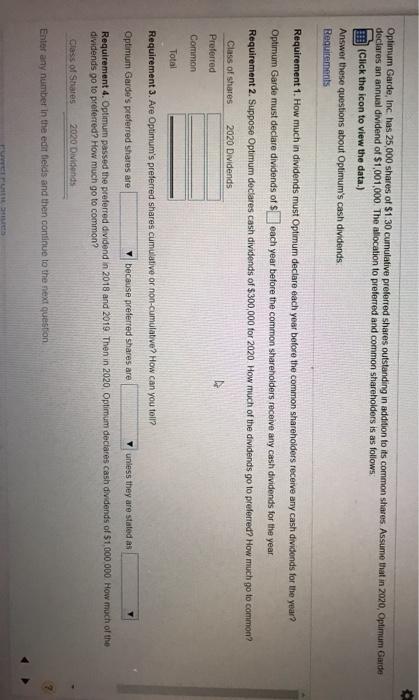

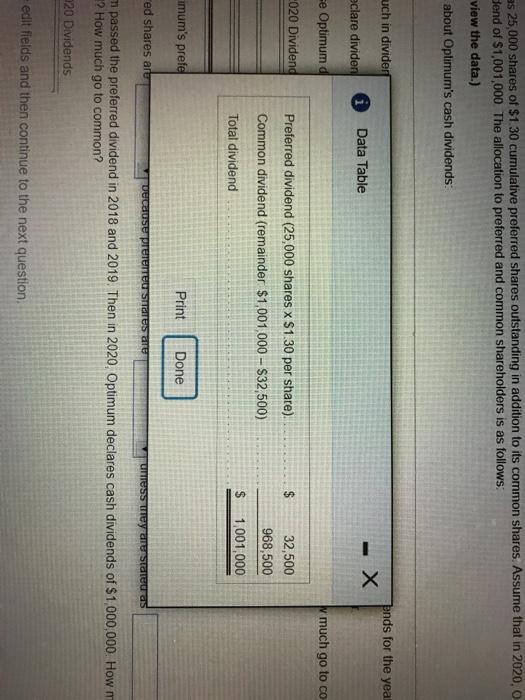

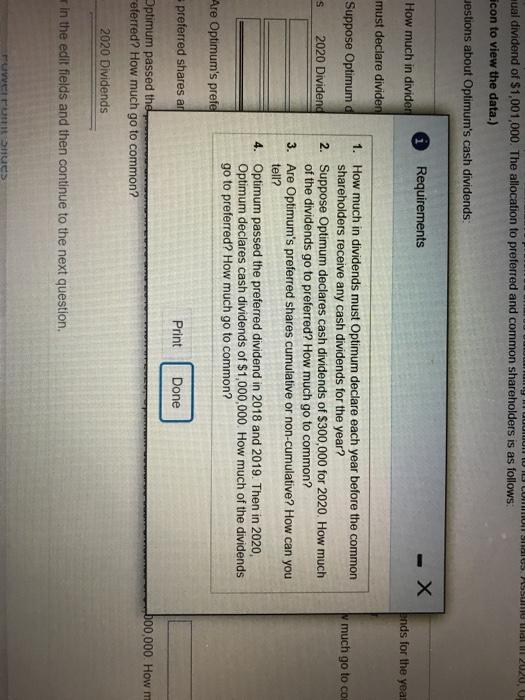

Optimum Garde, Inc. has 25,000 shares of $130 cumulative preferred shares outstanding in addition to its common shares. Assume that in 2020, Optimum Garde declares an annual dividend of $1,001,000 The allocation to preferred and common shareholders is as follows (Click the icon to view the data.) Answer these questions about Optimum's cash dividends Requirements Requirement 1. How much in dividends must Optimum declare each year before the common shareholders receive any cash dividends for the year? Optimum Garde must declare dividends of each year before the common shareholders receive any cash dividends for the year Requirement 2. Suppose Optimum declares cash dividends of $300,000 for 2020 How much of the dividends go to preferred? How much go to common? Class of shares 2020 Dividends Preferred Common Total Requirement 3. Are Optimum's preferred shares cumulative or non-cumulative? How can you tell? Optimum Garde's preferred shares are because preferred shares are V unless they are stated as Requirement 4. Optimum passed the preferred dividend in 2018 and 2019 Then in 2020 Optimum declares cash dividends of $1,000 000 How much of the dividends go to preferred? How much go to common? Class of States 2020 Dividends Enter any number in the edit fields and then continue to the next question Es 25,000 shares of $1.30 cumulative preferred shares outstanding in addition to its common shares. Assume that in 2020, O Bend of $1,001,000 The allocation to preferred and common shareholders is as follows: view the data.) about Optimum's cash dividends: uch in dividen ands for the year - Data Table eclare dividen e Optimum d y much go to co 020 Dividend $ Preferred dividend (25,000 shares X S1.30 per share). Common dividend (remainder $1,001,000 - $32,500) 32,500 968,500 $ Total dividend 1,001,000 imum's prefe Print Done ed shares art UeCause preTeTTBUSTEST UNESS tiey are state as m passed the preferred dividend in 2018 and 2019. Then in 2020, Optimum declares cash dividends of $1,000,000 How m 19 How much go to common? 20 Dividends edit fields and then continue to the next question. CUITUL SI SUMU lidl lll 2020. U mual dividend of $1,001,000. The allocation to preferred and common shareholders is as follows: Econ to view the data.) destions about Optimum's cash dividends: i Requirements How much in dividen Ends for the yea must declare dividen Suppose Optimum much go to co S 2020 Dividend 1. How much in dividends must Optimum declare each year before the common shareholders receive any cash dividends for the year? 2. Suppose Optimum declares cash dividends of $300,000 for 2020. How much of the dividends go to preferred? How much go to common? 3. Are Optimum's preferred shares cumulative or non-cumulative? How can you tell? 4. Optimum passed the preferred dividend in 2018 and 2019. Then in 2020, Optimum declares cash dividends of $1,000,000. How much of the dividends go to preferred? How much go to common? Are Optimum's prefe preferred shares ar Print Done Optimum passed the Feferred? How much go to common? 500.000. How m 2020 Dividends in the edit fields and then continue to the next question. Fruttit is