Answered step by step

Verified Expert Solution

Question

1 Approved Answer

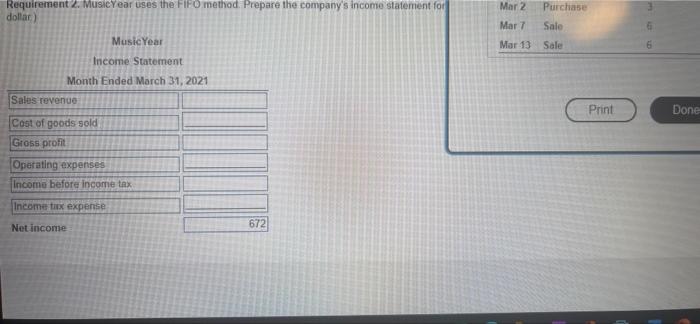

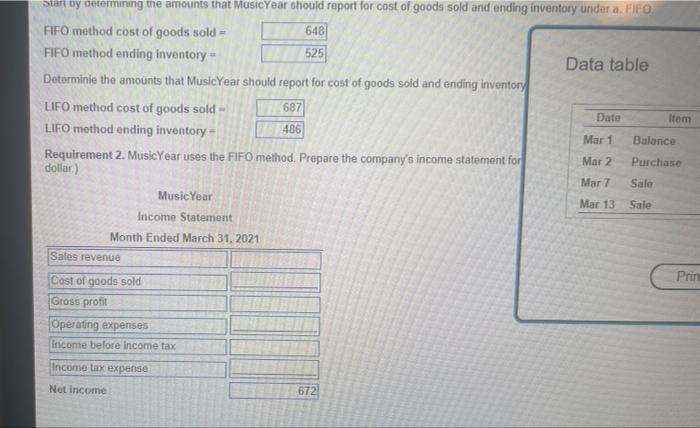

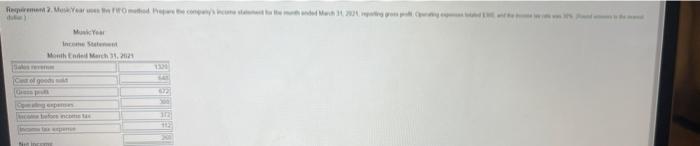

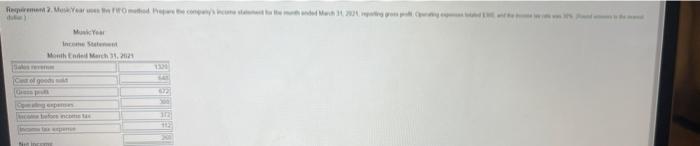

operating value is 300, taxes 30% Requirement 2. MusicYear uses the FIFO method. Prepare the company's income statement for dollar) MusicYear Income Statement Month Ended

