Question

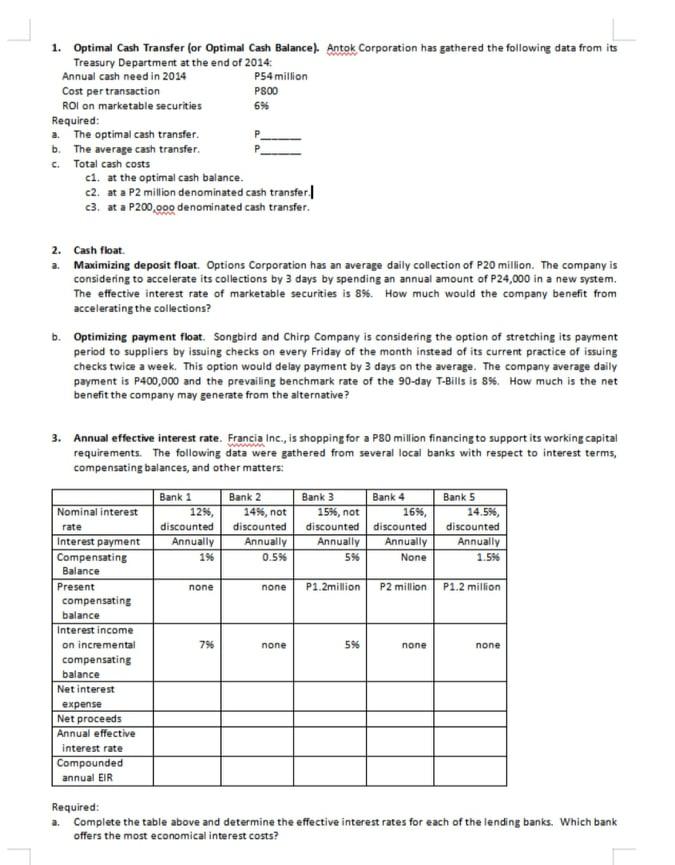

Optimal Cash Transfer (or Optimal Cash Balance). Romela Corporation has gathered the following data from its Treasury Department at the end of 2014: Annual cash

- Optimal Cash Transfer (or Optimal Cash Balance). Romela Corporation has gathered the following data from its Treasury Department at the end of 2014:

Annual cash need in 2014 P54 million

Cost per transaction P800

ROI on marketable securities 6%

Required:

- The optimal cash transfer. P_______

- The average cash transfer. P_______

- Total cash costs

c1. at the optimal cash balance.

c2. at a P2 million denominated cash transfer.

c3. at a P200,000 denominated cash transfer.

- Cash float.

- Maximizing deposit float. Options Corporation has an average daily collection of P20 million. The company is considering accelerating its collections by 3 days by spending an annual amount of P24,000 on a new system. The effective interest rate of marketable securities is 8%. How much would the company benefit from accelerating the collections?

- Optimizing payment float. Songbird and Chirp Company is considering the option of stretching its payment period to suppliers by issuing checks on every Friday of the month instead of its current practice of issuing checks twice a week. This option would delay the payment by 3 days on average. The company average daily payment is P400,000 and the prevailing benchmark rate of the 90-day T-Bills is 8%. How much is the net benefit the company may generate from the alternative?

- Annual effective interest rate. Francia Inc is shopping for

P80 million financing to support its working capital requirements. The following data were gathered from several local banks with respect to interest terms, compensating balances, and other matters:

P80 million financing to support its working capital requirements. The following data were gathered from several local banks with respect to interest terms, compensating balances, and other matters:

|

| Bank 1 | Bank 2 | Bank 3 | Bank 4 | Bank 5 |

| Nominal interest rate | 12%, discounted | 14%, not discounted | 15%, not discounted | 16%, discounted | 14.5%, discounted |

| Interest payment | Annually | Annually | Annually | Annually | Annually |

| Compensating Balance | 1% | 0.5% | 5% | None | 1.5% |

| Present compensating balance | none | none | P1.2million | P2 million | P1.2 million |

| Interest income on the incremental compensating balance |

7% |

none |

5% |

none |

none |

| Net interest expense |

|

|

|

|

|

| Net proceeds |

|

|

|

|

|

| Annual effective interest rate |

|

|

|

|

|

| Compounded annual EIR |

|

|

|

|

|

Required:

- Complete the table above and determine the effective interest rates for each of the lending banks. Which bank offers the most economical interest costs?

