Answered step by step

Verified Expert Solution

Question

1 Approved Answer

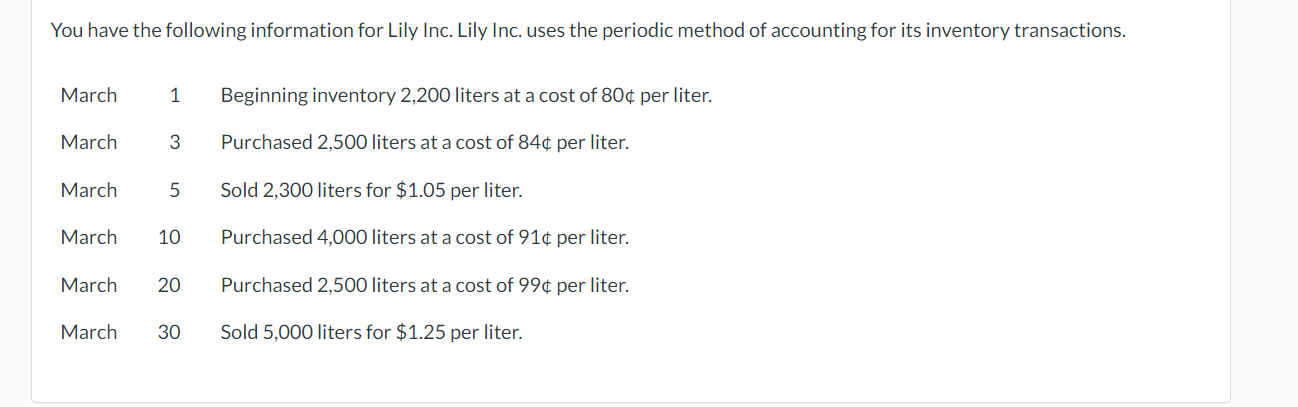

You have the following information for Lily Inc. Lily Inc. uses the periodic method of accounting for its inventory transactions. March 1 Beginning inventory 2,200

