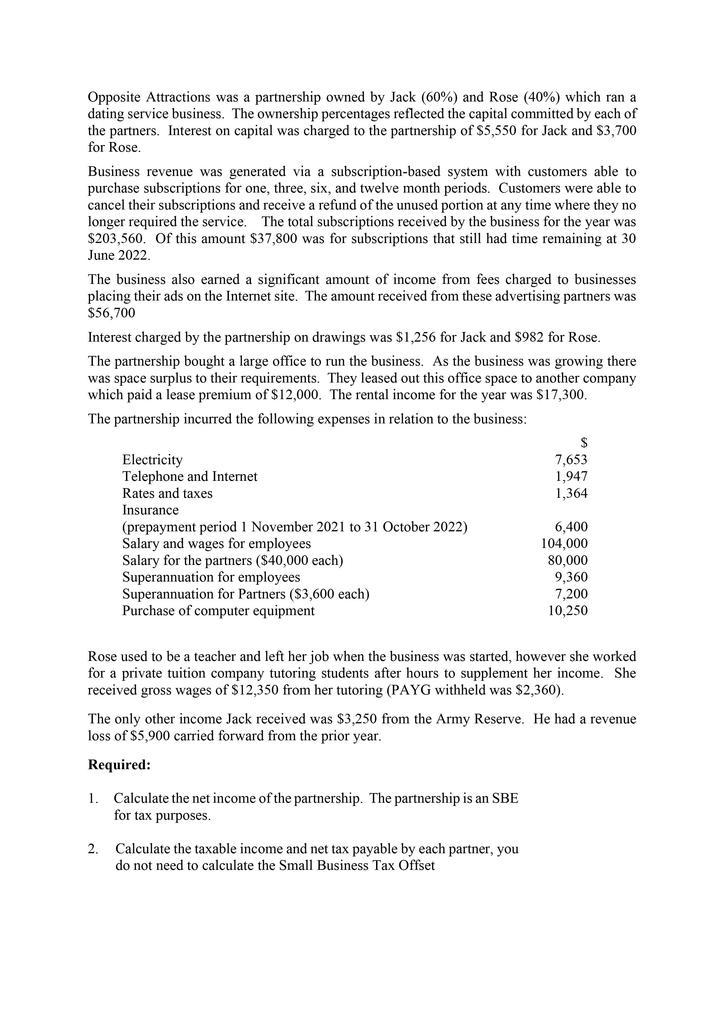

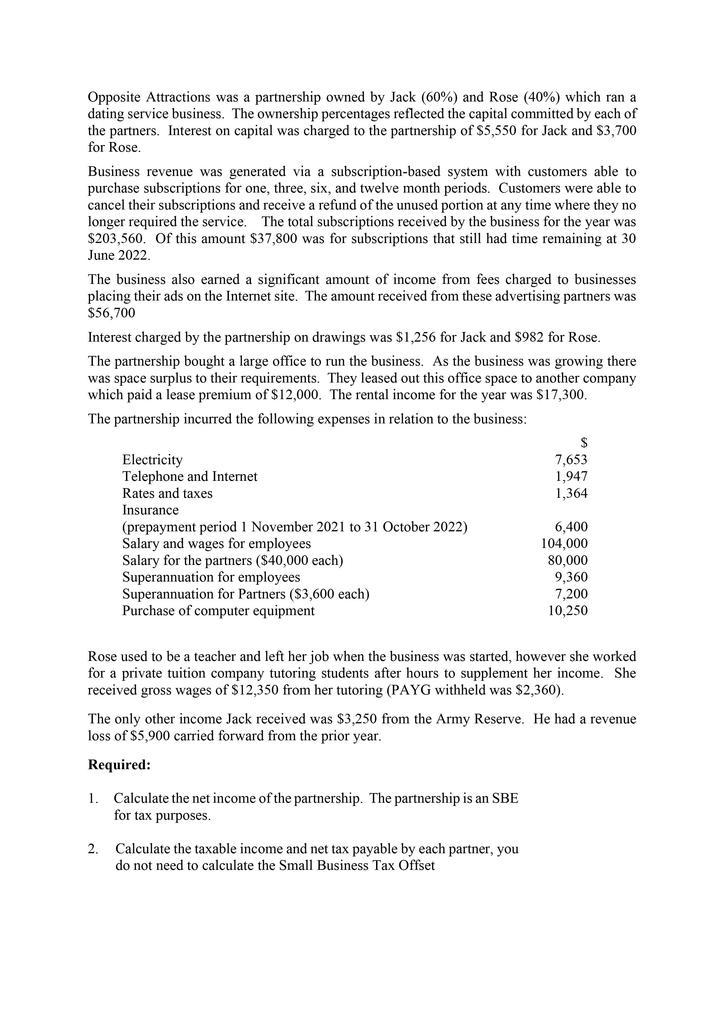

Opposite Attractions was a partnership owned by Jack (60\%) and Rose ( 40%) which ran a dating service business. The ownership percentages reflected the capital committed by each of the partners. Interest on capital was charged to the partnership of $5,550 for Jack and $3,700 for Rose. Business revenue was generated via a subscription-based system with customers able to purchase subscriptions for one, three, six, and twelve month periods. Customers were able to cancel their subscriptions and receive a refund of the unused portion at any time where they no longer required the service. The total subscriptions received by the business for the year was $203,560. Of this amount $37,800 was for subscriptions that still had time remaining at 30 June 2022 . The business also earned a significant amount of income from fees charged to businesses placing their ads on the Internet site. The amount received from these advertising partners was $56,700 Interest charged by the partnership on drawings was $1,256 for Jack and $982 for Rose. The partnership bought a large office to run the business. As the business was growing there was space surplus to their requirements. They leased out this office space to another company which paid a lease premium of $12,000. The rental income for the year was $17,300. The partnership incurred the following expenses in relation to the business: Rose used to be a teacher and left her job when the business was started, however she worked for a private tuition company tutoring students after hours to supplement her income. She received gross wages of $12,350 from her tutoring (PAYG withheld was $2,360 ). The only other income Jack received was $3,250 from the Army Reserve. He had a revenue loss of $5,900 carried forward from the prior year. Required: 1. Calculate the net income of the partnership. The partnership is an SBE for tax purposes. 2. Calculate the taxable income and net tax payable by each partner, you do not need to calculate the Small Business Tax Offset