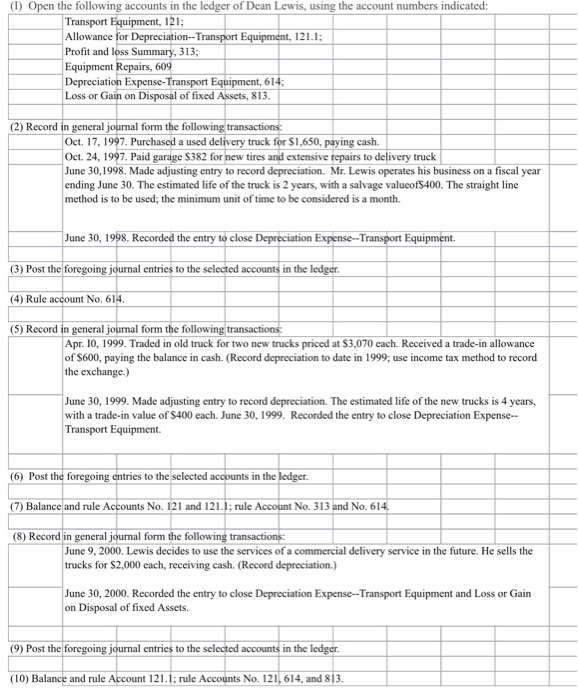

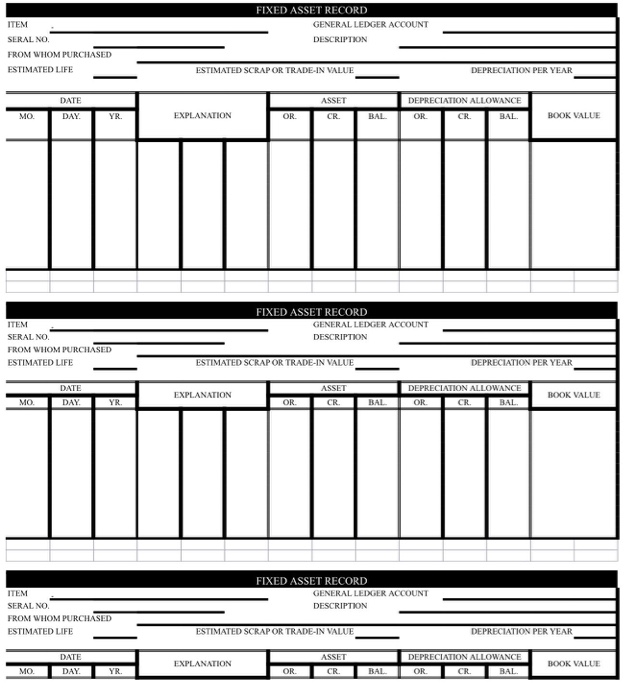

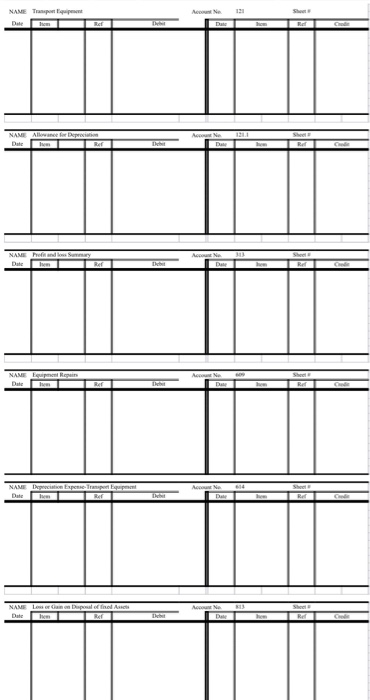

Open the following accounts in the ledger of Dean Lewis, using the account numbers indicated: Transport Equipment, 121; Allowance for Depreciation-Transport Equipment, 121-1 Profit and loss Summary, 313 Equipment Repairs, 609 Depreciation Expense-Transport Equipment, 61 Loss or Gain on Disposal of fixed Assets. 813 (2) Record in general joumal form the following transactions Oct. 17, 1997. Purchased a used delivery truck for Sl,650, paying cash. Oct. 24, 1997. Paid garage S382 for new tires and extensive repairs to delivery truck June 30, 1998. Made adjusting entry to record depreciation. Mr. Lewis operates his business on a fiscal year ending June 30. The estimated life ofthe truck is 2 years, with a salvage valueofS400. The straight line method is to be used; the minimum unit of time to be considered is a month. June 30, 1998. Recorded the entry to close Depreciation Expense-Transport Equipment. (3) Post the foregoing journal entries to the selected accounts in the ledger. (4) Rule account No. 614. (5) Record in general journal form the following transactions: Apr. 10, 1999. Traded in old truck for two new trucks priced at S3,070 each. Received a trade-in allowance of S600, paying the balance in cash. (Record depreciation to date in 1999; use income tax method to record the exchange.) June 30, 1999. Made adjusting entry to record depreciation. The estimated life of the new trucks is 4 years, with a trade-in value of S400 each. June 30, 1999. Recorded the entry to close Depreciation Expense-- Transport Equipment. (6) Post the foregoing entries to the selected accounts in the ledger. (7) Balance and rule Accounts No. 121 and 121.1 rule Account No. 313 and No. 614 (8) Record in general journal form the following transactions: June 9, 2000. Lewis decides to use the services of a commercial delivery service in the future. He sells the trucks for S2,000 each, receiving cash. (Record depreciation.) June 30, 2000. Recorded the entry to close Depreciation Expense-Transport Equipment and Loss or Gain on Disposal of fixed Assets. (9) Post the foregoing journal entries to the selected accounts in the ledger (10) Balance and rule Account 12LI: rule Accounts No. 121,6l4, and 813