Answered step by step

Verified Expert Solution

Question

1 Approved Answer

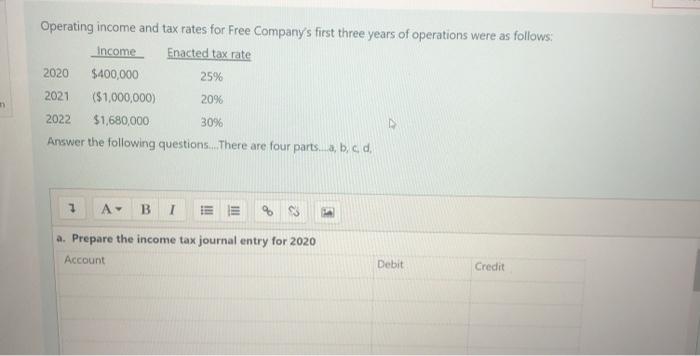

Operating income and tax rates for Free Company's first three years of operations were as follows: Income Enacted tax rate 2020 $400,000 25% 2021

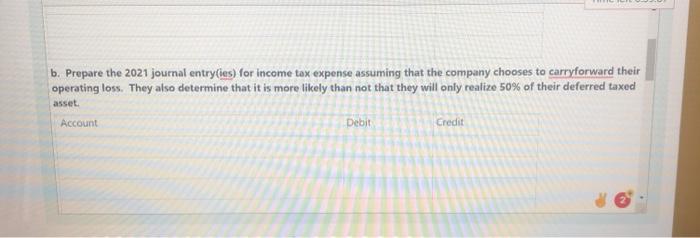

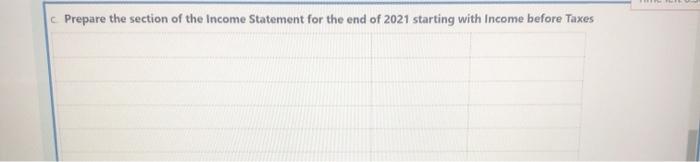

Operating income and tax rates for Free Company's first three years of operations were as follows: Income Enacted tax rate 2020 $400,000 25% 2021 (S1,000,000) 20% 2022 $1,680,000 30% Answer the following questions.There are four parts.a, b, c. d. A- a. Prepare the income tax journal entry for 2020 Account Debit Credit b. Prepare the 2021 journal entry(ies) for income tax expense assuming that the company chooses to carryforward their operating loss. They also determine that it is more likely than not that they will only realize 50% of their deferred taxed asset. Account Debit Credit c Prepare the section of the Income Statement for the end of 2021 starting with Income before Taxes d. Prepare the income tax journal entry for 2022 Account Debit Credit

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

tar rate a57 Inlome 2020 40010u 2022 lio00000 202 222 64o a Prepace Ih come tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started