Question

Open the attached spreadsheet. There are two investment opportunities named A and B (e.g., mutual funds). You are given $100,000 present if you would invest

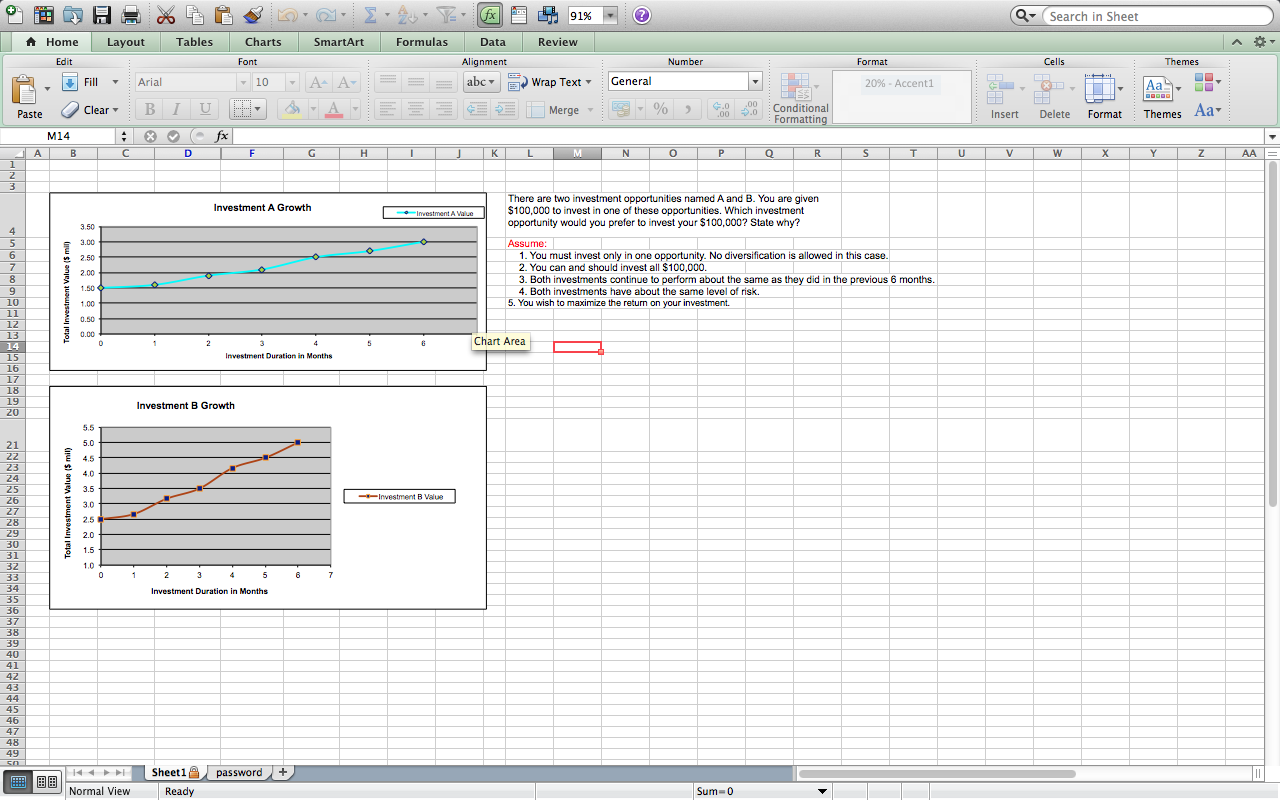

Open the attached spreadsheet. There are two investment opportunities named A and B (e.g., mutual funds). You are given $100,000 present if you would invest in one of these opportunities. Here are the rules and assumptions: 1. You must invest only in one opportunity. No diversification is allowed in this case. 2. You can and should invest all $100,000. You cannot hold anything back. If you do you will not be given the present. 3. Both investments continue to perform about the same as they did in the previous 6 months. 4. Both investments have about the same level of risk. 5. Consider the investment opportunities are similar to mutual funds. That is, the unit price of each share is not important in your investment strategy since you can buy a portion of a share. 6. You wish to maximize the return on your investment. Which investment opportunity would you prefer to invest your $100,000? Clearly explain why.

Open the attached spreadsheet. There are two investment opportunities named A and B (e.g., mutual funds). You are given $100,000 present if you would invest in one of these opportunities. Here are the rules and assumptions: 1. You must invest only in one opportunity. No diversification is allowed in this case. 2. You can and should invest all $100,000. You cannot hold anything back. If you do you will not be given the present. 3. Both investments continue to perform about the same as they did in the previous 6 months. 4. Both investments have about the same level of risk. 5. Consider the investment opportunities are similar to mutual funds. That is, the unit price of each share is not important in your investment strategy since you can buy a portion of a share. 6. You wish to maximize the return on your investment. Which investment opportunity would you prefer to invest your $100,000? Clearly explain why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started