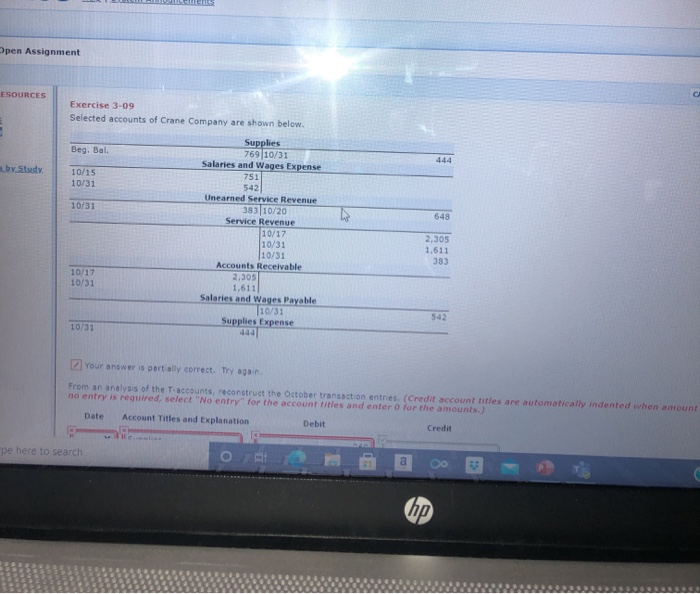

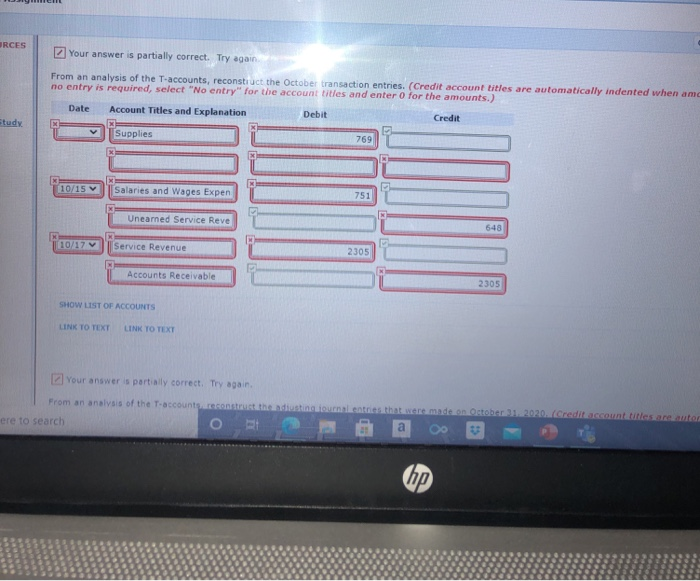

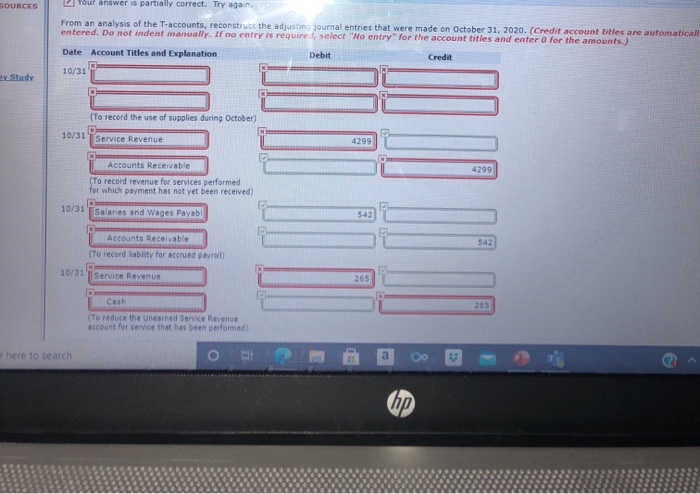

Open Assignment ESOURCES C by Study 751 Exercise 3-09 Selected accounts of Crane Company are shown below. Supplies Beg. Bal. 769 10/31 Salaries and Wages Expense 10/15 10/31 542 Unearned Service Revenue 10/31 383 10/20 Service Revenue 10/17 10/31 10/31 Accounts Receivable 10/17 2,305 10/31 1,6111 Salaries and Wages Payable 10/31 Supplies Expense 10/31 LD 648 2,305 1,611 383 542 Your answer is partially correct. Try again. From an analysis of the Taccounts, reconstruct the October transaction entries. (Credit account titles are automatically indented when amount no entry is required, select "No entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit pe here to search Oo hp URCES Your answer is partially correct. Try again From an analysis of the T-accounts, reconstruct the October transaction entries. (Credit account titles are automatically indented when am no entry is required, select "No entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit x Supplies 769 Study 10/15 Salaries and Wages Expen 751 Uneamed Service Reve 648 10/17 Service Revenue 2305 Accounts Receivable 2305 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT El your answer is partially correct. Try again From an analysis of the T-account that there made on the 2020. redituntiarenter ere to search O a 00 SOURCES Your answer is partially correct. Try again From an analysis of the T-accounts, reconstruct the adjusting journal entries that were made on October 31, 2020. (Credit account titles are automaticall entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit 10/31 2. Study (To record the use of supplies during October 10/31 Service Revenue 4299 4299 Accounts Receivable (To record revenue for services performed for which payment has not yet been received) 10/31 Salaries and Wages Payabl 542 542 Accounts Receivable (To record lablity for accrued payroll 10/31 | Service Revenue 265 Cash (To reduce the neared Service Revenue account for service that has been performed here to search o a