Answered step by step

Verified Expert Solution

Question

1 Approved Answer

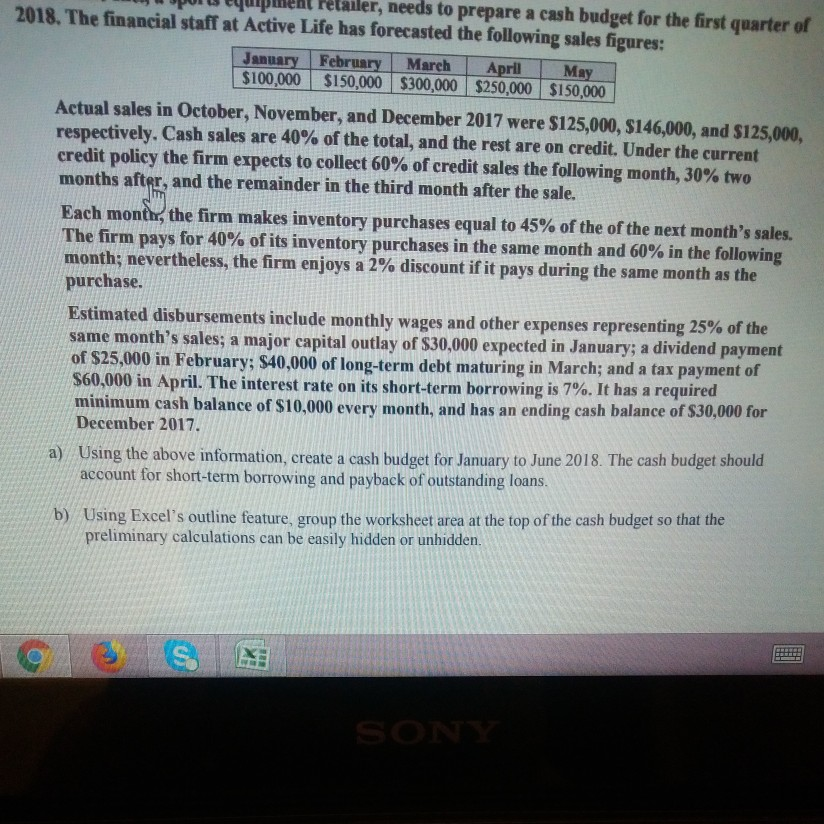

oports equlpheht Petailer, needs to prepare a cash budget for the first quarter of 2018. The financial staff at Active Life has forecasted the following

oports equlpheht Petailer, needs to prepare a cash budget for the first quarter of 2018. The financial staff at Active Life has forecasted the following sales figures: January February March April $100,000 $150,000 S300,000 $250,000 $150,000 Ma Actual sales in October, November, and December 2017 were $125,000, $146,000, and S125,000, respectively. Cash sales are 40% of the total, and the rest are on credit. Under the current credit policy the firm expects to collect 60% of credit sales the following month, 30% two months after, and the remainder in the third month after the sale. Each mone, the firm makes inventory purchases equal to 45% of the of the next month's sales. The firm pays for 40% of its inventory purchases in the same month and 60% in the following month, nevertheless, the firm enjoys a 2% discount if it pays during the same month as the purchase. Estimated disbursements include monthly wages and other expenses representing 25% of the same month's sales; of $25,000 in February: $40,000 of long-term debt maturing in March; and a tax payment of S60,000 in April. The interest rate on its short-term borrowing is 7%. It has a required a major capital outlay of $3 0,000 expected in January ; a dividend payment minimum cash balance of S10,000 every month, and has an ending cash balance of $30,000 for December 2017 Using the above information, create a cash budget for January to June 2018. The cash budget should account for short-term borrowing and payback of outstanding loans Using Excel's outline feature, group the worksheet area at the top of the cash budget so that the a) b) preliminary calculations can be easily hidden or unhidden oports equlpheht Petailer, needs to prepare a cash budget for the first quarter of 2018. The financial staff at Active Life has forecasted the following sales figures: January February March April $100,000 $150,000 S300,000 $250,000 $150,000 Ma Actual sales in October, November, and December 2017 were $125,000, $146,000, and S125,000, respectively. Cash sales are 40% of the total, and the rest are on credit. Under the current credit policy the firm expects to collect 60% of credit sales the following month, 30% two months after, and the remainder in the third month after the sale. Each mone, the firm makes inventory purchases equal to 45% of the of the next month's sales. The firm pays for 40% of its inventory purchases in the same month and 60% in the following month, nevertheless, the firm enjoys a 2% discount if it pays during the same month as the purchase. Estimated disbursements include monthly wages and other expenses representing 25% of the same month's sales; of $25,000 in February: $40,000 of long-term debt maturing in March; and a tax payment of S60,000 in April. The interest rate on its short-term borrowing is 7%. It has a required a major capital outlay of $3 0,000 expected in January ; a dividend payment minimum cash balance of S10,000 every month, and has an ending cash balance of $30,000 for December 2017 Using the above information, create a cash budget for January to June 2018. The cash budget should account for short-term borrowing and payback of outstanding loans Using Excel's outline feature, group the worksheet area at the top of the cash budget so that the a) b) preliminary calculations can be easily hidden or unhidden

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started