Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Operating Profit Margin, Asset Turnover, Return on Investment ( ROI ) , and Residual Income ( RI ) . Financial information for Livingston Tech Support,

Operating Profit Margin, Asset Turnover, Return on Investment ROI and Residual Income RI Financial information for Livingston Tech Support, Inc., for the most recent fiscal year appears as follows. All dollar amounts are in thousands.

Livingston Tech Support, Inc.

Segmented Income Statements

for the Current Fiscal Year

dollar amounts are in thousands

Web Division IT Division

Sales $ $

Cost of goods sold

Gross margin $ $

Allocated overhead from corporate

Selling and administrative expenses

Operating income $ $

Income tax expense rate

Net income $ $

Livingston Tech Support, Inc.

Segmented Balance Sheets

at End of Most Recent Fiscal Year

dollar amounts are in thousands

Web Division IT Division

Ending Balance Beginning Balance Ending Balance Beginning Balance

Assets

Cash

$ $ $ $

Accounts receivable

Inventory

Total current assets

$ $ $ $

Property, plant and equipment net

Investment in Global, Inc.

Land held for sale

Total assets $ $ $ $

Liabilities and owners' equity

Accounts payable

$ $ $ $

Other current liabilities

Total current liabilities

$ $ $ $

Longterm liabilities

Total liabilities

$ $ $ $

Total owners' equity

Total liabilities and owners' equity $ $ $ $

Required:

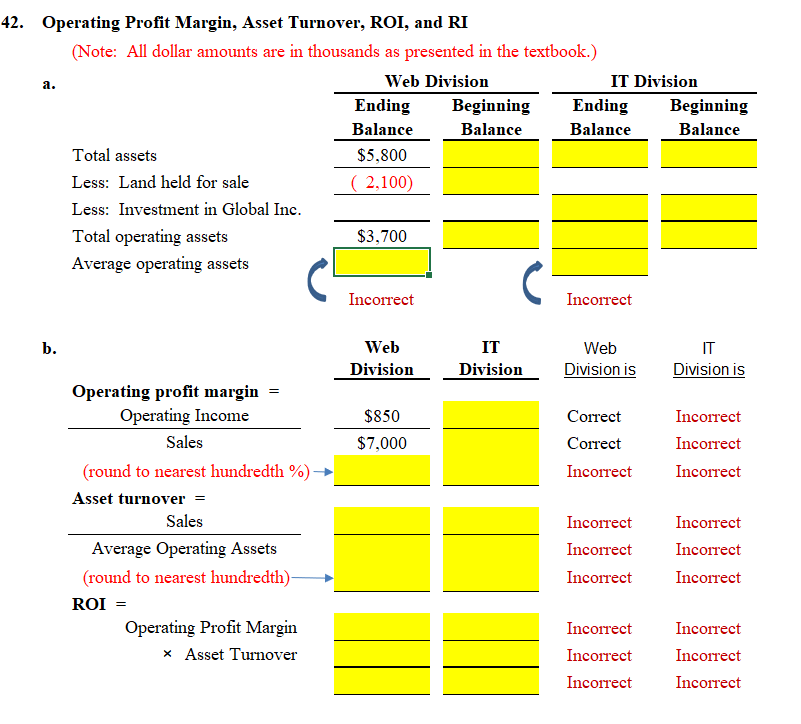

Calculate average operating assets for each division. Hint: land held for sale and investments in Global, Inc., are not operating assets.

Calculate operating profit margin, asset turnover, and return on investment for each division.

Calculate residual income for each division assuming a cost of capital rate of percent.

What does the information from requirements b and c tell us about each division?Operating Profit Margin, Asset Turnover, ROI, and RI

Note: All dollar amounts are in thousands as presented in the textbook.

a

b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started