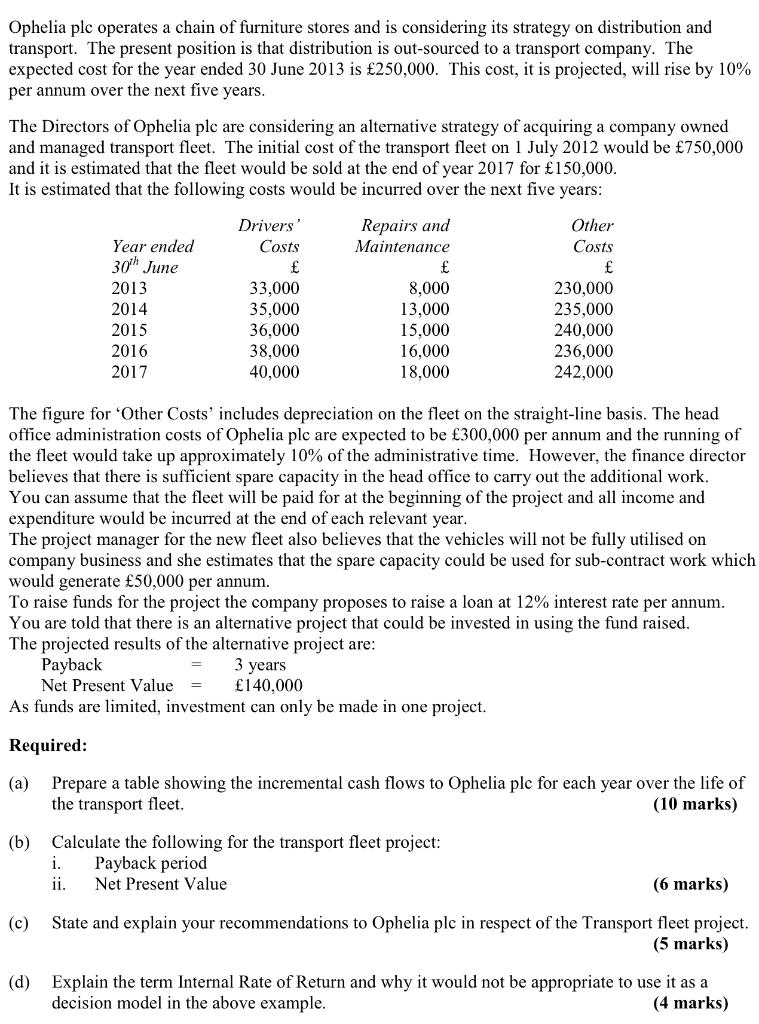

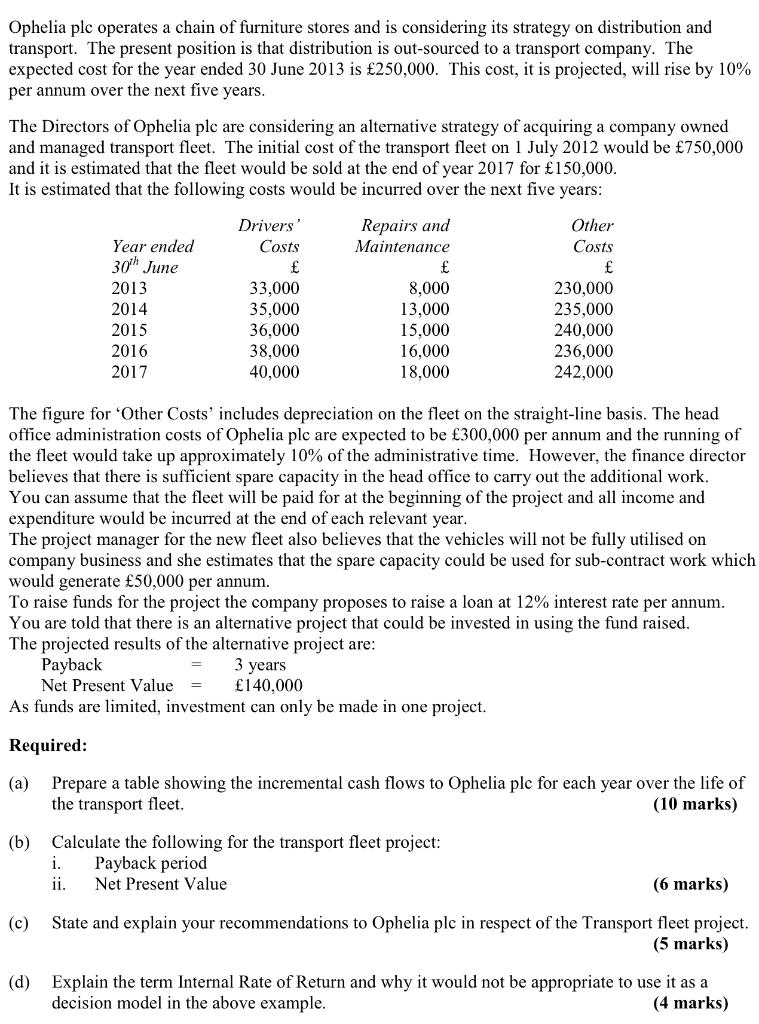

Ophelia plc operates a chain of furniture stores and is considering its strategy on distribution and transport. The present position is that distribution is out-sourced to a transport company. The expected cost for the year ended 30 June 2013 is 250,000. This cost, it is projected, will rise by 10% per annum over the next five years. The Directors of Ophelia ple are considering an alternative strategy of acquiring a company owned and managed transport fleet. The initial cost of the transport fleet on 1 July 2012 would be 750,000 and it is estimated that the fleet would be sold at the end of year 2017 for 150,000. It is estimated that the following costs would be incurred over the next five years: Year ended 30th June 2013 2014 2015 2016 2017 Drivers' Costs 33,000 35,000 36,000 38.000 40,000 Repairs and Maintenance 8,000 13,000 15,000 16,000 18,000 Other Costs 230,000 235,000 240,000 236,000 242,000 The figure for 'Other Costs' includes depreciation on the fleet on the straight-line basis. The head office administration costs of Ophelia plc are expected to be 300,000 per annum and the running of the fleet would take up approximately 10% of the administrative time. However, the finance director believes that there is sufficient spare capacity in the head office to carry out the additional work. You can assume that the fleet will be paid for at the beginning of the project and all income and expenditure would be incurred at the end of each relevant year. The project manager for the new fleet also believes that the vehicles will not be fully utilised on company business and she estimates that the spare capacity could be used for sub-contract work which would generate 50,000 per annum. To raise funds for the project the company proposes to raise a loan at 12% interest rate per annum. You are told that there is an alternative project that could be invested in using the fund raised. The projected results of the alternative project are: Payback 3 years Net Present Value 140,000 As funds are limited, investment can only be made in one project. = Required: (a) (b) Prepare a table showing the incremental cash flows to Ophelia plc for each year over the life of the transport fleet. (10 marks) Calculate the following for the transport fleet project: i. Payback period ii. Net Present Value (6 marks) (c) State and explain your recommendations to Ophelia plc in respect of the Transport fleet project. (5 marks) (d) Explain the term Internal Rate of Return and why it would not be appropriate to use it as a