Answered step by step

Verified Expert Solution

Question

1 Approved Answer

operational research question Imp Q.3. ABC company is considering investments into 6 projects: A, B, C, D, E and F. Details about each project are

operational research question Imp

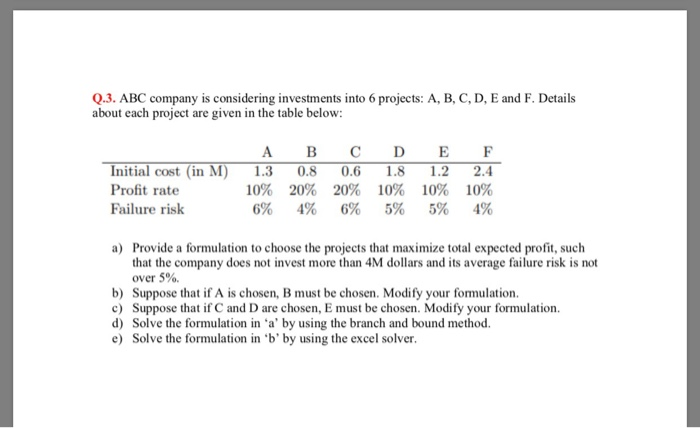

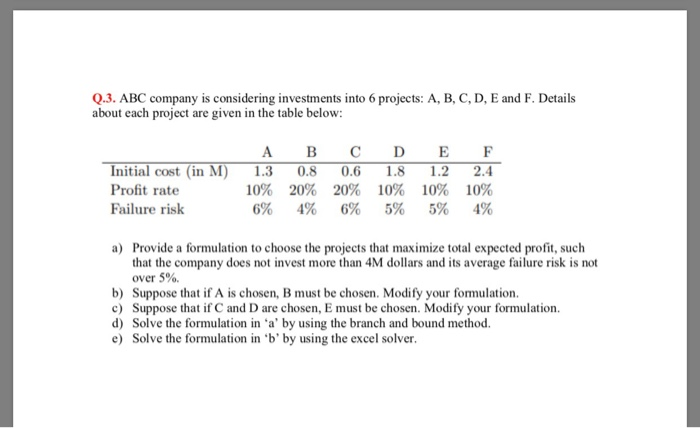

Q.3. ABC company is considering investments into 6 projects: A, B, C, D, E and F. Details about each project are given in the table below: 0.6 1.8 D E 1.2 F Initial cost (in M) 1.3 0.8 2.4 10% 20% 20% 10% 10% 10% 4% Profit rate 6% 4% 6% 5% 5% Failure risk a) Provide a formulation to choose the projects that maximize total expected profit, such that the company does not invest more than 4M dollars and its average failure risk is not over 5% b) Suppose that if A is chosen, B must be chosen. Modify your formulation c) Suppose that if C and D are chosen, E must be chosen. Modify your formulation d) Solve the formulation in 'a' by using the branch and bound method e) Solve the formulation in 'b' by using the excel solver. Q.3. ABC company is considering investments into 6 projects: A, B, C, D, E and F. Details about each project are given in the table below: 0.6 1.8 D E 1.2 F Initial cost (in M) 1.3 0.8 2.4 10% 20% 20% 10% 10% 10% 4% Profit rate 6% 4% 6% 5% 5% Failure risk a) Provide a formulation to choose the projects that maximize total expected profit, such that the company does not invest more than 4M dollars and its average failure risk is not over 5% b) Suppose that if A is chosen, B must be chosen. Modify your formulation c) Suppose that if C and D are chosen, E must be chosen. Modify your formulation d) Solve the formulation in 'a' by using the branch and bound method e) Solve the formulation in 'b' by using the excel solver

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started