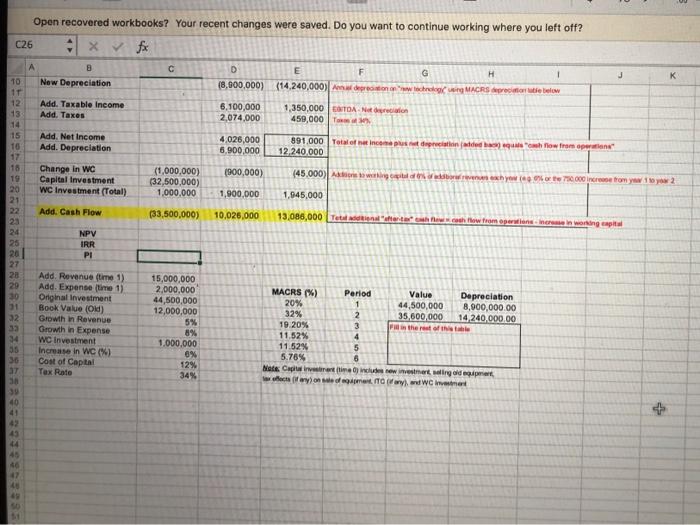

Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? C26 x fx A B New Depreciation 1 K (8.900,000) E F G H (14,240,000) American MACRSerie Add. Taxable income Add. Taxes 6,100,000 2,074,000 1,350,000 CATDA Norton 450,000 TO 11 12 13 14 15 16 17 16 19 20 21 22 23 Add. Net Income Add. Depreciation 4.028,000 6,900,000 891.000 Total of niet in plus depreciation de show from our 12 240.000 (900,000) Change in WC Capital Investment WC Investment (Total) (45.000) Ainowing whywote 5000 er from yo 162 (1,000,000) (32,500,000) 1.000.000 1,900.000 1.945,000 Add. Cash Flow (33,500,000) 10,026,000 13,086,000 Total datarachowcash flow from operations neram in working capital NPV IRR PI 25 20 27 28 29 30 15,000,000 2,000,000 44,500,000 12,000,000 5% 8% 1.000.000 32% Add. Revenue (time 1) Add. Expense time 1) Original investment Book Value (Old) Growth in Revenue Growth in Expense WO Investment Increase in WC (%) Cost of Capital Tax Rate 32 33 34 35 36 37 SA MACRS (%) Period Value Depreciation 20% 1 44,500,000 8,900,000.00 2 35,600,000 14,240,000.00 19.20% 3 in the rest of the 11.52% 4 11.52% 5 5.76% 6 Nada Capitaine de winter wing older waaronden IT ary) and Wine ex 129 34% 40 41 42 49 44 45 47 Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? C26 x fx A B New Depreciation 1 K (8.900,000) E F G H (14,240,000) American MACRSerie Add. Taxable income Add. Taxes 6,100,000 2,074,000 1,350,000 CATDA Norton 450,000 TO 11 12 13 14 15 16 17 16 19 20 21 22 23 Add. Net Income Add. Depreciation 4.028,000 6,900,000 891.000 Total of niet in plus depreciation de show from our 12 240.000 (900,000) Change in WC Capital Investment WC Investment (Total) (45.000) Ainowing whywote 5000 er from yo 162 (1,000,000) (32,500,000) 1.000.000 1,900.000 1.945,000 Add. Cash Flow (33,500,000) 10,026,000 13,086,000 Total datarachowcash flow from operations neram in working capital NPV IRR PI 25 20 27 28 29 30 15,000,000 2,000,000 44,500,000 12,000,000 5% 8% 1.000.000 32% Add. Revenue (time 1) Add. Expense time 1) Original investment Book Value (Old) Growth in Revenue Growth in Expense WO Investment Increase in WC (%) Cost of Capital Tax Rate 32 33 34 35 36 37 SA MACRS (%) Period Value Depreciation 20% 1 44,500,000 8,900,000.00 2 35,600,000 14,240,000.00 19.20% 3 in the rest of the 11.52% 4 11.52% 5 5.76% 6 Nada Capitaine de winter wing older waaronden IT ary) and Wine ex 129 34% 40 41 42 49 44 45 47