Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Operating cash flows Hoffmann-La Roche is considering replacing one permeability test equipment with a new model. The old equipment is fully depreciated and would

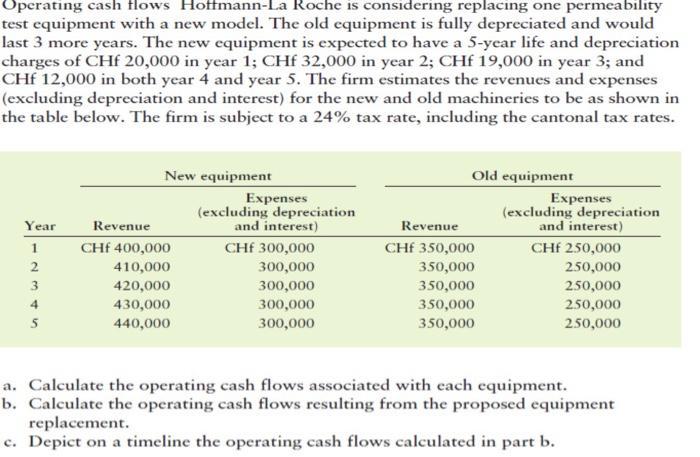

Operating cash flows Hoffmann-La Roche is considering replacing one permeability test equipment with a new model. The old equipment is fully depreciated and would last 3 more years. The new equipment is expected to have a 5-year life and depreciation charges of CHF 20,000 in year 1; CHf 32,000 in year 2; CHf 19,000 in year 3; and CHf 12,000 in both year 4 and year 5. The firm estimates the revenues and expenses (excluding depreciation and interest) for the new and old machineries to be as shown in the table below. The firm is subject to a 24% tax rate, including the cantonal tax rates. Year 1 2 3 4 5 New equipment Revenue CHF 400,000 410,000 420,000 430,000 440,000 Expenses (excluding depreciation and interest) CHF 300,000 300,000 300,000 300,000 300,000 Old equipment Revenue CHF 350,000 350,000 350,000 350,000 350,000 Expenses (excluding depreciation and interest) CHF 250,000 250,000 250,000 250,000 250,000 a. Calculate the operating cash flows associated with each equipment. b. Calculate the operating cash flows resulting from the proposed equipment replacement. c. Depict on a timeline the operating cash flows calculated in part b.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started