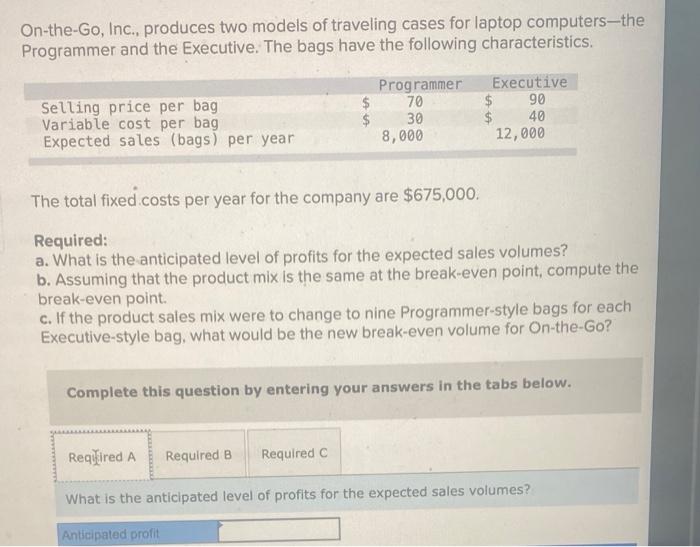

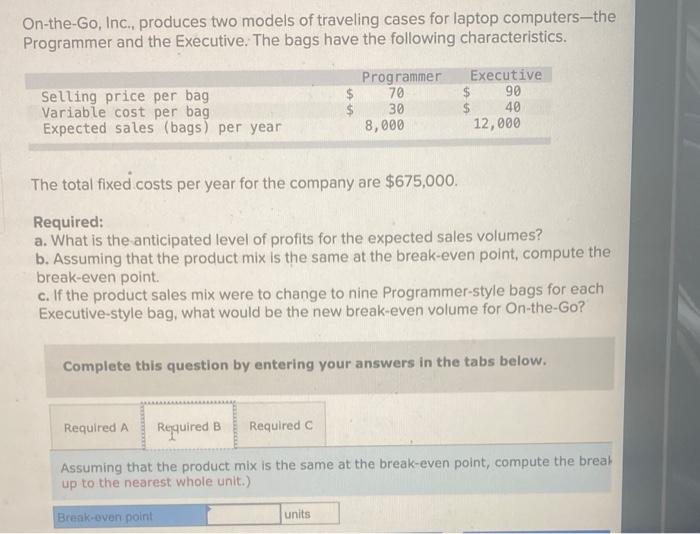

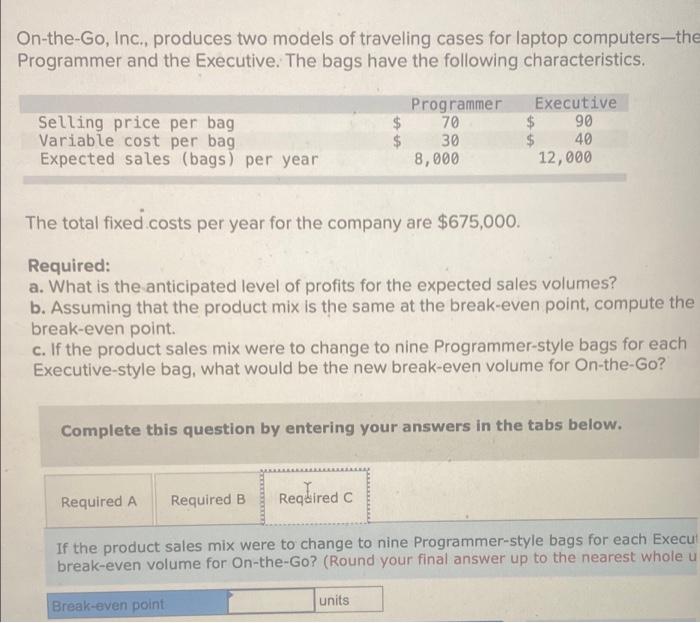

On-the-Go, Inc., produces two models of traveling cases for laptop computers-the Programmer and the Executive. The bags have the following characteristics. Programmer 70 Selling price per bag Variable cost per bag Expected sales (bags) per year $ $ Executive $ 90 $ 40 12,000 30 8,000 The total fixed.costs per year for the company are $675,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix is the same at the break-even point, compute the break-even point c. If the product sales mix were to change to nine Programmer-style bags for each Executive-style bag, what would be the new break-even volume for On-the-Go? Complete this question by entering your answers in the tabs below. Required A Required B Required What is the anticipated level of profits for the expected sales volumes? Anticipated profit On-the-Go, Inc., produces two models of traveling cases for laptop computers--the Programmer and the Executive. The bags have the following characteristics. $ Selling price per bag Variable cost per bag Expected sales (bags) per year Programmer 70 30 8,000 Executive $ 90 40 12,000 The total fixed costs per year for the company are $675,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix is the same at the break-even point, compute the break-even point c. If the product sales mix were to change to nine Programmer-style bags for each Executive-style bag, what would be the new break-even volume for On-the-Go? Complete this question by entering your answers in the tabs below. Required A Required B Required Assuming that the product mix is the same at the break-even point, compute the break up to the nearest whole unit.) Break-oven point units On-the-Go, Inc., produces two models of traveling cases for laptop computers-the Programmer and the Executive. The bags have the following characteristics. Executive 90 Selling price per bag Variable cost per bag Expected sales (bags) per year Programmer 70 30 8,000 $ 40 12,000 The total fixed.costs per year for the company are $675,000. Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the product mix is the same at the break-even point, compute the break-even point. c. If the product sales mix were to change to nine Programmer-style bags for each Executive-style bag, what would be the new break-even volume for On-the-Go? Complete this question by entering your answers in the tabs below. Required A Required B Required C If the product sales mix were to change to nine Programmer-style bags for each Execut break-even volume for On-the-Go? (Round your final answer up to the nearest whole u Break-even point units