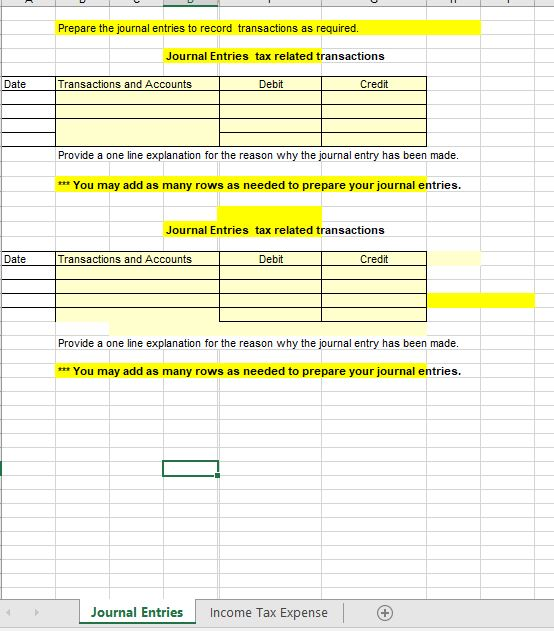

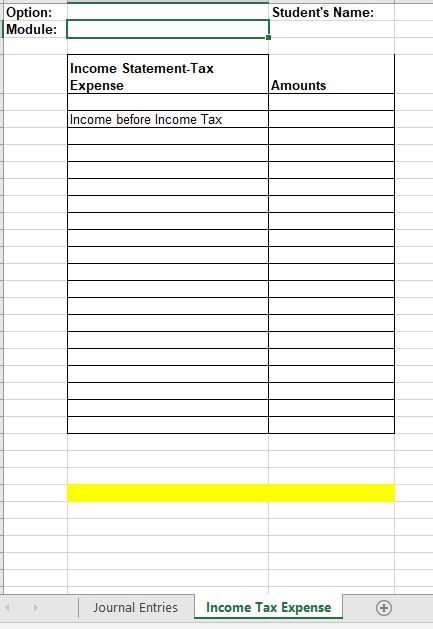

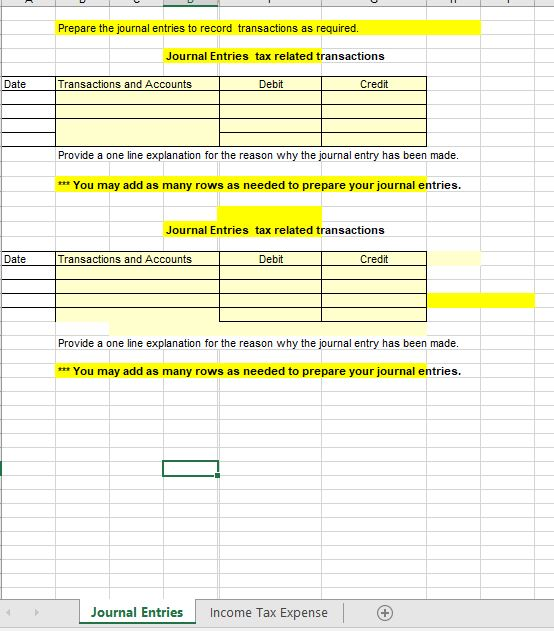

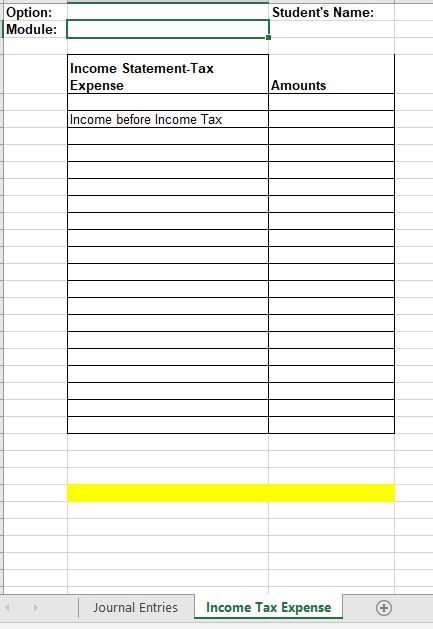

Option #1: Book and Income Tax Differences Complete the following questions. In addition to answering the items below, you must submit an analysis of the assignment. Analyze the specific outcomes and write an analysis directed toward the team at Geyser Company describing what the numbers mean and how they relate to the business. Submit journal entries in an Excel file and written segments in an MS Word document. For written answers, please make sure your responses are well-written, formatted per CSU-Global Guide to Writing and APA and have proper citations, where applicable. Geyser Company began operations in 2017 and has provided the following information. 1. Pretax financial income for 2017 is $200,000. 2. The tax rate enacted for 2017 and future years is 40% 3. Differences between the 2017 income statement and tax return are listed below: Warranty expense accrued for financial reporting purposes amounts to $10,000. Warranty deductions per a. the tax return amount to $4,000. b. Gross profit on construction contracts using the percentage-of-completion method for book purposes amounts to $184,000. Gross profit on construction contracts for tax purposes amounts to $124,000 Depreciation of property, plant, and equipment for financial reporting purposes amounts to $60,000. Depreciation of these assets amounts to $80,000 for the tax return. d. A $3,500 fine paid for violation of pollution laws was deducted in computing pretax financial income. e. Interest revenue earned on an investment in tax-exempt municipal bonds amounts to $1,400. C. 4. Taxable income is expected for the next few years. Provided with this assignment is the Excel workbook containing the spreadsheets you will need for this exercise. Use the spreadsheet Journal Entries to prepare the journal entry to record income tax expense, deferred taxes, and income taxes payable for 2017. Draft the income tax expense section of the income statement, beginning with "Income before income taxes" Prepare the journal entries to record transactions as required. Journal Entries tax related transactions Date Transactions and Accounts Debit Credit Provide a one line explanation for the reason why the journal entry has been made. You may add as many rows as needed to prepare your journal entries. Journal Entries tax related transactions Transactions and Accounts Date Debit Credit Provide a one line explanation for the reason why the journal entry has been made. You may add as many rows as needed to prepare your journal entries. Journal Entries Income Tax Expense Student's Name: Option: Module: Income Statement-Tax