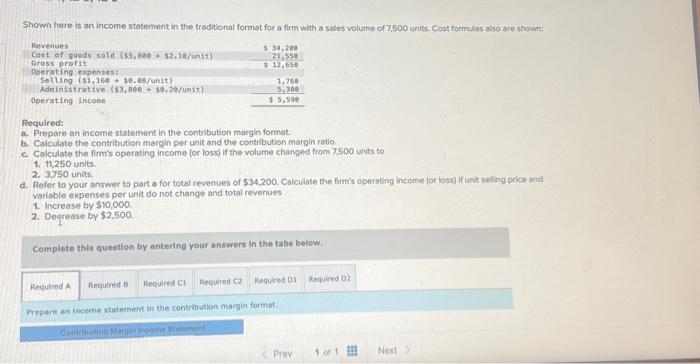

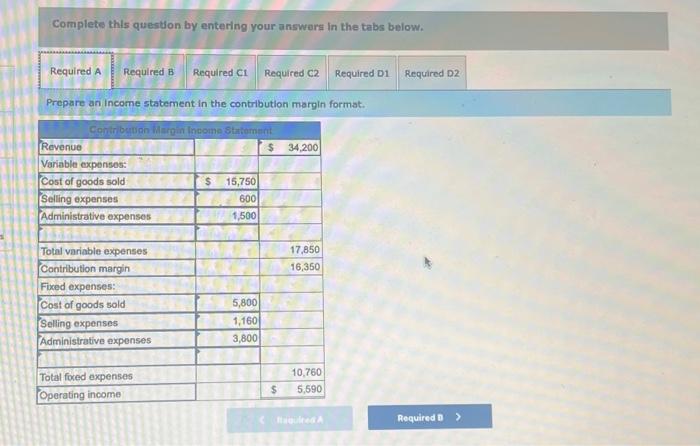

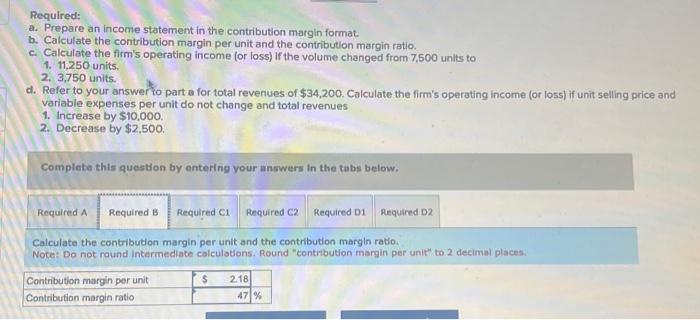

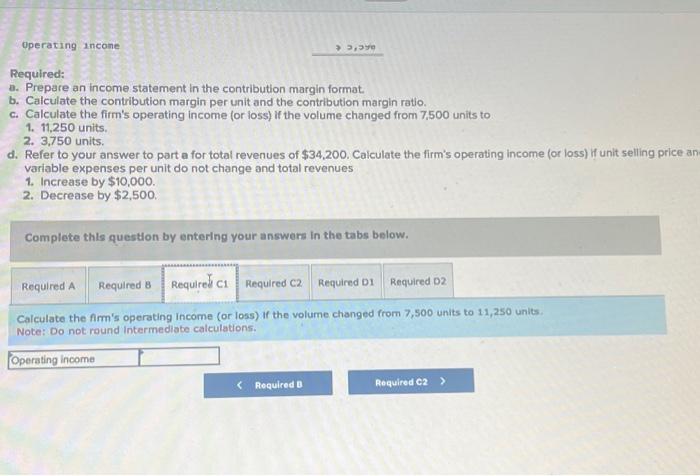

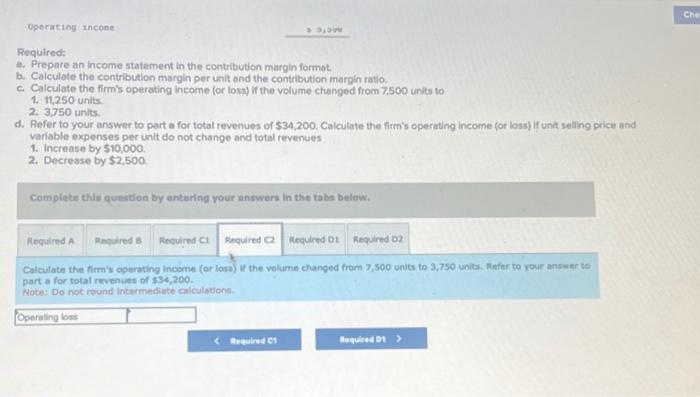

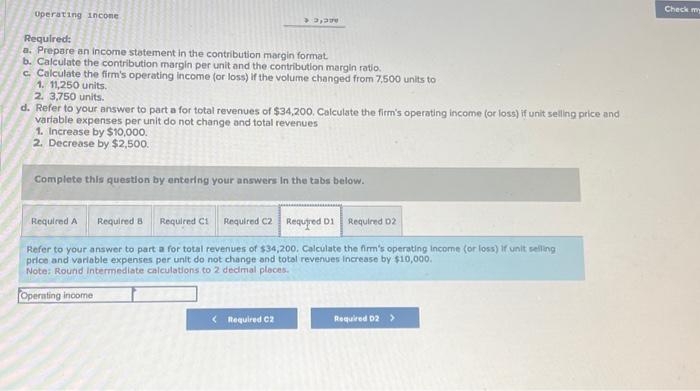

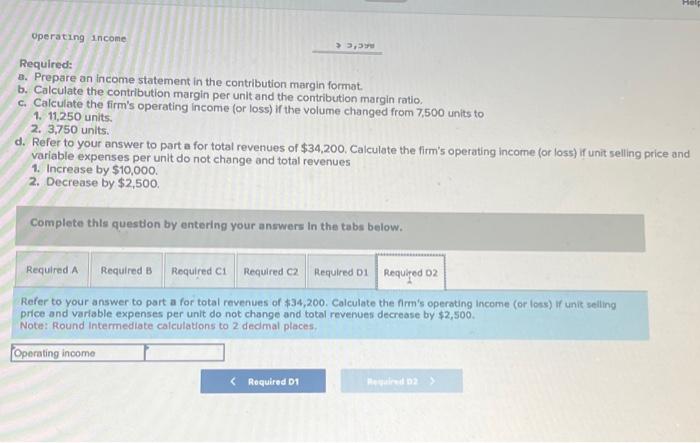

Operating incone Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per unit and the contribution margin ratio. c. Calculate the firm's operating income (or loss) if the volume changed from 7,500 units to 1. 11,250 units. 2. 3,750 units. d. Refer to your answer to part a for total revenues of $34,200. Calculate the firm's operating income (or loss) if unit selling price an variable expenses per unit do not change and total revenues 1. Increase by $10,000. 2. Decrease by $2,500. Complete thls question by entering your answers in the tabs below. Calculate the firm's operating income (or loss) If the volume changed from 7,500 units to 11,250 units. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Prepare an income statement in the contribution margin format. Shown here is an income statement in the traditional format for a firm whin a sales volume of 7,s00 units. Cost formulas also are shown: Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per unit and the contribution margin ratio. c. Calculate the firm's operating income (or loss) if the volume chanped from 7,500 units to 1. 11,250 units 2. 3,750 units. d. Refer to your answer to part a for total revenues of $34,200. Calculate the firm's operating income (or lass) if unit selling price and variablo expenses per unit do not change and total revenues 1. Increase by $10,000. 2. Destease by $2,500. Complete this question by entering your answers in the tabs below. Prepare an income statement in the contritition maryin format. Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per unit and the contribution marpin ratio, c. Calculate the firm's operating income (or losy) if the volume changed from 7,500 unlts to 1. 11,250 units. 2. 3,750 units. d. Pefer to your nnswer to part a for total revenues of $34,200. Calculate the firm's operating income (or loss) if unit selling price and variable expenses per unit do not change and total revenues 1. Increase by $10,000. 2. Decrease by $2,500 Complete this question by entering your answers in the tabs below. Calculote the firn's eperating incoome (or loss) it the volume changed from 7,500 units to 3,750 units, Refer to your anwwer to part a for total revenues of $34,200. pars. bo not recand intarmadiate caleulationt. Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per unit and the contribution margin ratio. c. Calculate the firm's operating income (or loss) if the volume changed from 7,500 units to 1. 11,250 units. 2. 3,750 units. d. Refer to your answerto part a for total revenues of $34,200. Calculate the firm's operating income (or loss) if unit selling price and variable experises per unit do not change and total revenues 1. Increase by $10,000. 2. Decrease by $2,500. Complete this question by entering your answers in the tabs below. Calculate the contribution margin per unit and the contribution margin ratio. Note: Do not round intermediate calculations. Round "contribution margin per unit"t to 2 decimal places. Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per unit and the contribution margin ratio. c. Calculate the firm's operating income (or loss) if the volume changed from 7,500 units to 1. 11,250 units. 2. 3,750 units. d. Refer to your answer to part a for total revenues of $34,200, Calculate the firm's operating income (or loss) if unit selling price and variable expenses per unit do not change and total revenues 1. Increase by $10,000. 2. Decrease by $2,500. Complete this question by entering your answers in the tabs below. Refer to your answer to part a for total revenues of $34,200. Calculate the firm's operating income (or loss) if unit selling price and variable expenses per unit do not change and total revenues decrease by $2,500. Note: Round intermediate calculations to 2 dedmal places. Required: a. Prepare an income statement in the contribution margin format b. Calculate the contribution margin per unit and the contribution margin ratio. c. Calculate the firm's operating income (or loss) if the volume changed from 7,500 units to 1. 11,250 units. 2. 3,750 units: d. Refer to your answer to part a for total revenues of $34,200. Calculate the firm's operating income (or loss) if unit selling price and variable expenses per unit do not change and total revenues 1. Increase by $10,000. 2. Decrease by $2,500. Complete this question by entering your answers In the tabs below. Refer to your answer to part a for total revenues of $34,200, Calculate the fim's operating income (or loss) if unit seling price and variable expenses per unit do not change and total revenues increase by $10,000. Notes Round intermedtate citcutations to 2 dedmal ploces