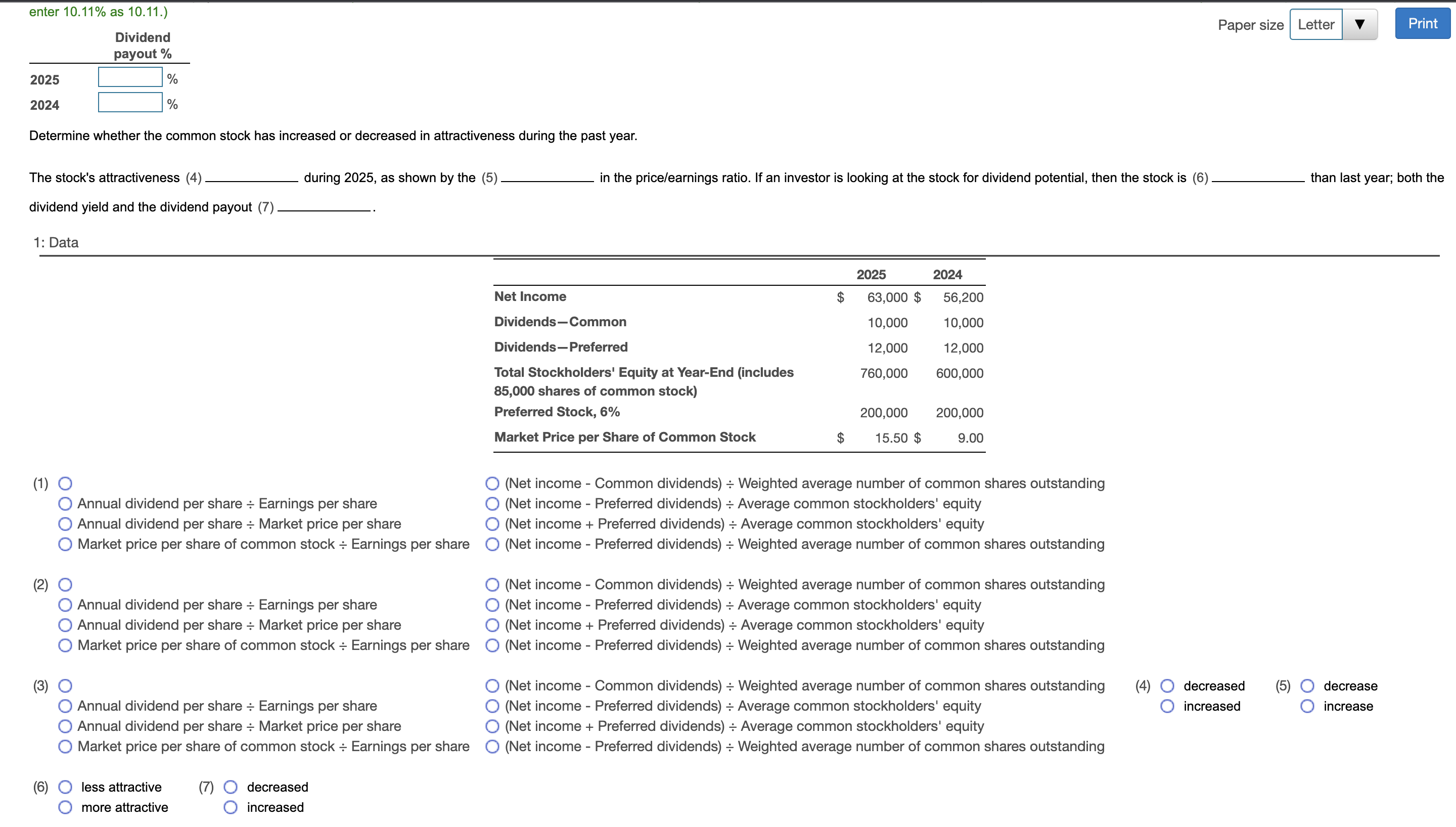

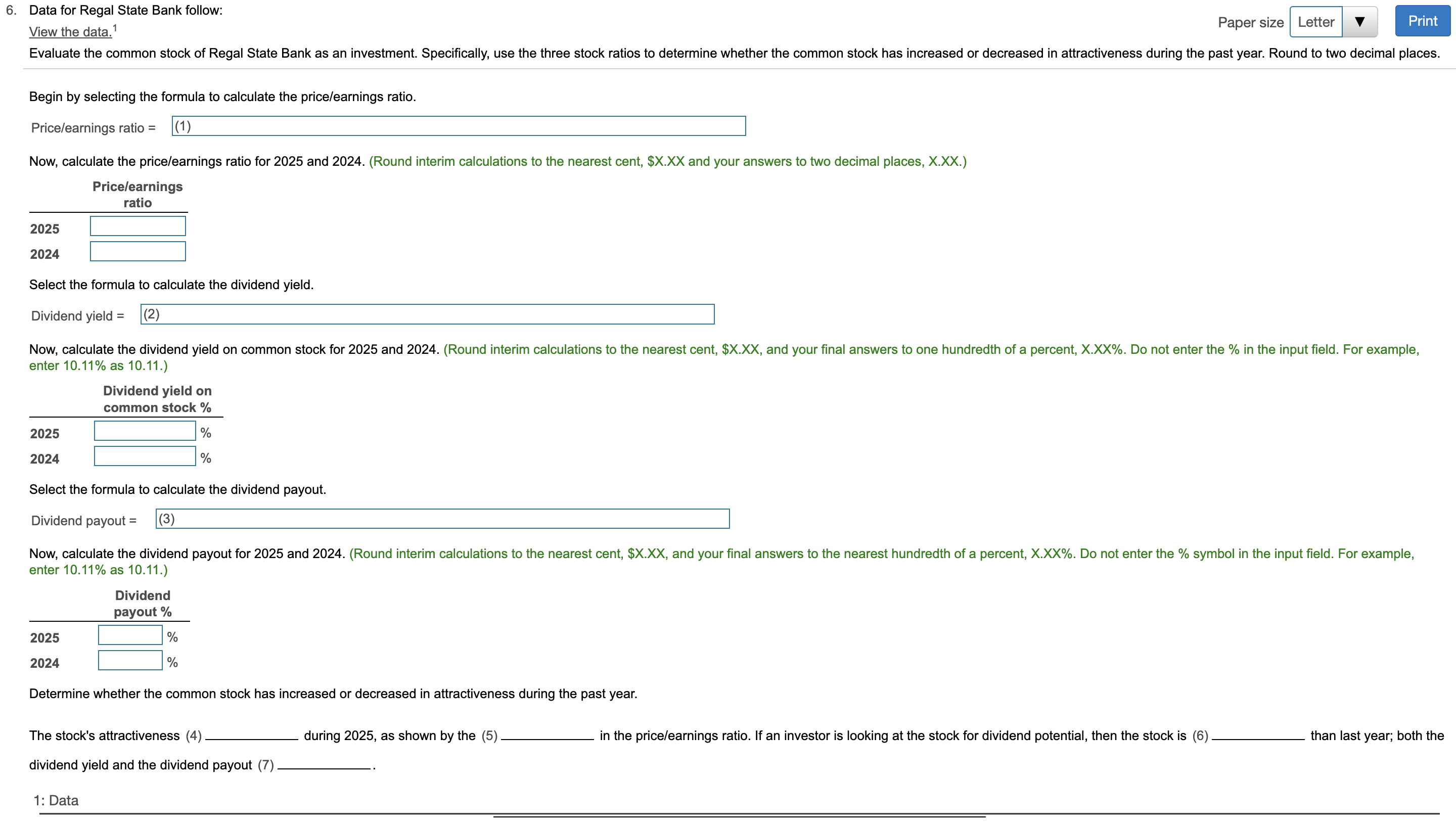

onter 111% ac 111 I Paper size Determine whether the common stock has increased or decreased in attractiveness during the past year. The stock's attractiveness (4) during 2025, as shown by the (5) in the price/earnings ratio. If an investor is looking at the stock for dividend potential, then the stock is (6) than last year; both the dividend yield and the dividend payout (7) 1: Data (1) Annual dividend per share Earnings per share Annual dividend per share Market price per share Market price per share of common stock Earnings per share (2) Annual dividend per share Earnings per share Annual dividend per share Market price per share Market price per share of common stock Earnings per share (3) Annual dividend per share Earnings per share Annual dividend per share Market price per share Market price per share of common stock Earnings per share (Net income - Common dividends) Weighted average number of common shares outstanding (Net income - Preferred dividends) Average common stockholders' equity (Net income + Preferred dividends) Average common stockholders' equity (Net income - Preferred dividends) Weighted average number of common shares outstanding (Net income - Common dividends) Weighted average number of common shares outstanding (Net income - Preferred dividends) Average common stockholders' equity (Net income + Preferred dividends) Average common stockholders' equity (Net income - Preferred dividends) Weighted average number of common shares outstanding (Net income - Common dividends) Weighted average number of common shares outstanding (Net income - Preferred dividends) Average common stockholders' equity (Net income + Preferred dividends) Average common stockholders' equity (Net income - Preferred dividends) Weighted average number of common