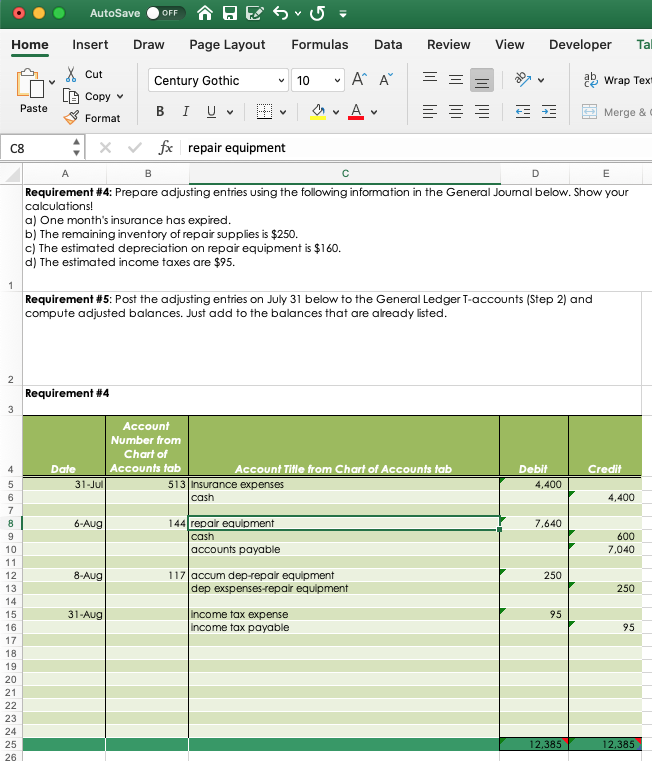

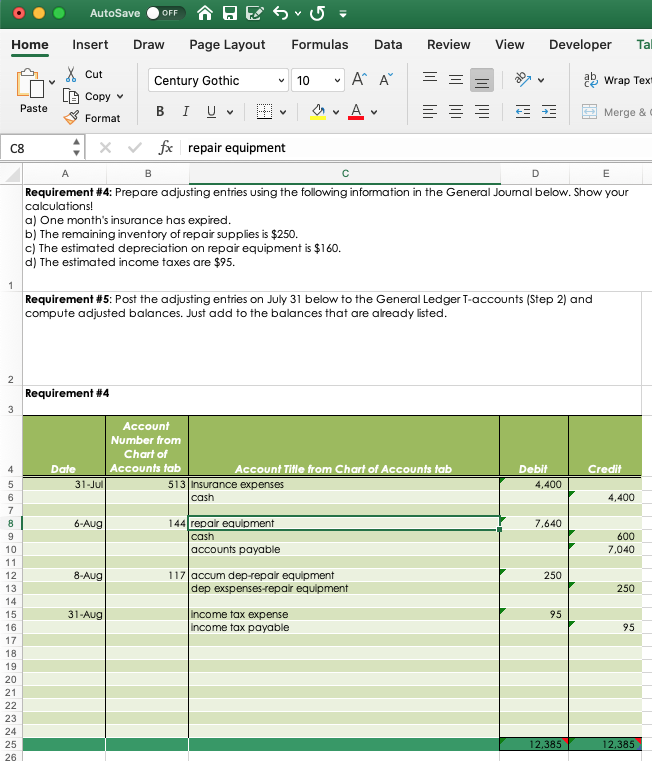

ooo AutoSave OFF HE S U Home Insert Draw Page Layout Formulas Data Review View Developer Tal X Cut Century Gothic 10 A A = = = a v alle Wrap Tex (6 Copy Paste Format B IU A E Merge & C8 x fx repair equipment AB Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $250. c) The estimated depreciation on repair equipment is $160. d) The estimated income taxes are $95. Requirement #5: Post the adjusting entries on July 31 below to the General Ledger T-accounts (Step 2) and compute adjusted balances. Just add to the balances that are already listed. Requirement #4 Account Number from Chart of Date Accounts tab Account Title from Chart of Accounts tab 31-Jul 513 Insurance expenses cash Credit Debit 4,400 4,400 6-Aug 7,640 144 repair equipment cash accounts payable 600 7,040 8-Aug| 250 117 |accum dep-repair equipment dep exspenses-repair equipment 250 31-Aug 95 income tax expense income tax payable 95 12,385 12,385 ooo AutoSave OFF HE S U Home Insert Draw Page Layout Formulas Data Review View Developer Tal X Cut Century Gothic 10 A A = = = a v alle Wrap Tex (6 Copy Paste Format B IU A E Merge & C8 x fx repair equipment AB Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $250. c) The estimated depreciation on repair equipment is $160. d) The estimated income taxes are $95. Requirement #5: Post the adjusting entries on July 31 below to the General Ledger T-accounts (Step 2) and compute adjusted balances. Just add to the balances that are already listed. Requirement #4 Account Number from Chart of Date Accounts tab Account Title from Chart of Accounts tab 31-Jul 513 Insurance expenses cash Credit Debit 4,400 4,400 6-Aug 7,640 144 repair equipment cash accounts payable 600 7,040 8-Aug| 250 117 |accum dep-repair equipment dep exspenses-repair equipment 250 31-Aug 95 income tax expense income tax payable 95 12,385 12,385