decision model in the above example. (4 marks) Ophelia plc operates a chain of furniture stores and is considering its strategy on distribution and transport. The present position is that distribution is out-sourced to a transport company. The expected cost for the year ended 30 June 2013 is 250,000. This cost, it is projected, will rise by 10% per annum over the next five years. The Directors of Ophelia ple are considering an alternative strategy of acquiring a company owned and managed transport fleet. The initial cost of the transport fleet on 1 July 2012 would be 750,000 and it is estimated that the fleet would be sold at the end of year 2017 for 150,000. It is estimated that the following costs would be incurred over the next five years: Year ended 30th June 2013 2014 2015 2016 2017 Drivers' Costs 33,000 35,000 36,000 38.000 40,000 Repairs and Maintenance 8,000 13,000 15,000 16,000 18,000 Other Costs 230,000 235,000 240,000 236,000 242,000 The figure for 'Other Costs' includes depreciation on the fleet on the straight-line basis. The head office administration costs of Ophelia plc are expected to be 300,000 per annum and the running of the fleet would take up approximately 10% of the administrative time. However, the finance director believes that there is sufficient spare capacity in the head office to carry out the additional work. You can assume that the fleet will be paid for at the beginning of the project and all income and expenditure would be incurred at the end of each relevant year. The project manager for the new fleet also believes that the vehicles will not be fully utilised on company business and she estimates that the spare capacity could be used for sub-contract work which would generate 50,000 per annum. To raise funds for the project the company proposes to raise a loan at 12% interest rate per annum. You are told that there is an alternative project that could be invested in using the fund raised. The projected results of the alternative project are: Payback 3 years Net Present Value 140,000 As funds are limited, investment can only be made in one project. = Required: (a) (b) Prepare a table showing the incremental cash flows to Ophelia plc for each year over the life of the transport fleet. (10 marks) Calculate the following for the transport fleet project: i. Payback period ii. Net Present Value (6 marks) (c) State and explain your recommendations to Ophelia plc in respect of the Transport fleet project. (5 marks) (d) Explain the term Internal Rate of Return and why it would not be appropriate to use it as a decision model in the above example. (4 marks)