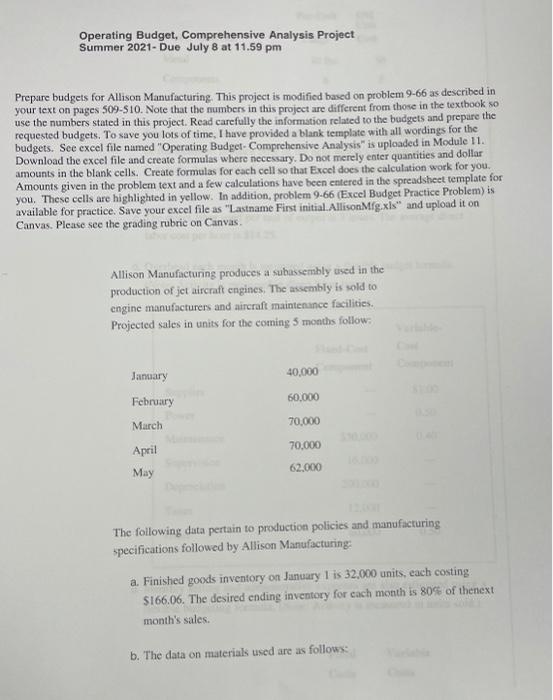

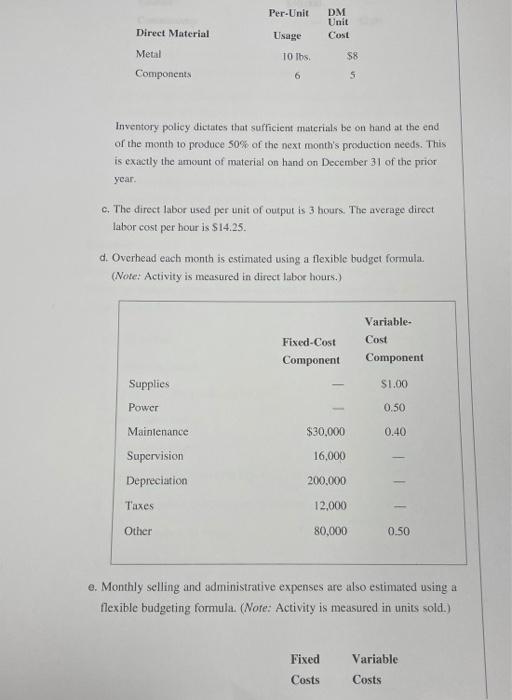

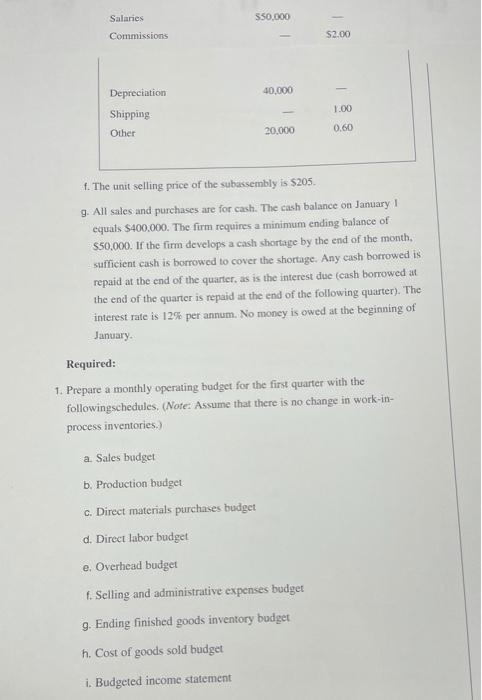

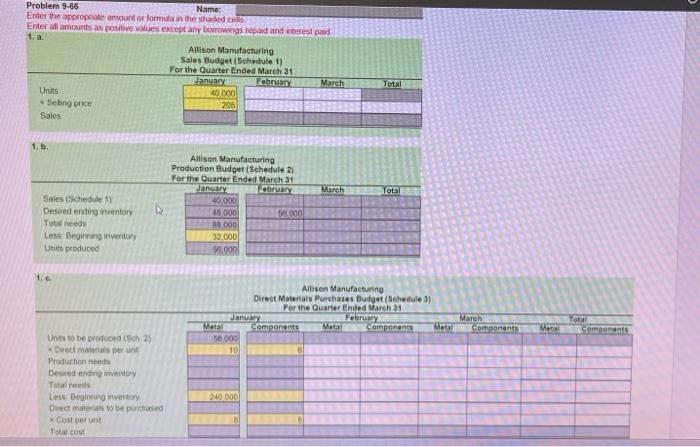

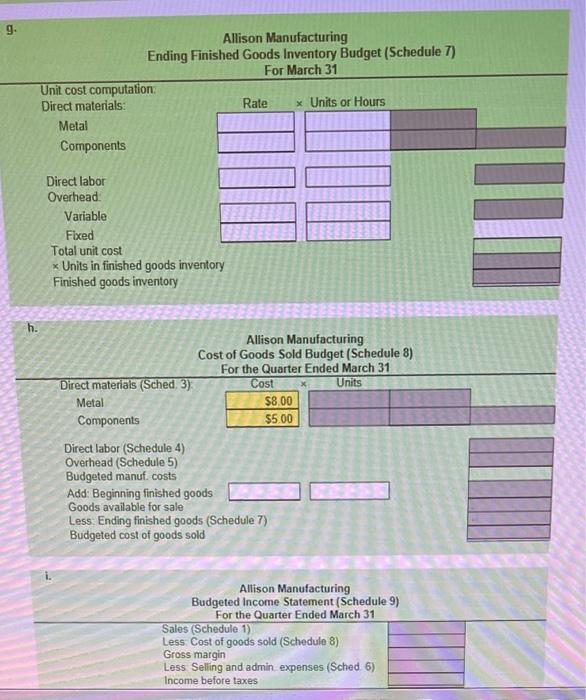

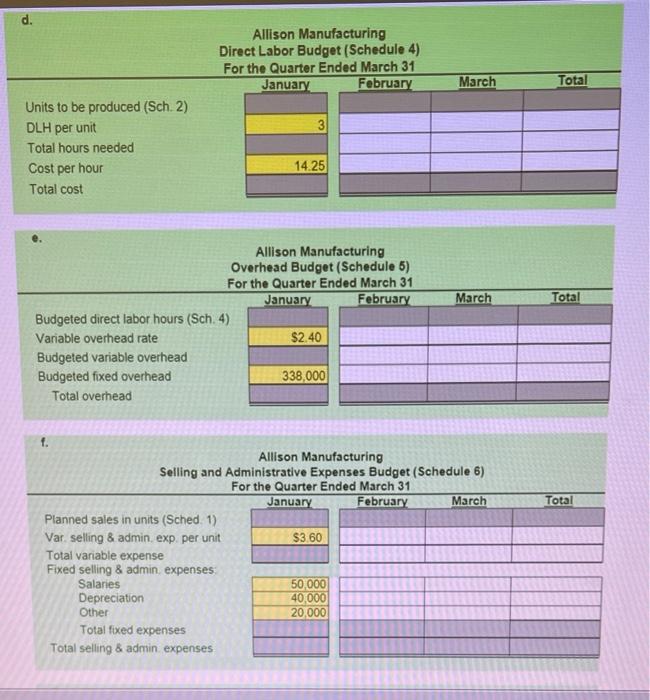

Operating Budget, Comprehensive Analysis Project Summer 2021-Due July 8 at 11:59 pm Prepare budgets for Allison Manufacturing. This project is modified based on problem 9-66 as described in your text on pages 509-510. Note that the numbers in this project are different from those in the textbook so use the numbers stated in this project. Read carefully the information related to the budgets and prepare the requested budgets. To save you lots of time, I have provided a blank template with all wordings for the budgets. See excel file named "Operating Budget Comprehensive Analysis" is uploaded in Module 11. Download the excel file and create formulas where necessary. Do not merely enter quantities and dollar amounts in the blank cells. Create formulas for each cell so that Excel does the calculation work for you. Amounts given in the problem text and a few calculations have been entered in the spreadsheet template for you. These cells are highlighted in yellow. In addition, problem 9-66 (Excel Budget Practice Problem) is available for practice. Save your excel file as "Lastname First initial.AllisonMfg.xls" and upload it on Canvas. Please see the grading rubric on Canvas Allison Manufacturing produces a subassembly used in the production of jet aircraft engines. The assembly is sold to engine manufacturers and aircraft maintenance facilities. Projected sales in units for the coming 5 months follow: January 40.000 60.000 February March 70,000 70.000 April May 62.000 The following data pertain to production policies and manufacturing specifications followed by Allison Manufacturing: a. Finished goods inventory on January 1 is 32,000 units, each costing S166.06. The desired ending inventory for cach month is 80% of thenext month's sales. b. The data on materials used are as follows: Per-Unit DM Unit Cost Direct Material Usage Metal 10 lbs S8 Components 6 S Inventory policy dictates that sufficient materials be on hand at the end of