Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Optimal Balance (Pty) Ltd is a holistic health store that operates in the Western Cape. It started trading 20 years ago and has seen

Â

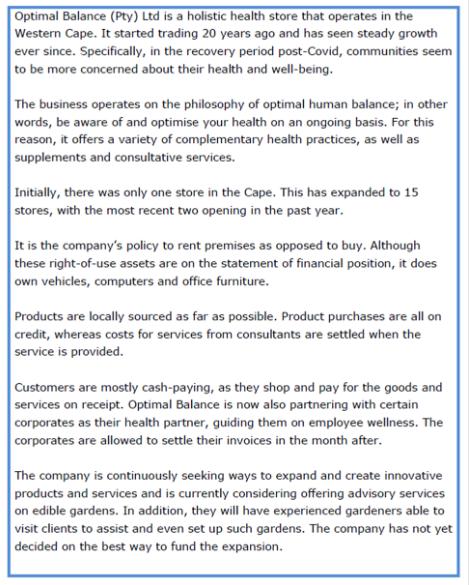

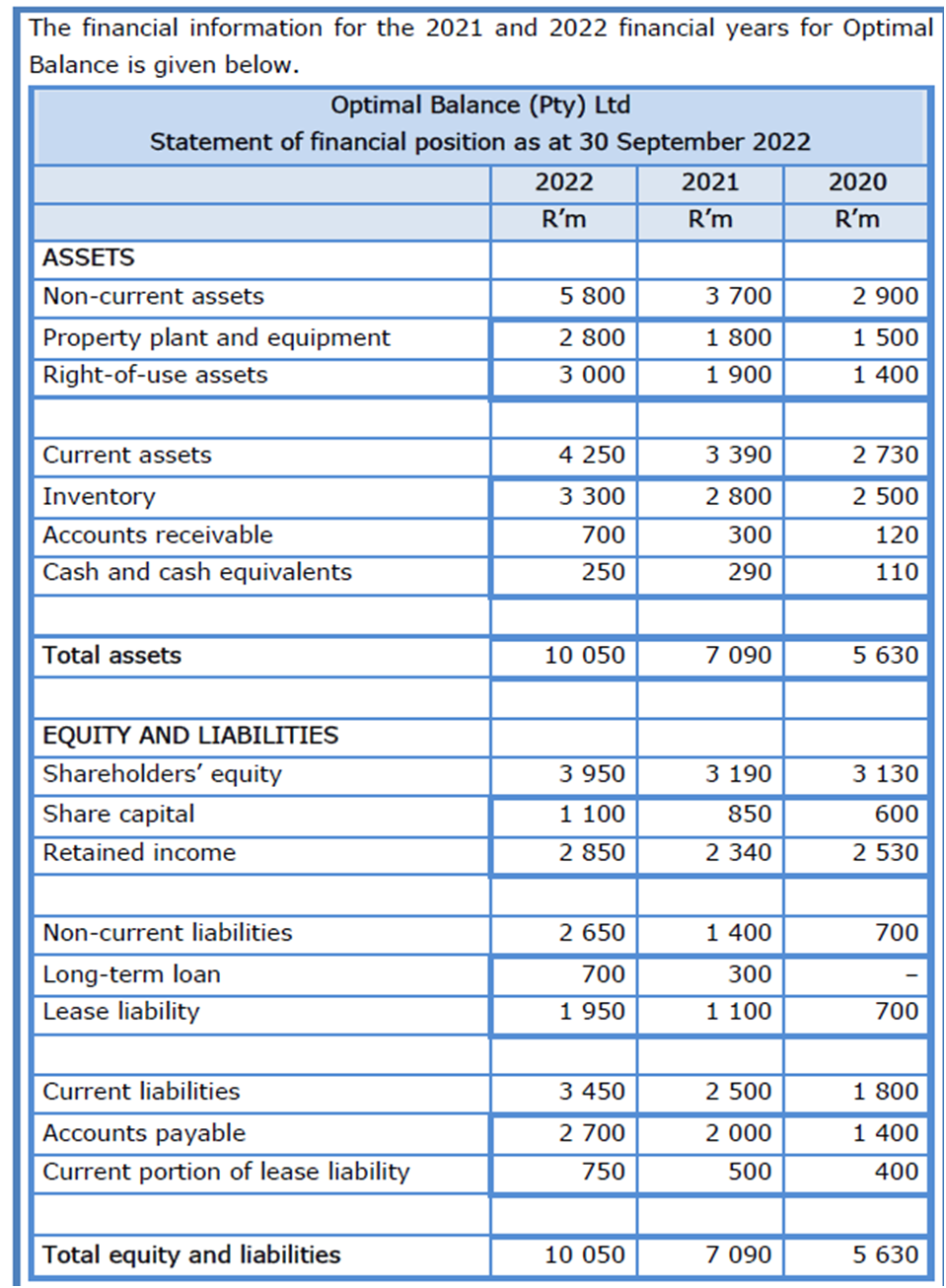

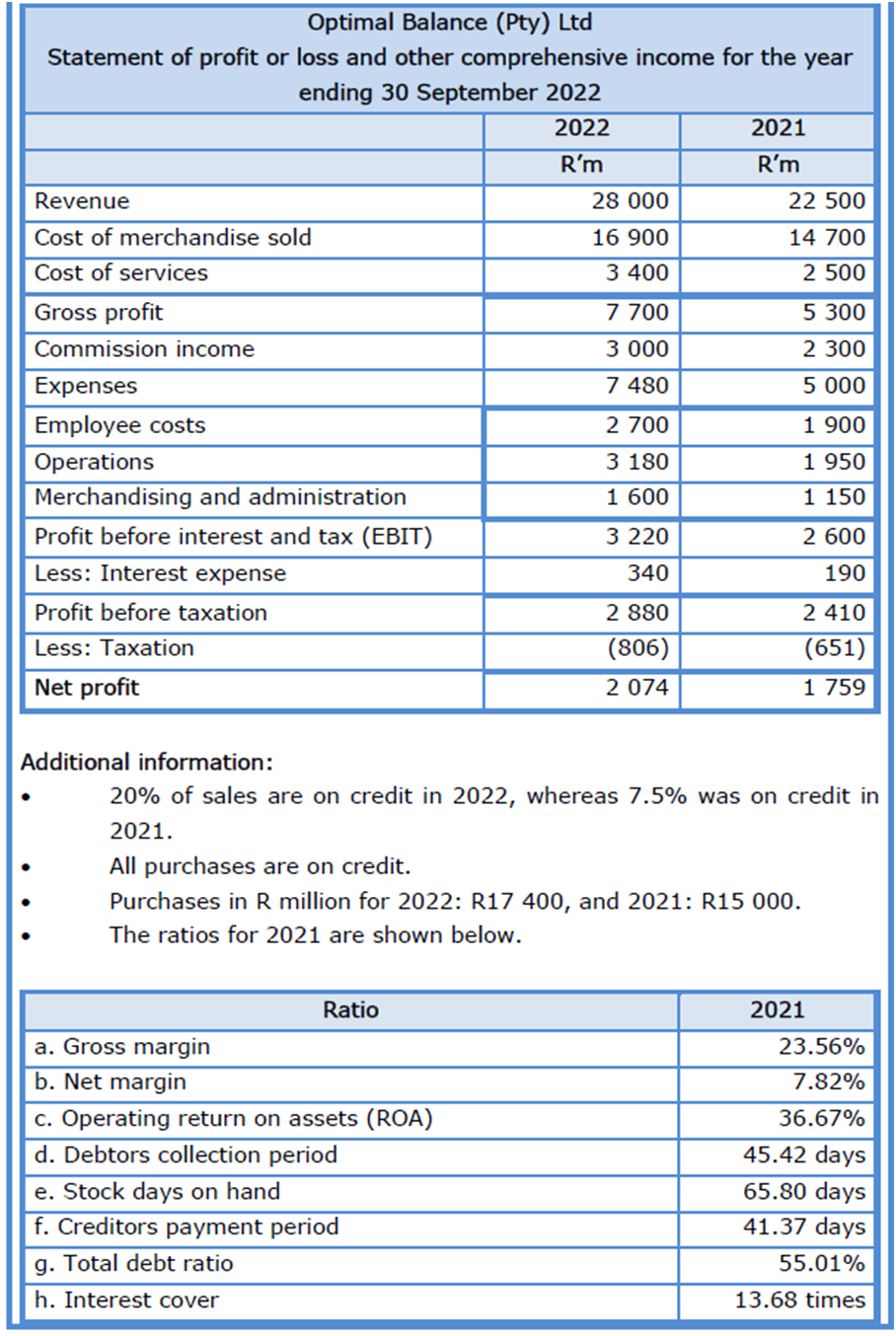

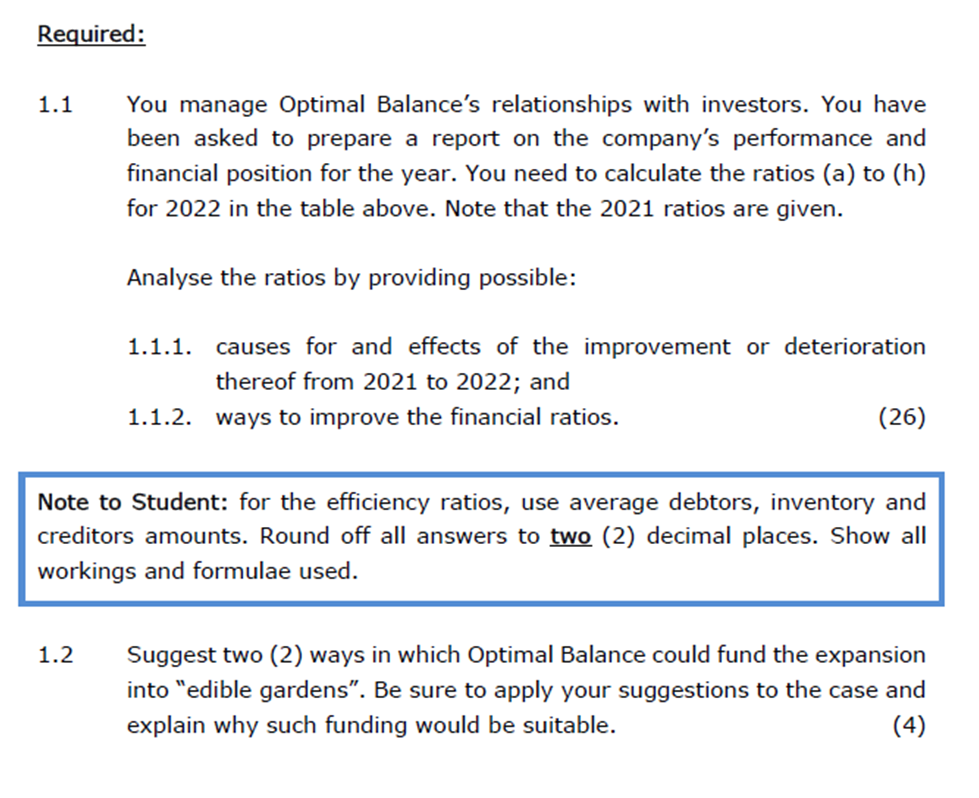

Optimal Balance (Pty) Ltd is a holistic health store that operates in the Western Cape. It started trading 20 years ago and has seen steady growth ever since. Specifically, in the recovery period post-Covid, communities seem to be more concerned about their health and well-being. The business operates on the philosophy of optimal human balance; in other words, be aware of and optimise your health on an ongoing basis. For this reason, it offers a variety of complementary health practices, as well as supplements and consultative services. Initially, there was only one store in the Cape. This has expanded to 15 stores, with the most recent two opening in the past year. It is the company's policy to rent premises as opposed to buy. Although these right-of-use assets are on the statement of financial position, it does own vehicles, computers and office