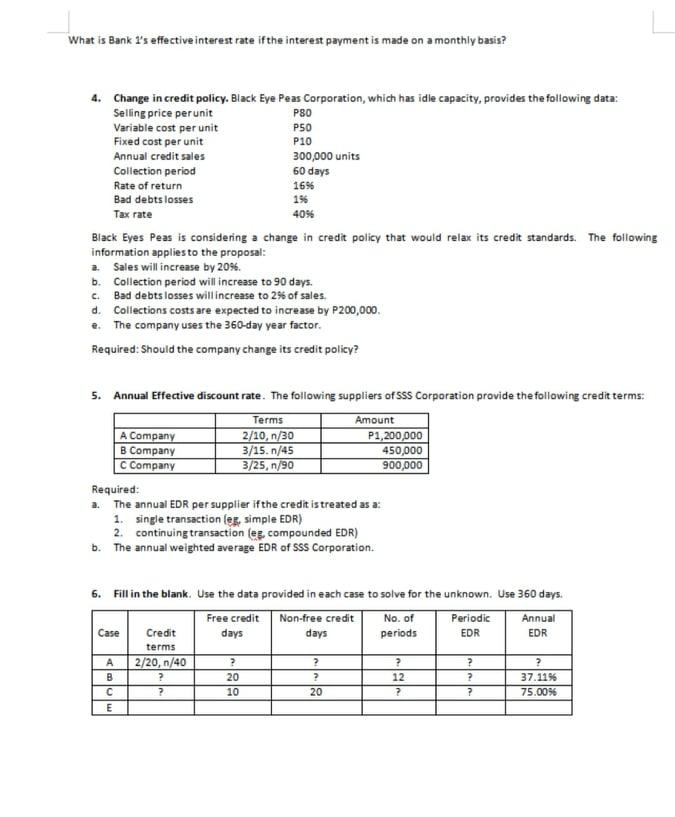

What is Bank 1s effective interest rate if the interest payment is made on a monthly basis?

- Change in credit policy. Black Eye Peas Corporation, which has idle capacity, provides the following data:

Selling price per unit P80

Variable cost per unit P50

Fixed cost per unit P10

Annual credit sales 300,000 units

Collection period 60 days

Rate of return 16%

Bad debts lose 1%

Tax rate 40%

Black Eyes Peas is considering a change in credit policy that would relax its credit standards. The following information applies to the proposal:

a. Sales will increase by 20%.

b. Collection period will increase to 90 days.

c. Bad debt losses will increase to 2% of sales.

d. Collections costs are expected to increase by P200,000.

e. The company uses the 360-day year factor.

Required: Should the company change its credit policy?

- Annual Effective discount rate. The following suppliers of SSS Corporation provide the following credit terms:

|

| Terms | Amount |

| A Company | 2/10, n/30 | P1,200,000 |

| B Company | 3/15. n/45 | 450,000 |

| C Company | 3/25, n/90 | 900,000 |

Required:

- The annual EDR per supplier if the credit is treated as a:

- single transaction (eg, simple EDR)

- continuing transaction (eg, compounded EDR)

- The annual weighted average EDR of SSS Corporation.

- Fill in the blank. Use the data provided in each case to solve for the unknown. Use 360 days.

|

Case |

Credit terms | Free credit days | Non-free credit days | No. of periods | Periodic EDR | Annual EDR |