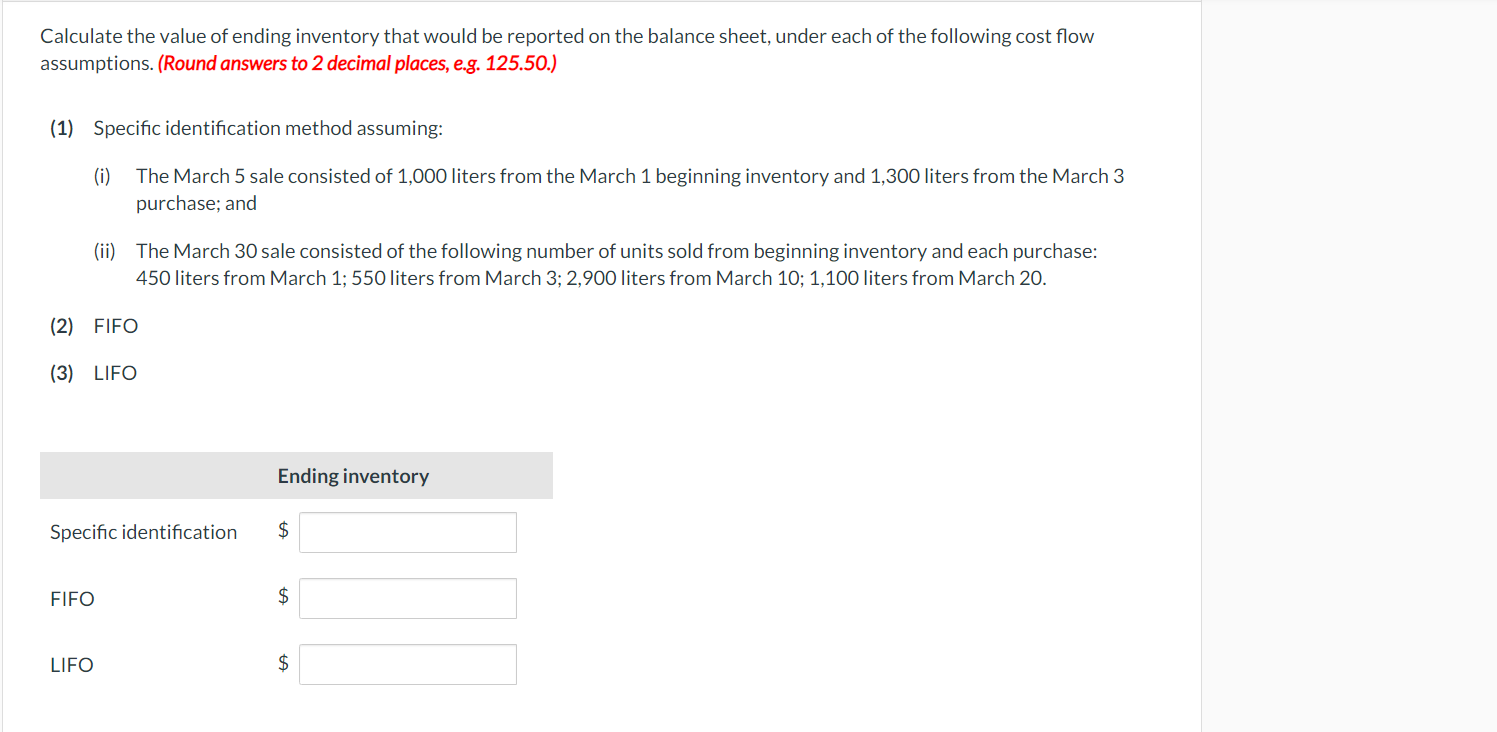

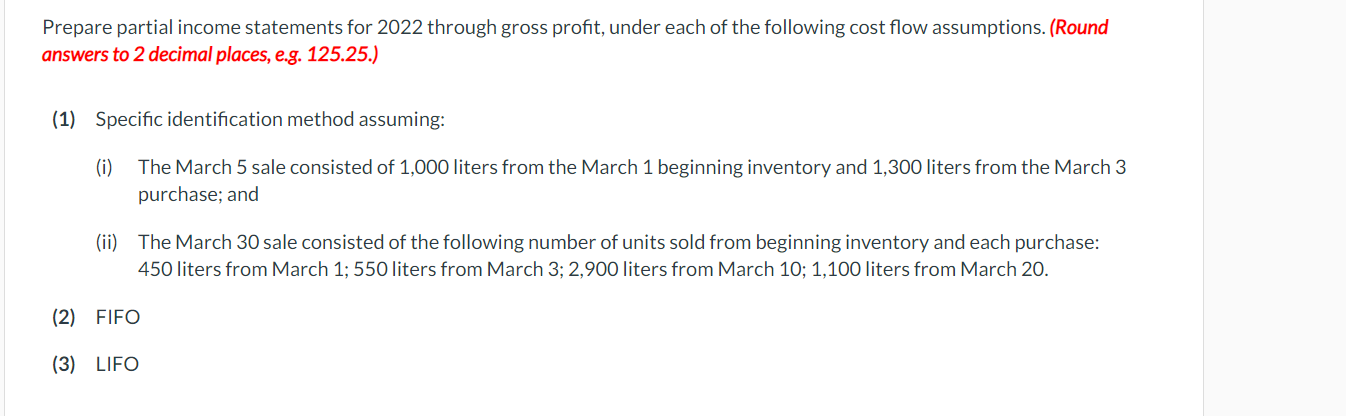

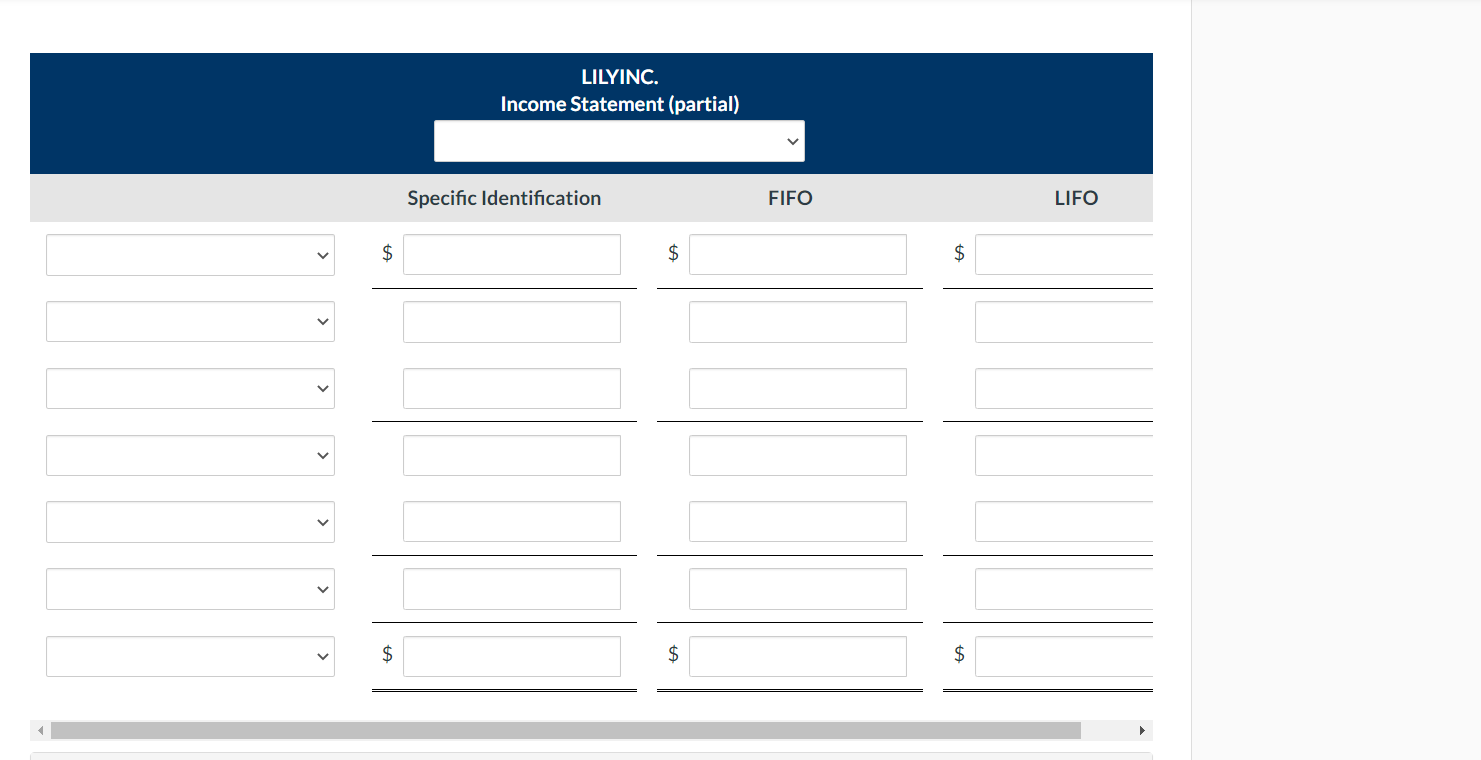

You have the following information for Lily Inc. Lily Inc. uses the periodic method of accounting for its inventory transactions. March 1 Beginning inventory 2,200 liters at a cost of 80/ per liter. March 3 Purchased 2,500 liters at a cost of 84 per liter. March 5 Sold 2,300 liters for $1.05 per liter. March 10 Purchased 4,000 liters at a cost of 914 per liter. March 20 Purchased 2,500 liters at a cost of 99$ per liter. March 30 Sold 5,000 liters for $1.25 per liter. Calculate the value of ending inventory that would be reported on the balance sheet, under each of the following cost flow assumptions. (Round answers to 2 decimal places, e.g. 125.50.) (1) Specific identification method assuming: (i) The March 5 sale consisted of 1,000 liters from the March 1 beginning inventory and 1,300 liters from the March 3 purchase; and (ii) The March 30 sale consisted of the following number of units sold from beginning inventory and each purchase: 450 liters from March 1; 550 liters from March 3; 2,900 liters from March 10; 1,100 liters from March 20. (2) FIFO (3) LIFO Prepare partial income statements for 2022 through gross profit, under each of the following cost flow assumptions. (Round answers to 2 decimal places, e.g. 125.25.) (1) Specific identification method assuming: (i) The March 5 sale consisted of 1,000 liters from the March 1 beginning inventory and 1,300 liters from the March 3 purchase; and (ii) The March 30 sale consisted of the following number of units sold from beginning inventory and each purchase: 450 liters from March 1; 550 liters from March 3; 2,900 liters from March 10; 1,100 liters from March 20. (2) FIFO (3) LIFO LILYINC. Income Statement (partial) Specific Identification $ FIFO $ $ $

