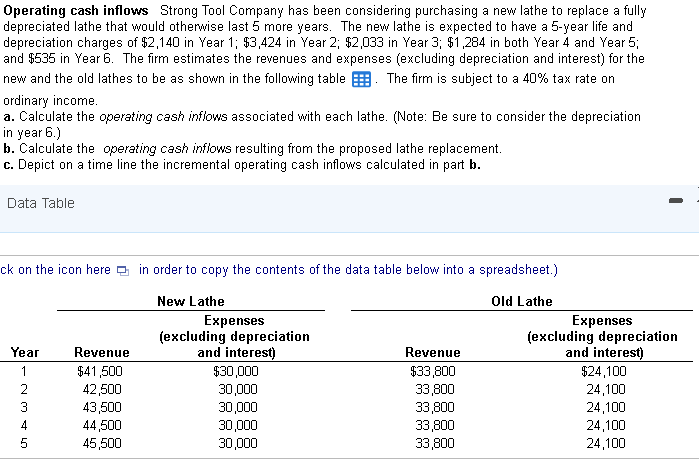

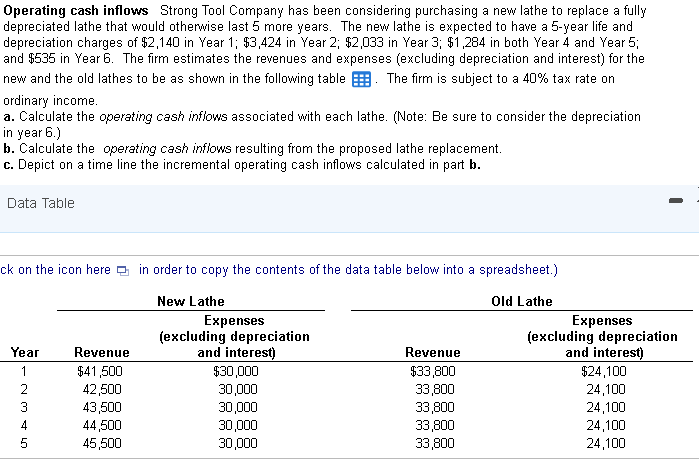

Operating cash inflows Strong Tool Company has been considering purchasing a new lathe to replace a fully depreciated lathe that would otherwise last 5 more years. The new lathe is expected to have a 5-year life and depreciation charges of $2,140 in Year 1; $3,424 in Year 2; $2,033 in Year 3; $1,284 in both Year 4 and Year 5; and $535 in Year 6. The firm estimates the revenues and expenses (excluding depreciation and interest) for the new and the old lathes to be as shown in the following table . The firm is subject to a 40% tax rate on ordinary income a. Calculate the operating cash inflows associated with each lathe. (Note: Be sure to consider the depreciation in year 6.) b. Calculate the operating cash inflows resulting from the proposed lathe replacement. c. Depict on a time line the incremental operating cash inflows calculated in part b. Data Table ck on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year U AWN-R Revenue $41,500 42,500 43,500 44,500 45,500 New Lathe Expenses (excluding depreciation and interest) $30,000 30,000 30,000 30,000 30,000 Revenue $33,800 33,800 33,800 33,800 33,800 Old Lathe Expenses (excluding depreciation and interest) $24,100 24,100 24,100 24,100 24,100 Operating cash inflows Strong Tool Company has been considering purchasing a new lathe to replace a fully depreciated lathe that would otherwise last 5 more years. The new lathe is expected to have a 5-year life and depreciation charges of $2,140 in Year 1; $3,424 in Year 2; $2,033 in Year 3; $1,284 in both Year 4 and Year 5; and $535 in Year 6. The firm estimates the revenues and expenses (excluding depreciation and interest) for the new and the old lathes to be as shown in the following table . The firm is subject to a 40% tax rate on ordinary income a. Calculate the operating cash inflows associated with each lathe. (Note: Be sure to consider the depreciation in year 6.) b. Calculate the operating cash inflows resulting from the proposed lathe replacement. c. Depict on a time line the incremental operating cash inflows calculated in part b. Data Table ck on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year U AWN-R Revenue $41,500 42,500 43,500 44,500 45,500 New Lathe Expenses (excluding depreciation and interest) $30,000 30,000 30,000 30,000 30,000 Revenue $33,800 33,800 33,800 33,800 33,800 Old Lathe Expenses (excluding depreciation and interest) $24,100 24,100 24,100 24,100 24,100