Answered step by step

Verified Expert Solution

Question

1 Approved Answer

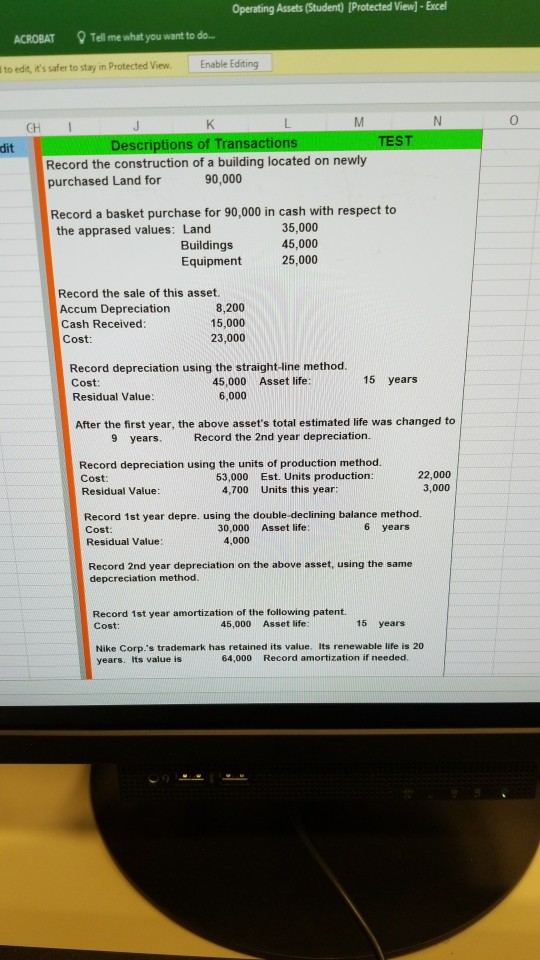

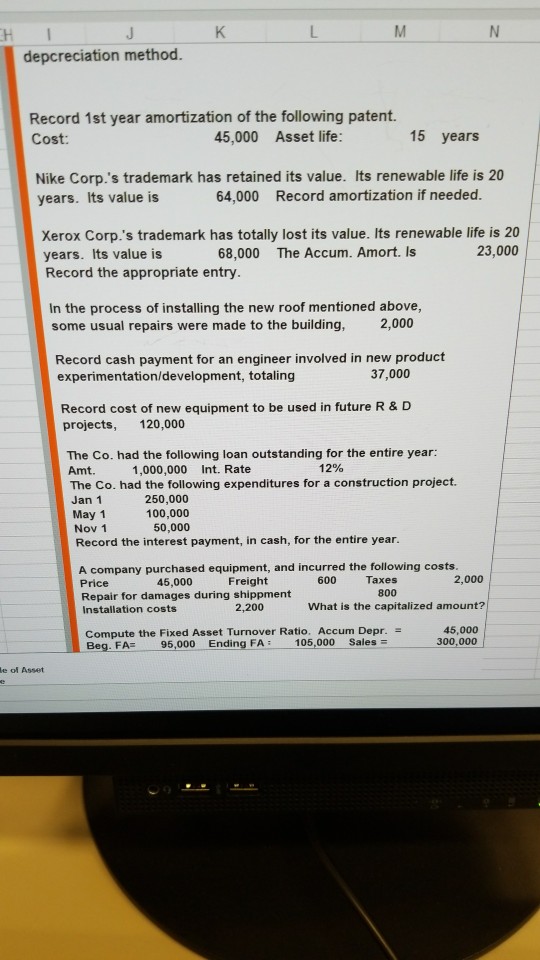

Operating Assets (Student) [Protected Viewl- Excel ACROBAT Tell me what you want to do. to edit, it's safer to stay in Protected View. Enable Editing

Operating Assets (Student) [Protected Viewl- Excel ACROBAT Tell me what you want to do. to edit, it's safer to stay in Protected View. Enable Editing 0 CH I TEST dit Record the construction of a building located on newly purchased Land for 90,000 Record a basket purchase for 90,000 in cash with respect to 35,000 45,000 25,000 the apprased values: Land Buildings Equipment Record the sale of this asset. Accum Depreciation Cash Received Cost: 8,200 15,000 23,000 Record depreciation using the straight-line method. Cost: Residual Value 45,000 Asset life: 15 years 6,000 After the first year, the above asset's total estimated life was changed to 9 years. Record the 2nd year depreciation. Record depreciation using the units of production method. Cost Residual Value 53,000 4,700 Est. Units production: Units this year: 22,000 3,000 Record 1st year depre. using the double-declining balance method. Cost: Residual Value 30,000 Asset life: 6 years 4,000 Record 2nd year depreciation on the above asset, using the same depcreciation method Record 1st year amortization of the following patent. Cost 45,000 Asset life 15 years Nike Corp.'s trademark has retained its value. Its renewable life is 20 years its value is 64,000 Record amortization if needed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started