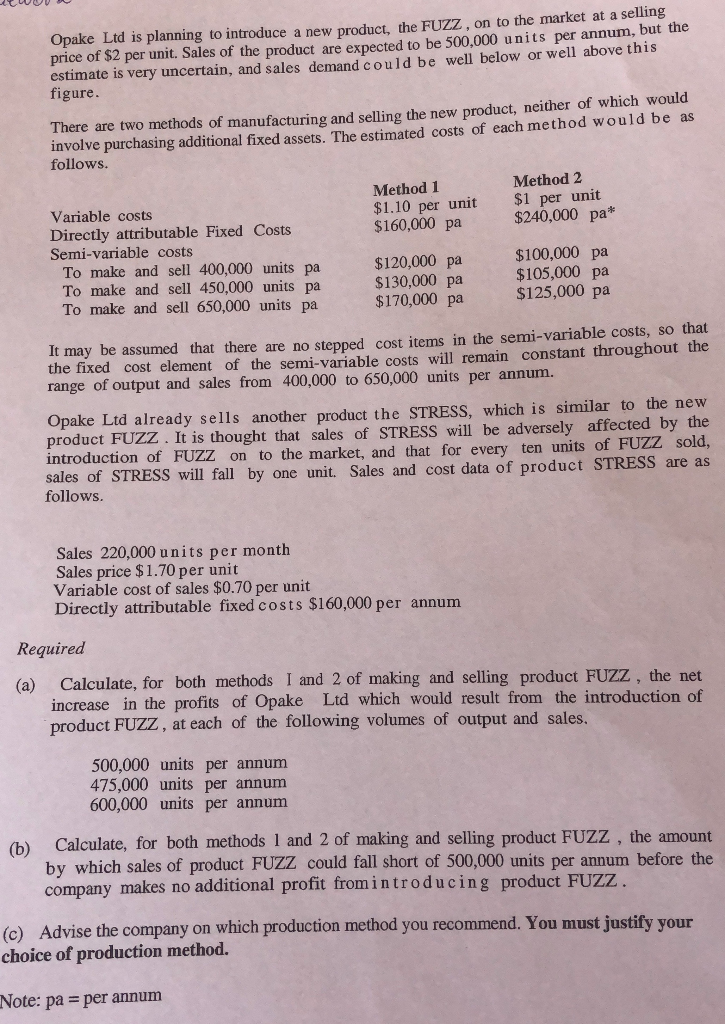

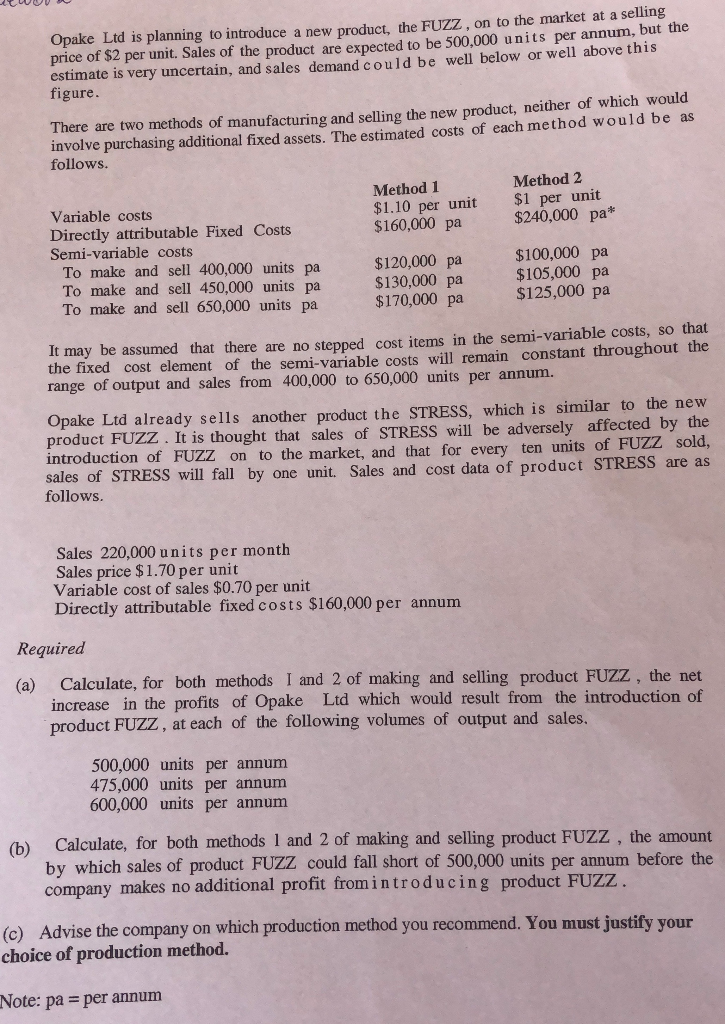

Opake Ltd is planning to introduce a new product, the FUzZ, on to the market at a selling price of $2 per unit. Sales of the product are expected to be 500,000 units per annum, but the estimate is very uncertain, and sales demand could be well below or well above this figure There are two methods of manufacturing and selling the new product, neither of which would involve purchasing additional fixed assets. The estimated costs of each method would be as follows Variable costs Directly attributable Fixed Costs Semi-variable costs Method1 $1.10 per unit $160,000 pa Method 2 $1 per unit $240,000 pa* $100,000 pa $105,000 pa $125,000 pa To make and sell 400,000 units pa $120,000 pa $130,000 pa $170,000 pa To make and sell 450,000 units pa To make and sell 650,000 units pa It may be assumed that there are no stepped cost items in the semi-variable costs, so that the fixed cost element of the semi-variable costs will remain constant throughout the range of output and sales from 400,000 to 650,000 units per annum. Opake Ltd already sells another product the STRESS, which is similar to the new product FUZZ. It is thought that sales of STRESS will be adversely affected by the introduction of FUZZ on to the market, and that for every ten units of FUZZ sold, sales of STRESS will fall by one unit. Sales and cost data of product STRESS are as follows Sales 220,000 units per month Sales price $1.70 per unit Variable cost of sales $0.70 per unit Directly attributable fixed costs $160,000 per annum Required Calculate, for both methods I and 2 of making and selling product FUZZ, the net increase in the profits of Opake Ltd which would result from the introduction of product FUZZ, at each of the following volumes of output and sales. (a) 500,000 units per annum 475,000 units per annum 600,000 units per annum Calculate, for both methods 1 and 2 of making and selling product FUZZ, the amount by which sales of product FUZZ could fall short of 500,000 units per annum before the company makes no additional profit fromintroducing product FUZZ (b) (c) Advise the company on which production method you recommend. You must justify your choice of production method. Note: pa = per annum