| A | 2/20, n/40 | ? | ? | ? | ? | ? |

| B | ? | 20 | ? | 12 | ? | 37.11% |

| C | ? | 10 | 20 | ? | ? | 75.00% |

| E |

|

|

|

|

|

|

1. Optimal Cash Transfer for Optimal Cash Balance). Antok Corporation has gathered the following data from its Treasury Department at the end of 2014 Annual cash need in 2014 P54 million Cost per transaction P800 ROI on marketable securities 696 Required: a. The optimal cash transfer. b. The average cash transfer. c. Total cash costs ci. at the optimal cash balance. c2. at a P2 million denominated cash transfer c3. at a P200.000 denominated cash transfer. 2. Cash float 2. Maximizing deposit float. Options Corporation has an average daily collection of P20 million. The company is considering to accelerate its collections by 3 days by spending an annual amount of P24,000 in a new system. The effective interest rate of marketable securities is 8%. How much would the company benefit from accelerating the collections? b. Optimizing payment float. Songbird and Chirp Company is considering the option of stretching its payment period to suppliers by issuing checks on every Friday of the month instead of its current practice of issuing checks twice a week. This option would delay payment by 3 days on the average. The company average daily payment is P400,000 and the prevailing benchmark rate of the 90-day T-Bills is 8%. How much is the net benefit the company may generate from the alternative? 3. Annual effective interest rate. Francia Inc., is shopping for a P80 million financing to support its working capital requirements. The following data were gathered from several local banks with respect to interest terms, compensating balances, and other matters: Bank 1 12%, discounted Annually 196 Bank 2 14%, not discounted Annually 0.596 Bank 3 Bank 4 15%, not 16%, discounted discounted Annually Annually 5% None Bank 5 14.5% discounted Annually 1.5% none none P1.2million P2 million P1.2 million Nominal interest rate Interest payment Compensating Balance Present compensating balance Interest income on incremental compensating balance Net interest expense Net proceeds Annual effective interest rate Compounded annual EIR 796 none 596 none none Required: a. Complete the table above and determine the effective interest rates for each of the lending banks, which bank offers the most economical interest costs? What is Bank I's effective interest rate if the interest payment is made on a monthly basis? 4. Change in credit policy. Black Eye Peas Corporation, which has idle capacity, provides the following data: Selling price per unit P80 Variable cost per unit P50 Fixed cost per unit P10 Annual credit sales 300,000 units Collection period 60 days Rate of return 16% Bad debts losses Tax rate 40% Black Eyes Peas is considering a change in credit policy that would relax its credit standards. The following information applies to the proposal: 2. Sales will increase by 20%. b. Collection period will increase to 90 days. C. Bad debts losses will increase to 2% of sales, d. Collections costs are expected to increase by P200,000 e. The company uses the 360-day year factor. Required: Should the company change its credit policy? 5. Annual Effective discount rate. The following suppliers of SSS Corporation provide the following credit terms: Terms Amount A Company 2/10,n/30 P1,200,000 B Company 3/15. n/45 450,000 C Company 3/25, n/90 900,000 Required: a. The annual EDR per supplier if the credit is treated as a 1. single transaction leg, simple EDR) 2. continuing transaction (eg compounded EDR) b. The annual weighted average EDR of SSS Corporation. Case 6. Fill in the blank. Use the data provided in each case to solve for the unknown. Use 360 days. Free credit Non-free credit No. of Periodic Annual Credit days days periods EDR EDR terms 2/20, n/40 ? ? ? ? ? B ? 20 ? 12 ? 37.11% ? 10 20 7 7 75.0096 E 1. Optimal Cash Transfer for Optimal Cash Balance). Antok Corporation has gathered the following data from its Treasury Department at the end of 2014 Annual cash need in 2014 P54 million Cost per transaction P800 ROI on marketable securities 696 Required: a. The optimal cash transfer. b. The average cash transfer. c. Total cash costs ci. at the optimal cash balance. c2. at a P2 million denominated cash transfer c3. at a P200.000 denominated cash transfer. 2. Cash float 2. Maximizing deposit float. Options Corporation has an average daily collection of P20 million. The company is considering to accelerate its collections by 3 days by spending an annual amount of P24,000 in a new system. The effective interest rate of marketable securities is 8%. How much would the company benefit from accelerating the collections? b. Optimizing payment float. Songbird and Chirp Company is considering the option of stretching its payment period to suppliers by issuing checks on every Friday of the month instead of its current practice of issuing checks twice a week. This option would delay payment by 3 days on the average. The company average daily payment is P400,000 and the prevailing benchmark rate of the 90-day T-Bills is 8%. How much is the net benefit the company may generate from the alternative? 3. Annual effective interest rate. Francia Inc., is shopping for a P80 million financing to support its working capital requirements. The following data were gathered from several local banks with respect to interest terms, compensating balances, and other matters: Bank 1 12%, discounted Annually 196 Bank 2 14%, not discounted Annually 0.596 Bank 3 Bank 4 15%, not 16%, discounted discounted Annually Annually 5% None Bank 5 14.5% discounted Annually 1.5% none none P1.2million P2 million P1.2 million Nominal interest rate Interest payment Compensating Balance Present compensating balance Interest income on incremental compensating balance Net interest expense Net proceeds Annual effective interest rate Compounded annual EIR 796 none 596 none none Required: a. Complete the table above and determine the effective interest rates for each of the lending banks, which bank offers the most economical interest costs? What is Bank I's effective interest rate if the interest payment is made on a monthly basis? 4. Change in credit policy. Black Eye Peas Corporation, which has idle capacity, provides the following data: Selling price per unit P80 Variable cost per unit P50 Fixed cost per unit P10 Annual credit sales 300,000 units Collection period 60 days Rate of return 16% Bad debts losses Tax rate 40% Black Eyes Peas is considering a change in credit policy that would relax its credit standards. The following information applies to the proposal: 2. Sales will increase by 20%. b. Collection period will increase to 90 days. C. Bad debts losses will increase to 2% of sales, d. Collections costs are expected to increase by P200,000 e. The company uses the 360-day year factor. Required: Should the company change its credit policy? 5. Annual Effective discount rate. The following suppliers of SSS Corporation provide the following credit terms: Terms Amount A Company 2/10,n/30 P1,200,000 B Company 3/15. n/45 450,000 C Company 3/25, n/90 900,000 Required: a. The annual EDR per supplier if the credit is treated as a 1. single transaction leg, simple EDR) 2. continuing transaction (eg compounded EDR) b. The annual weighted average EDR of SSS Corporation. Case 6. Fill in the blank. Use the data provided in each case to solve for the unknown. Use 360 days. Free credit Non-free credit No. of Periodic Annual Credit days days periods EDR EDR terms 2/20, n/40 ? ? ? ? ? B ? 20 ? 12 ? 37.11% ? 10 20 7 7 75.0096 E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started