Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Opportunity Costs (H. Schaefer) Wolve Corp. is working at full production capacity producing 10,000 units of a unique product, AutoA. Manufacturing costs per unit for

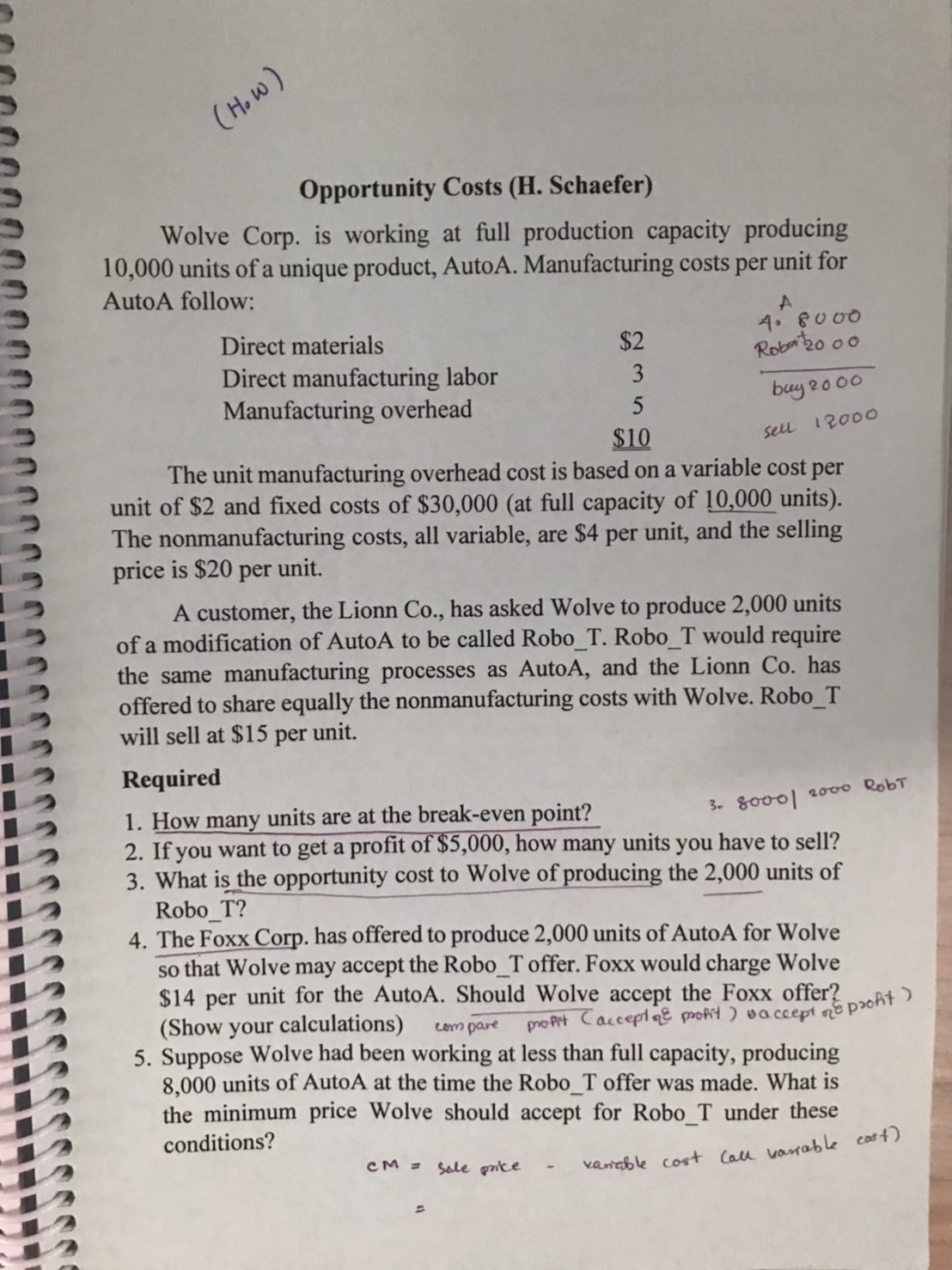

Opportunity Costs (H. Schaefer) Wolve Corp. is working at full production capacity producing 10,000 units of a unique product, AutoA. Manufacturing costs per unit for AutoA follow: A The unit manufacturing overhead cost is based on a variable cost per unit of $2 and fixed costs of $30,000 (at full capacity of 10,000 units). The nonmanufacturing costs, all variable, are $4 per unit, and the selling price is $20 per unit. A customer, the Lionn Co., has asked Wolve to produce 2,000 units of a modification of AutoA to be called Robo_T. Robo_T would require the same manufacturing processes as Auto A, and the Lionn Co. has offered to share equally the nonmanufacturing costs with Wolve. Robo_T will sell at $15 per unit. Required 1. How many units are at the break-even point? 3. 800012000Rob 2. If you want to get a profit of $5,000, how many units you have to sell? 3. What is the opportunity cost to Wolve of producing the 2,000 units of Robo_T? 4. The Foxx Corp. has offered to produce 2,000 units of AutoA for Wolve so that Wolve may accept the Robo_T offer. Foxx would charge Wolve $14 per unit for the AutoA. Should Wolve accept the Foxx offer? (Show your calculations) compare propit (accept \& 2 profit) vaccept of profit 5. Suppose Wolve had been working at less than full capacity, producing 8,000 units of AutoA at the time the Robo_T offer was made. What is the minimum price Wolve should accept for Robo_T under these conditions? CM=soleanice-variablecostcallvariable= Opportunity Costs (H. Schaefer) Wolve Corp. is working at full production capacity producing 10,000 units of a unique product, AutoA. Manufacturing costs per unit for AutoA follow: A The unit manufacturing overhead cost is based on a variable cost per unit of $2 and fixed costs of $30,000 (at full capacity of 10,000 units). The nonmanufacturing costs, all variable, are $4 per unit, and the selling price is $20 per unit. A customer, the Lionn Co., has asked Wolve to produce 2,000 units of a modification of AutoA to be called Robo_T. Robo_T would require the same manufacturing processes as Auto A, and the Lionn Co. has offered to share equally the nonmanufacturing costs with Wolve. Robo_T will sell at $15 per unit. Required 1. How many units are at the break-even point? 3. 800012000Rob 2. If you want to get a profit of $5,000, how many units you have to sell? 3. What is the opportunity cost to Wolve of producing the 2,000 units of Robo_T? 4. The Foxx Corp. has offered to produce 2,000 units of AutoA for Wolve so that Wolve may accept the Robo_T offer. Foxx would charge Wolve $14 per unit for the AutoA. Should Wolve accept the Foxx offer? (Show your calculations) compare propit (accept \& 2 profit) vaccept of profit 5. Suppose Wolve had been working at less than full capacity, producing 8,000 units of AutoA at the time the Robo_T offer was made. What is the minimum price Wolve should accept for Robo_T under these conditions? CM=soleanice-variablecostcallvariable=