the month to produce 50% of the next month's production needs. This is exactly the amount of material on hand on December 31 of the price year. C. The direct labor used per unit of output is 3 hours. The average direct labor cost per hour is $14.25. d. Overhead each month is estimated using a flexible budget formula. (Note: Activity is measured in direct labor hours.) Fixed-Cost Component Variable- Cost Component Supplies S1.00 Power 0.50 Maintenance $30,000 0.40 16,000 Supervision Depreciation Taxes 200.000 12.000 Other 80,000 0.50 e. Monthly selling and administrative expenses are also estimated using a flexible budgeting formula. (Note: Activity is measured in units sold.) Fixed Variable Costs Costs 550.000 Salaries Commissions - $2.00 Depreciation 40,000 Shipping 1.00 0.60 Other 20.000 f. The unit selling price of the subassembly is $205. g. All sales and purchases are for cash. The cash balance on January 1 equats $400,000. The firm requires a minimum ending balance of $50,000. If the firm develops a cash shortage by the end of the month, sufficient cash is borrowed to cover the shortage. Any cash borrowed is repaid at the end of the quarter, as is the interest due (cash borrowed at the end of the quarter is repaid at the end of the following quarter). The interest rate is 12% per annum. No money is owed at the beginning of January Required: 1. Prepare a monthly operating budget for the first quarter with the followingschedules. (Note: Assume that there is no change in work-in- process inventories.) a Sales budget b. Production budget c. Direct materials purchases budget d. Direct labor budget e. Overhead budget f. Selling and administrative expenses budget 9. Ending finished goods inventory budget h. Cost of goods sold budget i. Budgeted income statement Problem 9-66 Namo: Enter the appropriate amount o formula in the shaded con Enter all amounts as positive values except any borrowings tepad and interest paid 1. a. Allison Manufacturing Sales Budget (Schedule 1) For the Quarter Ended March 31 January February March Units 40.000 Seling price 205 Sales Total 1.b March Total Sales Schedule Desired ending inventory Total needs Les Beginning inventory Units produced Allison