shares outstanding decreased increased (5) decrease increase (6) less attractive (7) decreased more attractive increased View the data. 1 Begin by selecting the formula to calculate the price/earninas ratio. Price/earnings ratio = Now, calculate the price/earnings ratio for 2025 and 2024. (Round interim calculations to the nearest cent, \$X.XX and your answers to two decimal places, X.XX.) Select the formula to calculate the dividend yield. Dividend yield = enter 10.11% as 10.11 .) Select the formula to calculate the dividend payout. Dividend payout =(3) enter 10.11% as 10.11 .) Determine whether the common stock has increased or decreased in attractiveness during the past year. The stock's attractiveness (4) during 2025 , as shown by the (5) in the price/earnings ratio. If an investor is looking at the stock for dividend potential, then the stock is (6) than last year; both the dividend yield and the dividend payout (7. 1: Data

onter 111% ac 111 I Paper size Determine whether the common stock has increased or decreased in attractiveness during the past year. The stock's attractiveness (4) during 2025, as shown by the (5) in the price/earnings ratio. If an investor is looking at the stock for dividend potential, then the stock is (6) than last year; both the dividend yield and the dividend payout (7) 1: Data (1) Annual dividend per share Earnings per share Annual dividend per share Market price per share Market price per share of common stock Earnings per share (2) Annual dividend per share Earnings per share Annual dividend per share Market price per share Market price per share of common stock Earnings per share (3) Annual dividend per share Earnings per share Annual dividend per share Market price per share Market price per share of common stock Earnings per share (Net income - Common dividends) Weighted average number of common