furniture. Products are locally sourced as far as possible. Product purchases are all on credit, whereas costs for services from consultants are settled when the service is provided. Customers are mostly cash-paying, as they shop and pay for the goods and services on receipt. Optimal Balance is now also partnering with certain corporates as their health partner, guiding them on employee wellness. The corporates are allowed to settle their invoices in the month after. The company is continuously seeking ways to expand and create innovative products and services and is currently considering offering advisory services on edible gardens. In addition, they will have experienced gardeners able to visit clients to assist and even set up such gardens. The company has not yet decided on the best way to fund the expansion. The financial information for the 2021 and 2022 financial years for Optimal Balance is given below. Optimal Balance (Pty) Ltd Statement of financial position as at 30 September 2022 2022 R'm ASSETS Non-current assets Property plant and equipment Right-of-use assets Current assets Inventory Accounts receivable Cash and cash equivalents Total assets EQUITY AND LIABILITIES Shareholders' equity Share capital Retained income Non-current liabilities Long-term loan Lease liability Current liabilities Accounts payable Current portion of lease liability Total equity and liabilities 5 800 2 800 3 000 4 250 3 300 700 250 10 050 3 950 1 100 2 850 2 650 700 1 950 3 450 2 700 750 10 050 2021 R'm 3 700 1 800 1 900 3 390 2 800 300 290 7 090 3 190 850 2 340 1 400 300 1 100 2 500 2 000 500 7 090 2020 R'm 2 900 1 500 1 400 2 730 2 500 120 110 5 630 3 130 600 2 530 700 700 1 800 1 400 400 5 630 Optimal Balance (Pty) Ltd Statement of profit or loss and other comprehensive income for the year ending 30 September 2022 2022 R'm Revenue Cost of merchandise sold Cost of services Gross profit Commission income Expenses Employee costs Operations Merchandising and administration Profit before interest and tax (EBIT) Less: Interest expense Profit before taxation Less: Taxation Net profit Additional information: a. Gross margin b. Net margin Ratio 28 000 16 900 3 400 c. Operating return on assets (ROA) d. Debtors collection period 7 700 3 000 7 480 2 700 3 180 1 600 3 220 340 e. Stock days on hand f. Creditors payment period g. Total debt ratio h. Interest cover 2 880 (806) 2 074 2021 R'm 20% of sales are on credit in 2022, whereas 7.5% was on credit in 2021. All purchases are on credit. Purchases in R million for 2022: R17 400, and 2021: R15 000. The ratios for 2021 are shown below. 22 500 14 700 2 500 5 300 2 300 5 000 1 900 1 950 1 150 2 600 190 2 410 (651) 1 759 2021 23.56% 7.82% 36.67% 45.42 days 65.80 days 41.37 days 55.01% 13.68 times Required: 1.1 You manage Optimal Balance's relationships with investors. You have been asked to prepare a report on the company's performance and financial position for the year. You need to calculate the ratios (a) to (h) for 2022 in the table above. Note that the 2021 ratios are given. 1.2 Analyse the ratios by providing possible: 1.1.1. causes for and effects of the improvement or deterioration thereof from 2021 to 2022; and 1.1.2. ways to improve the financial ratios. (26) Note to Student: for the efficiency ratios, use average debtors, inventory and creditors amounts. Round off all answers to two (2) decimal places. Show all workings and formulae used. Suggest two (2) ways in which Optimal Balance could fund the expansion into "edible gardens". Be sure to apply your suggestions to the case and explain why such funding would be suitable. (4)

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started