Opportunity Costs (H. Schaefer) Wolve Corp. is working at full production capacity producing 10,000 units of a unique product, AutoA. Manufacturing costs per unit for AutoA follow: A The unit manufacturing overhead cost is based on a variable cost per unit of $2 and fixed costs of $30,000 (at full capacity of 10,000 units). The nonmanufacturing costs, all variable, are $4 per unit, and the selling price is $20 per unit. A customer, the Lionn Co., has asked Wolve to produce 2,000 units of a modification of AutoA to be called Robo_T. Robo_T would require the same manufacturing processes as Auto A, and the Lionn Co. has offered to share equally the nonmanufacturing costs with Wolve. Robo_T will sell at $15 per unit. Required 1. How many units are at the break-even point? 3. 800012000Rob 2. If you want to get a profit of $5,000, how many units you have to sell? 3. What is the opportunity cost to Wolve of producing the 2,000 units of Robo_T? 4. The Foxx Corp. has offered to produce 2,000 units of AutoA for Wolve so that Wolve may accept the Robo_T offer. Foxx would charge Wolve $14 per unit for the AutoA. Should Wolve accept the Foxx offer? (Show your calculations) compare propit (accept \& 2 profit) vaccept of profit 5. Suppose Wolve had been working at less than full capacity, producing 8,000 units of AutoA at the time the Robo_T offer was made. What is the minimum price Wolve should accept for Robo_T under these conditions? CM=soleanice-variablecostcallvariable= Opportunity Costs (H. Schaefer) Wolve Corp. is working at full production capacity producing 10,000 units of a unique product, AutoA. Manufacturing costs per unit for AutoA follow: A The unit manufacturing overhead cost is based on a variable cost per unit of $2 and fixed costs of $30,000 (at full capacity of 10,000 units). The nonmanufacturing costs, all variable, are $4 per unit, and the selling price is $20 per unit. A customer, the Lionn Co., has asked Wolve to produce 2,000 units of a modification of AutoA to be called Robo_T. Robo_T would require the same manufacturing processes as Auto A, and the Lionn Co. has offered to share equally the nonmanufacturing costs with Wolve. Robo_T will sell at $15 per unit. Required 1. How many units are at the break-even point? 3. 800012000Rob 2. If you want to get a profit of $5,000, how many units you have to sell? 3. What is the opportunity cost to Wolve of producing the 2,000 units of Robo_T? 4. The Foxx Corp. has offered to produce 2,000 units of AutoA for Wolve so that Wolve may accept the Robo_T offer. Foxx would charge Wolve $14 per unit for the AutoA. Should Wolve accept the Foxx offer? (Show your calculations) compare propit (accept \& 2 profit) vaccept of profit 5. Suppose Wolve had been working at less than full capacity, producing 8,000 units of AutoA at the time the Robo_T offer was made. What is the minimum price Wolve should accept for Robo_T under these conditions? CM=soleanice-variablecostcallvariable= Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started