Answered step by step

Verified Expert Solution

Question

1 Approved Answer

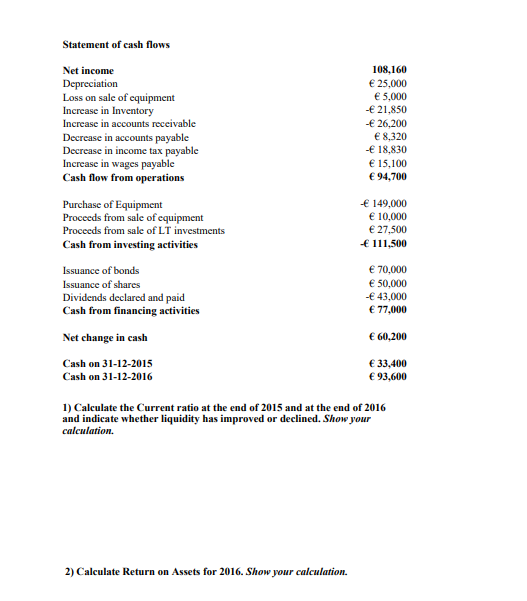

Opening balances of Current Assets and Current Liabilities are not provided. The questions are to be solved from the Statement of Cash Flows only. Statement

Opening balances of Current Assets and Current Liabilities are not provided. The questions are to be solved from the Statement of Cash Flows only.

Statement of cash flows Net income Depreciation Loss on sale of equipment Increase in Inventory Increase in accounts receivable Decrease in accounts payable Decrease in income tax payable Increase in wages payable Cash flow from operations 108,160 25.000 5,000 - 21.850 - 26,200 8,320 - 18,830 15,100 94,700 149,000 10,000 27,500 111.500 Purchase of Equipment Proceeds from sale of equipment Proceeds from sale of LT investments Cash from investing activities Issuance of bonds Issuance of shares Dividends declared and paid Cash from financing activities Net change in cash Cash on 31-12-2015 Cash on 31-12-2016 70,000 50,000 43,000 77,000 60,200 33,400 93.600 1) Calculate the Current ratio at the end of 2015 and at the end of 2016 and indicate whether liquidity has improved or declined. Show your calculation. 2) Calculate Return on Assets for 2016. Show your calculation. Statement of cash flows Net income Depreciation Loss on sale of equipment Increase in Inventory Increase in accounts receivable Decrease in accounts payable Decrease in income tax payable Increase in wages payable Cash flow from operations 108,160 25.000 5,000 - 21.850 - 26,200 8,320 - 18,830 15,100 94,700 149,000 10,000 27,500 111.500 Purchase of Equipment Proceeds from sale of equipment Proceeds from sale of LT investments Cash from investing activities Issuance of bonds Issuance of shares Dividends declared and paid Cash from financing activities Net change in cash Cash on 31-12-2015 Cash on 31-12-2016 70,000 50,000 43,000 77,000 60,200 33,400 93.600 1) Calculate the Current ratio at the end of 2015 and at the end of 2016 and indicate whether liquidity has improved or declined. Show your calculation. 2) Calculate Return on Assets for 2016. Show your calculationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started