Question

Operating Leverage: *Hutcheon Tool & Dye's current business model supports the following set of data: Fixed costs = $255,000; variable costs = $22; selling

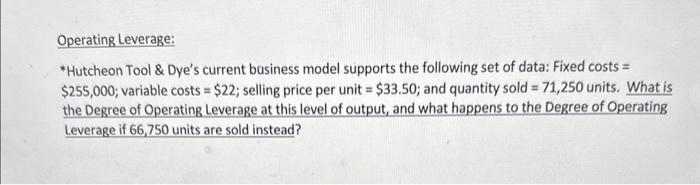

Operating Leverage: *Hutcheon Tool & Dye's current business model supports the following set of data: Fixed costs = $255,000; variable costs = $22; selling price per unit = $33.50; and quantity sold = 71,250 units. What is the Degree of Operating Leverage at this level of output, and what happens to the Degree of Operating Leverage if 66,750 units are sold instead?

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The Degree of Operating Leverage DOL can be calculated using the following formula DOL Contribution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting for Managers

Authors: Eric Noreen, Peter Brewer, Ray Garrison

4th edition

1259578542, 978-1259578540

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App