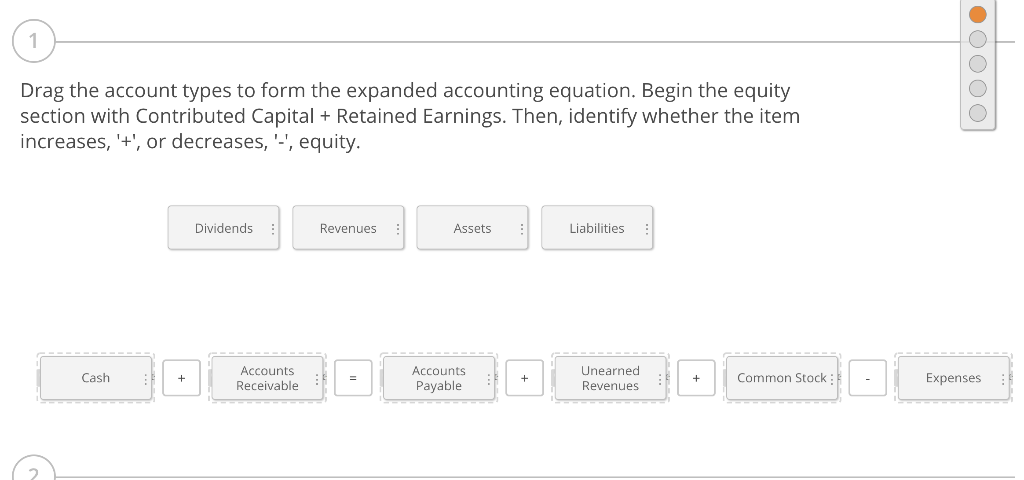

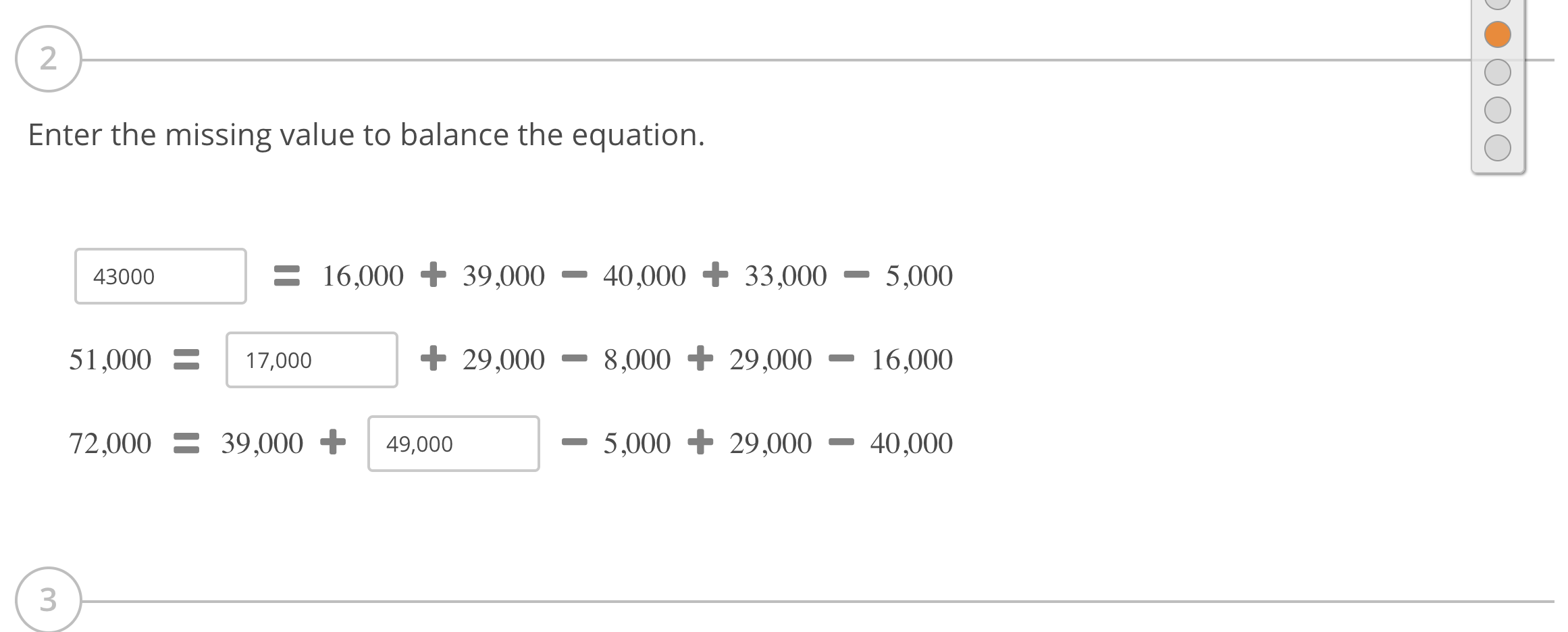

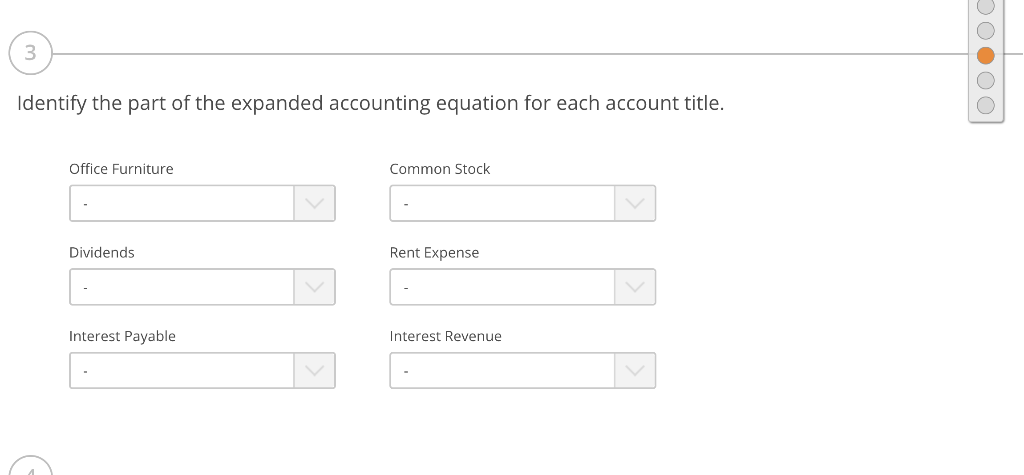

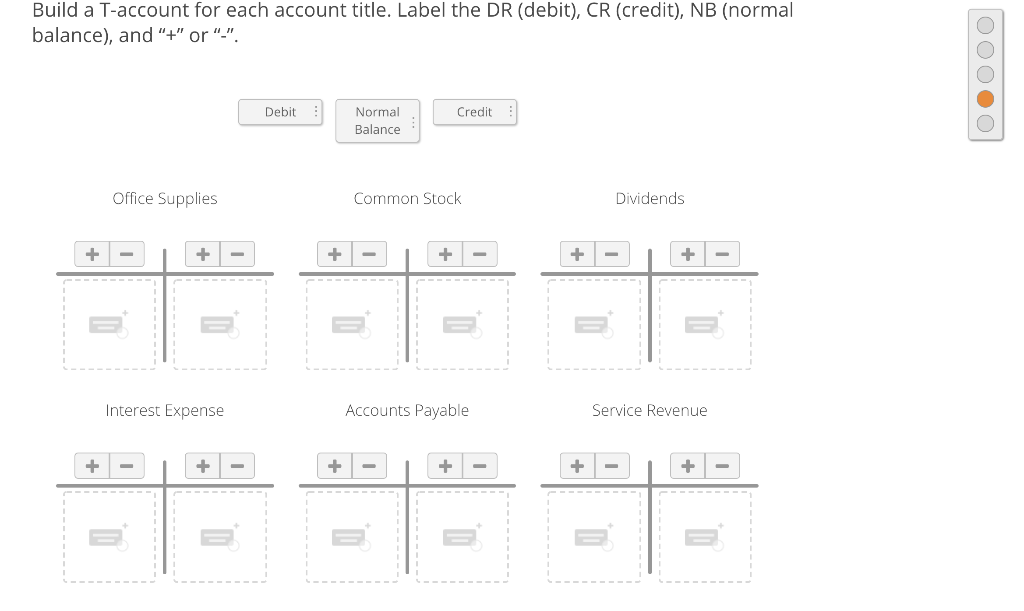

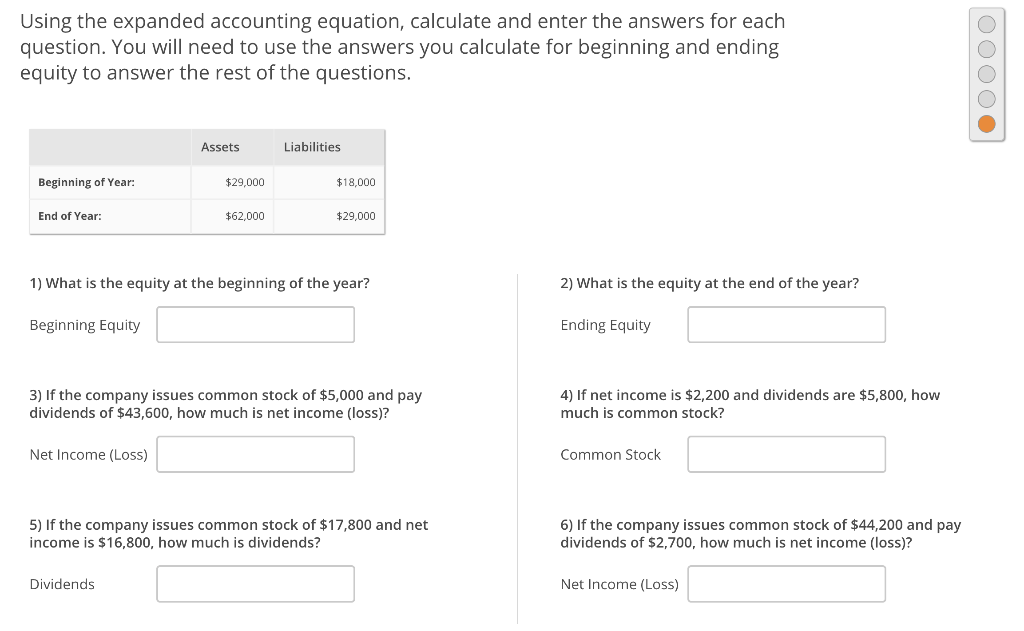

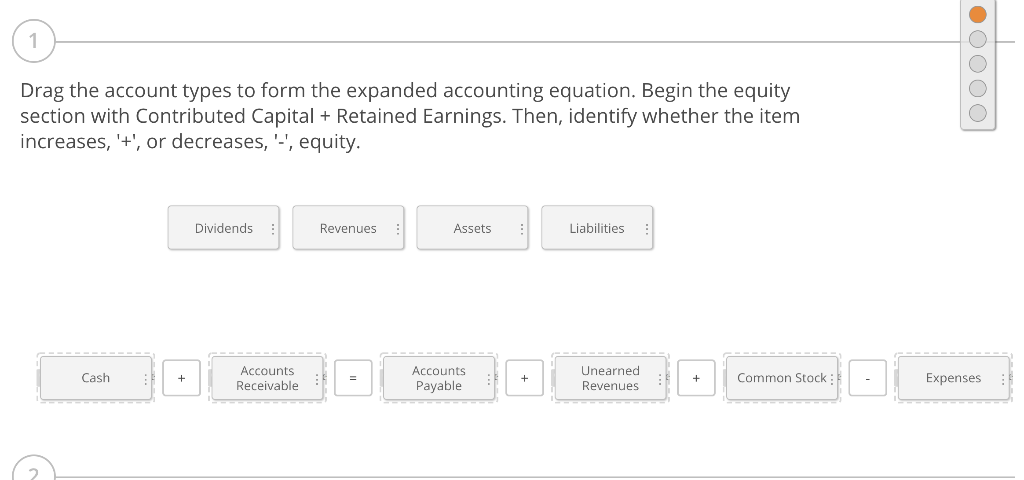

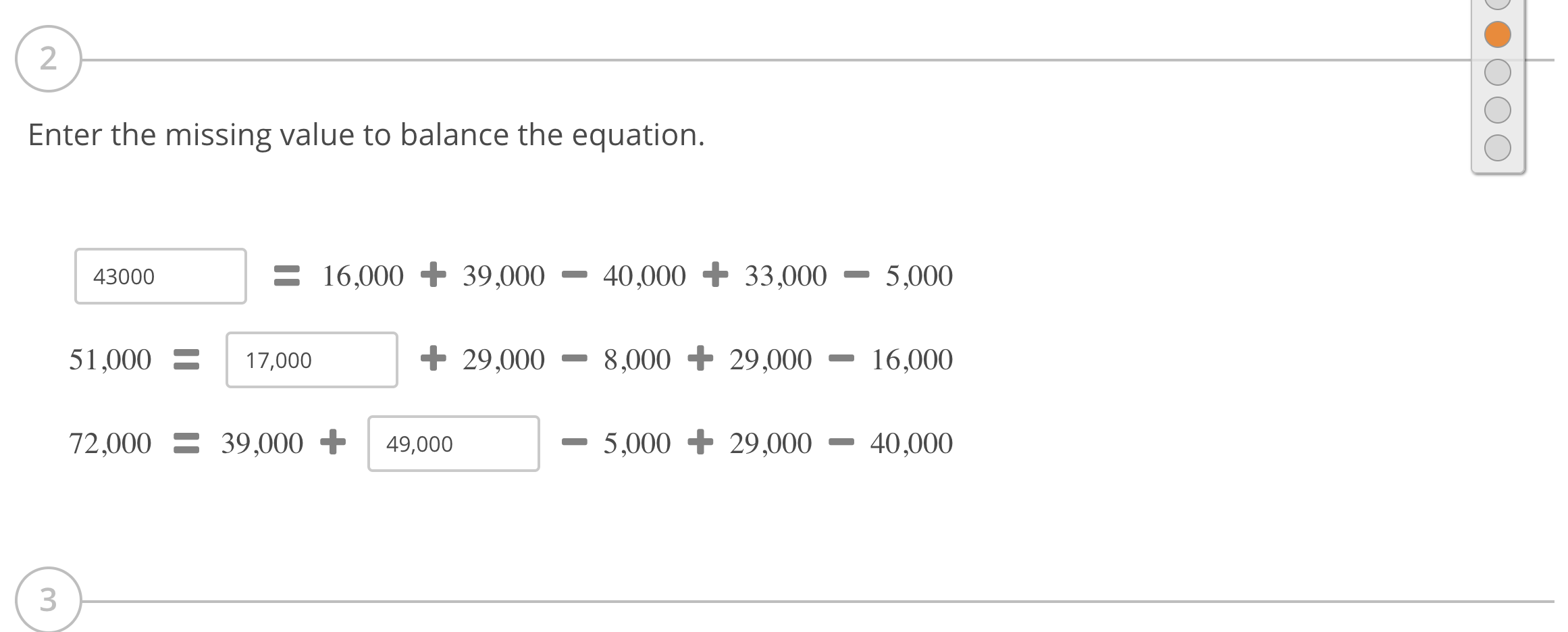

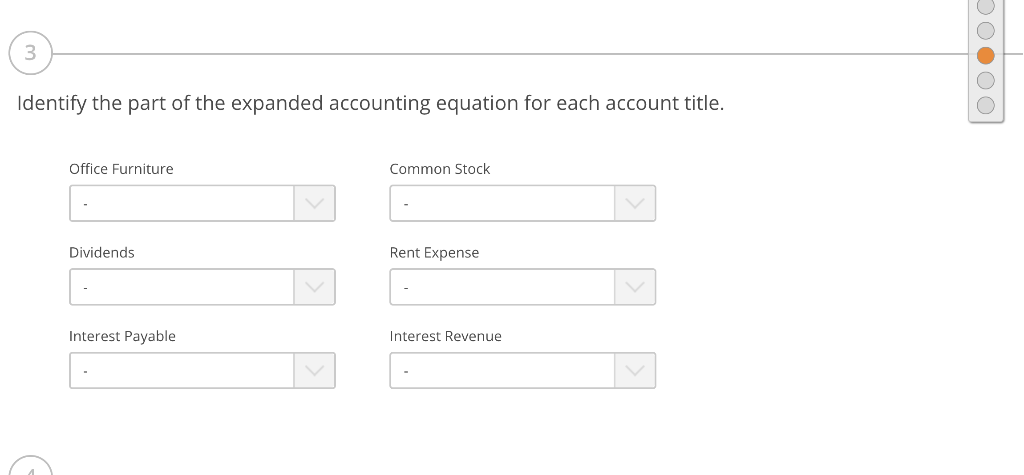

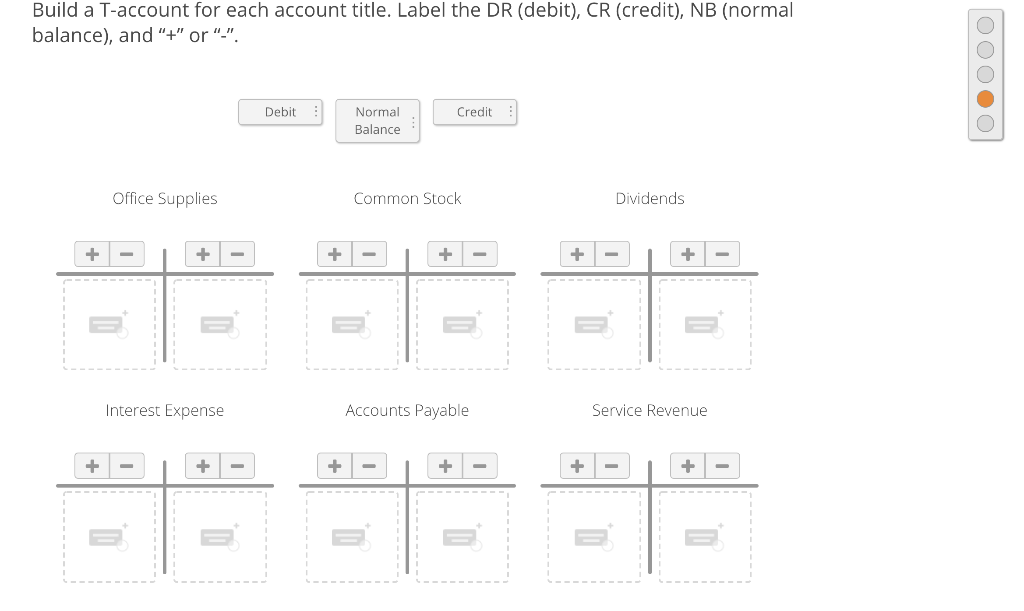

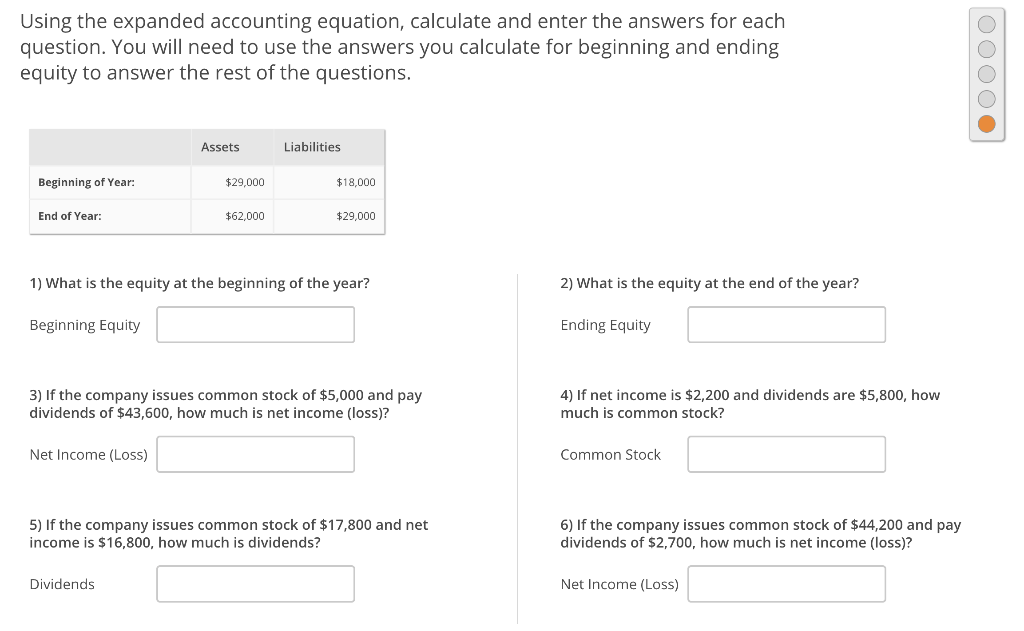

OOOOO Drag the account types to form the expanded accounting equation. Begin the equity section with Contributed Capital + Retained Earnings. Then, identify whether the item increases, '+', or decreases, '-, equity. Dividends Revenues Assets Liabilities Cash + Accounts Receivable Accounts Payable + Unearned Revenues + Common Stock: Expenses 2 Enter the missing value to balance the equation. 43000 = 16,000 + 39,000 40,000 + 33,000 5,000 51,000 = 17,000 + 29,000 8,000 + 29,000 16,000 72,000 = 39,000 + 49,000 5,000 + 29,000 40,000 3 3 Jo.00 Identify the part of the expanded accounting equation for each account title. Office Furniture Common Stock Dividends Rent Expense Interest Payable Interest Revenue Build a T-account for each account title. Label the DR (debit), CR (credit), NB (normal balance), and "+" or "-". 000.0 Debit Credit Normal Balance Office Supplies Common Stock Dividends + + + + = = = = Interest Expense Accounts Payable Service Revenue = Using the expanded accounting equation, calculate and enter the answers for each question. You will need to use the answers you calculate for beginning and ending equity to answer the rest of the questions. 0000 Assets Liabilities Beginning of Year: $29.000 $18,000 End of Year: $62,000 $29,000 1) What is the equity at the beginning of the year? 2) What is the equity at the end of the year? Beginning Equity Ending Equity 3) If the company issues common stock of $5,000 and pay dividends of $43,600, how much is net income (loss)? 4) If net income is $2,200 and dividends are $5,800, how much is common stock? Net Income (Loss) Common Stock 5) If the company issues common stock of $17,800 and net income is $16,800, how much is dividends? 