Answered step by step

Verified Expert Solution

Question

1 Approved Answer

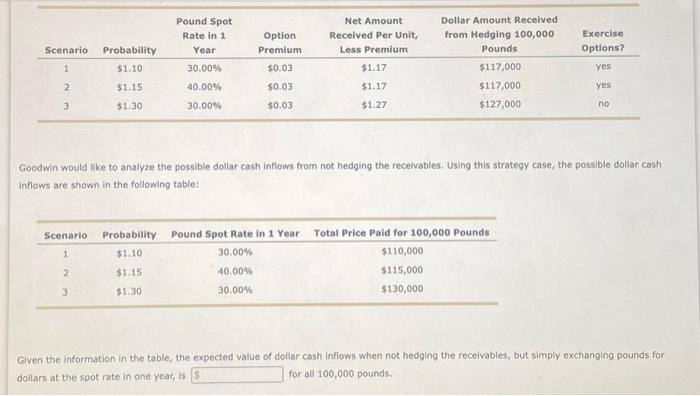

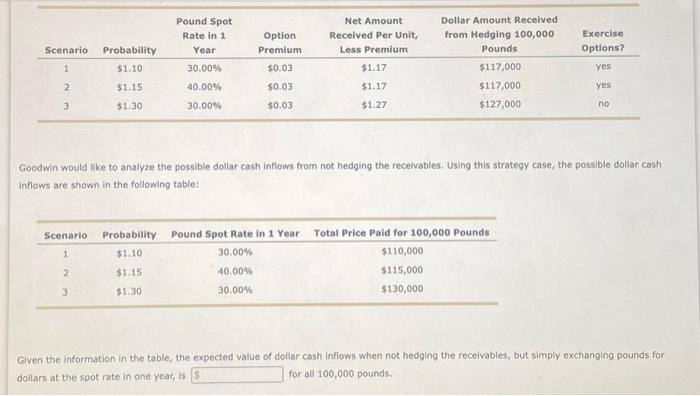

optimal hedge vs no hedge recievables Goodwin would like to analyze the possible dollar cash inflows from not hedging the receivables. Using this strategy case,

optimal hedge vs no hedge recievables

Goodwin would like to analyze the possible dollar cash inflows from not hedging the receivables. Using this strategy case, the possible dollar cash inflows are shown in the following table: Given the information in the table, the expected value of doltar cash inflows when not hedging the receivables, but simply exchanging pounds for dollars at the spot rate in one year, is for all 100,000 pounds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started