shares outstanding (Net income - Preferred dividends) Average common stockholders' equity (Net income + Preferred dividends) Average common stockholders' equity (Net income - Preferred dividends) Weighted average number of common shares outstanding (Net income - Common dividends) Weighted average number of common shares outstanding (Net income - Preferred dividends) Average common stockholders' equity (Net income + Preferred dividends) Average common stockholders' equity (Net income - Preferred dividends) Weighted average number of common shares outstanding (Net income - Common dividends) Weighted average number of common shares outstanding (Net income - Preferred dividends) Average common stockholders' equity (Net income + Preferred dividends) Average common stockholders' equity (Net income - Preferred dividends) Weighted average number of common shares outstanding decreased increased (5) decrease increase (6) less attractive (7) decreased more attractive increased View the data. 1 Begin by selecting the formula to calculate the price/earninas ratio. Price/earnings ratio = Now, calculate the price/earnings ratio for 2025 and 2024. (Round interim calculations to the nearest cent, \$X.XX and your answers to two decimal places, X.XX.) Select the formula to calculate the dividend yield. Dividend yield = enter 10.11% as 10.11 .) Select the formula to calculate the dividend payout. Dividend payout =(3) enter 10.11% as 10.11 .) Determine whether the common stock has increased or decreased in attractiveness during the past year. The stock's attractiveness (4) during 2025 , as shown by the (5) in the price/earnings ratio. If an investor is looking at the stock for dividend potential, then the stock is (6) than last year; both the dividend yield and the dividend payout (7. 1: Data Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started