operating value is 300, taxes 30%

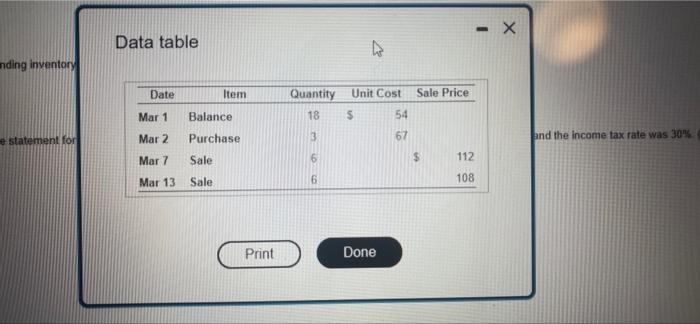

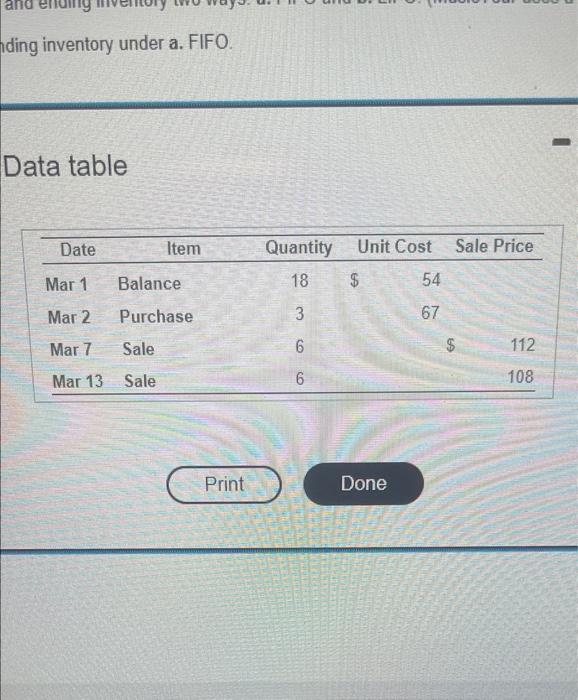

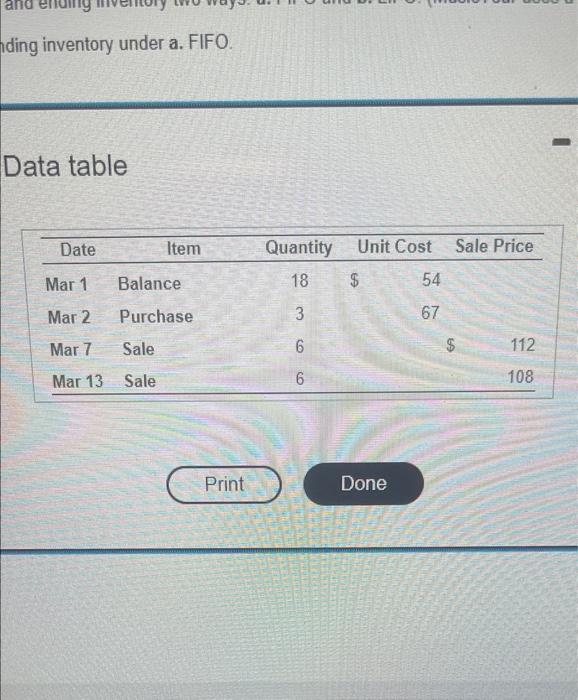

Requirement 2. MusicYear uses the FIFO method. Prepare the company's income statement for dollar) MusicYear Income Statement Month Ended March 31, 2021 Sales revenue Cost of goods sold Gross profit Operating expenses Income before income tax Income tax expense Net income 672 Mar 2 Mar 7 Mar 13 Purchase Sale Sale Print Done anding inventory statement for Data table Date Mar 1 Mar 2 Mar 7 Mar 13 Item Balance Purchase Sale Sale Print Quantity 18 3 6 6 Unit Cost $ Done 54 67 - X Sale Price 112 108 $ and the income tax rate was 30% Start by determining the amounts that MusicYear should report for cost of goods sold and ending inventory under a. FIFO FIFO method cost of goods sold = 648 FIFO method ending inventory = 525 Data table Determinie the amounts that MusicYear should report for cost of goods sold and ending inventory LIFO method cost of goods sold- 687 Date LIFO method ending inventory - 486 Requirement 2. MusicYear uses the FIFO method. Prepare the company's income statement for dollar) Music Year Income Statement Month Ended March 31, 2021 Sales revenue Cost of goods sold Gross profit Operating expenses Income before income tax Income tax expense Net income 672 Mar 1 Mar 2 Mar 7 Mar 13 Item Balance Purchase Sale Sale Prim Requirement 2. Mes Year up the FIFO method Prepare the compa Music Year Income Statement Month Ended March 31, 2021 Sales reve 132 Ce of goods Op ang expenses ce before income tax Nil 672 300 312 112 and ding inventory under a. FIFO. Data table Date Mar 1 Mar 2 Mar 7 Mar 13 Item Balance Purchase Sale Sale Print Quantity 18 366 Unit Cost Sale Price $ 54 67 112 Done 108 Requirement 2. MusicYear uses the FIFO method. Prepare the company's income statement for dollar) MusicYear Income Statement Month Ended March 31, 2021 Sales revenue Cost of goods sold Gross profit Operating expenses Income before income tax Income tax expense Net income 672 Mar 2 Mar 7 Mar 13 Purchase Sale Sale Print Done anding inventory statement for Data table Date Mar 1 Mar 2 Mar 7 Mar 13 Item Balance Purchase Sale Sale Print Quantity 18 3 6 6 Unit Cost $ Done 54 67 - X Sale Price 112 108 $ and the income tax rate was 30% Start by determining the amounts that MusicYear should report for cost of goods sold and ending inventory under a. FIFO FIFO method cost of goods sold = 648 FIFO method ending inventory = 525 Data table Determinie the amounts that MusicYear should report for cost of goods sold and ending inventory LIFO method cost of goods sold- 687 Date LIFO method ending inventory - 486 Requirement 2. MusicYear uses the FIFO method. Prepare the company's income statement for dollar) Music Year Income Statement Month Ended March 31, 2021 Sales revenue Cost of goods sold Gross profit Operating expenses Income before income tax Income tax expense Net income 672 Mar 1 Mar 2 Mar 7 Mar 13 Item Balance Purchase Sale Sale Prim Requirement 2. Mes Year up the FIFO method Prepare the compa Music Year Income Statement Month Ended March 31, 2021 Sales reve 132 Ce of goods Op ang expenses ce before income tax Nil 672 300 312 112 and ding inventory under a. FIFO. Data table Date Mar 1 Mar 2 Mar 7 Mar 13 Item Balance Purchase Sale Sale Print Quantity 18 366 Unit Cost Sale Price $ 54 67 112 Done 108

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started