Expense Amounts Income before Income Tax Income Tax Expense Journal Entries + Option #1: Book and Income Tax Differences Complete the following questions. In addition to answering the items below, you must submit an analysis of the assignment. Analyze the specific outcomes and write an analysis directed toward the team at Geyser Company describing what the numbers mean and how they relate to the business. Submit journal entries in an Excel file and written segments in an MS Word document. For written answers, please make sure your responses are well-written, formatted per CSU-Global Guide to Writing and APA and have proper citations, where applicable. Geyser Company began operations in 2017 and has provided the following information. 1. Pretax financial income for 2017 is $200,000. 2. The tax rate enacted for 2017 and future years is 40% 3. Differences between the 2017 income statement and tax return are listed below: Warranty expense accrued for financial reporting purposes amounts to $10,000. Warranty deductions per a. the tax return amount to $4,000. b. Gross profit on construction contracts using the percentage-of-completion method for book purposes amounts to $184,000. Gross profit on construction contracts for tax purposes amounts to $124,000 Depreciation of property, plant, and equipment for financial reporting purposes amounts to $60,000. Depreciation of these assets amounts to $80,000 for the tax return. d. A $3,500 fine paid for violation of pollution laws was deducted in computing pretax financial income. e. Interest revenue earned on an investment in tax-exempt municipal bonds amounts to $1,400. C. 4. Taxable income is expected for the next few years. Provided with this assignment is the Excel workbook containing the spreadsheets you will need for this exercise. Use the spreadsheet Journal Entries to prepare the journal entry to record income tax expense, deferred taxes, and income taxes payable for 2017. Draft the income tax expense section of the income statement, beginning with "Income before income taxes" Prepare the journal entries to record transactions as required. Journal Entries tax related transactions Date Transactions and Accounts Debit Credit Provide a one line explanation for the reason why the journal entry has been made. You may add as many rows as needed to prepare your journal entries. Journal Entries tax related transactions Transactions and Accounts Date Debit Credit Provide a one line explanation for the reason why the journal entry has been made. You may add as many rows as needed to prepare your journal entries. Journal Entries Income Tax Expense Student's Name: Option: Module: Income Statement-Tax Expense Amounts Income before Income Tax Income Tax Expense Journal Entries +