6) If the company issues common stock of $44,200 and pay dividends of $2,700, how much is net income (loss)? Dividends Net Income (Loss) OOOOO Drag the account types to form the expanded accounting equation. Begin the equity section with Contributed Capital + Retained Earnings. Then, identify whether the item increases, '+', or decreases, '-, equity. Dividends Revenues Assets Liabilities Cash + Accounts Receivable Accounts Payable + Unearned Revenues + Common Stock: Expenses 2 Enter the missing value to balance the equation. 43000 = 16,000 + 39,000 40,000 + 33,000 5,000 51,000 = 17,000 + 29,000 8,000 + 29,000 16,000 72,000 = 39,000 + 49,000 5,000 + 29,000 40,000 3 3 Jo.00 Identify the part of the expanded accounting equation for each account title. Office Furniture Common Stock Dividends Rent Expense Interest Payable Interest Revenue Build a T-account for each account title. Label the DR (debit), CR (credit), NB (normal balance), and "+" or "-". 000.0 Debit Credit Normal Balance Office Supplies Common Stock Dividends + + + + = = = = Interest Expense Accounts Payable Service Revenue = Using the expanded accounting equation, calculate and enter the answers for each question. You will need to use the answers you calculate for beginning and ending equity to answer the rest of the questions. 0000 Assets Liabilities Beginning of Year: $29.000 $18,000 End of Year: $62,000 $29,000 1) What is the equity at the beginning of the year? 2) What is the equity at the end of the year? Beginning Equity Ending Equity 3) If the company issues common stock of $5,000 and pay dividends of $43,600, how much is net income (loss)? 4) If net income is $2,200 and dividends are $5,800, how much is common stock? Net Income (Loss) Common Stock 5) If the company issues common stock of $17,800 and net income is $16,800, how much is dividends? 6) If the company issues common stock of $44,200 and pay dividends of $2,700, how much is net income (loss)? Dividends Net Income (Loss)