Manufacturing Production Budget (Schedule 21 For the Quarter Ended March 31 January February 40.000 48000 56 000 38.000 32.000 50,000 Allison Manufacturing Direct Materials Purchases Budget (Schedule 3) For the Quarter Ended March 31 January February March Metal Components components Meta Components 50.000 10 Metal Total Coments Unt to be produced 15ch 2) Drect materials per un Production needs Desired ending inventory Totalveeds Less Beginning inventory Direct materials to be purchased cost perunt Total cost 240 000 g. Allison Manufacturing Ending Finished Goods Inventory Budget (Schedule 7) For March 31 Unit cost computation Direct materials Rate * Units or Hours Metal Components Direct labor Overhead Variable Fixed Total unit cost * Units in finished goods inventory Finished goods inventory h. Allison Manufacturing Cost of Goods Sold Budget (Schedule 8) For the Quarter Ended March 31 Direct materials (Sched. 3) Cost Units Metal $8.00 Components $5.00 Direct labor (Schedule 4) Overhead (Schedule 5) Budgeted manuf. costs Add: Beginning finished goods Goods available for sale Less Ending finished goods (Schedule 7) Budgeted cost of goods sold Allison Manufacturing Budgeted Income Statement (Schedule 9) For the Quarter Ended March 31 Sales (Schedule 1) Less Cost of goods sold (Schedule 8) Gross margin Less Seling and admin expenses (Sched 6) Income before taxes Allison Manufacturing Direct Labor Budget (Schedule 4) For the Quarter Ended March 31 January February March Total 3 Units to be produced (Sch.2) DLH per unit Total hours needed Cost per hour Total cost 14.25 March Total Allison Manufacturing Overhead Budget (Schedule 5) For the Quarter Ended March 31 January February Budgeted direct labor hours (Sch. 4) Variable overhead rate $2.40 Budgeted variable overhead Budgeted fixed overhead 338,000 Total overhead Total Allison Manufacturing Selling and Administrative Expenses Budget (Schedule 6) For the Quarter Ended March 31 January February March Planned sales in units (Sched 1) Var selling & admin. exp. per unit $3.60 Total variable expense Fixed selling & admin expenses Salaries 50,000 Depreciation 40,000 Other 20,000 Total fixed expenses Total selling & admin expenses