You have the following information for Lily Inc. Lily Inc. uses the periodic method of accounting for its inventory transactions. March 1 Beginning inventory 2,200 liters at a cost of 80/ per liter. March 3 Purchased 2,500 liters at a cost of 84 per liter. March 5 Sold 2,300 liters for $1.05 per liter. March 10 Purchased 4,000 liters at a cost of 914 per liter. March 20 Purchased 2,500 liters at a cost of 99$ per liter. March 30 Sold 5,000 liters for $1.25 per liter. Calculate the value of ending inventory that would be reported on the balance sheet, under each of the following cost flow assumptions. (Round answers to 2 decimal places, e.g. 125.50.) (1) Specific identification method assuming: (i) The March 5 sale consisted of 1,000 liters from the March 1 beginning inventory and 1,300 liters from the March 3 purchase; and (ii) The March 30 sale consisted of the following number of units sold from beginning inventory and each purchase: 450 liters from March 1; 550 liters from March 3; 2,900 liters from March 10; 1,100 liters from March 20. (2) FIFO (3) LIFO Prepare partial income statements for 2022 through gross profit, under each of the following cost flow assumptions. (Round answers to 2 decimal places, e.g. 125.25.) (1) Specific identification method assuming: (i) The March 5 sale consisted of 1,000 liters from the March 1 beginning inventory and 1,300 liters from the March 3 purchase; and (ii) The March 30 sale consisted of the following number of units sold from beginning inventory and each purchase: 450 liters from March 1; 550 liters from March 3; 2,900 liters from March 10; 1,100 liters from March 20. (2) FIFO (3) LIFO LILYINC. Income Statement (partial) Specific Identification $ FIFO $ $ $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started