Option #1: Computing and Recording Depreciation Two Brother's Moving Company purchased a group of new moving trucks for a total amount of $125,000. The vehicles

Option #1: Computing and Recording Depreciation

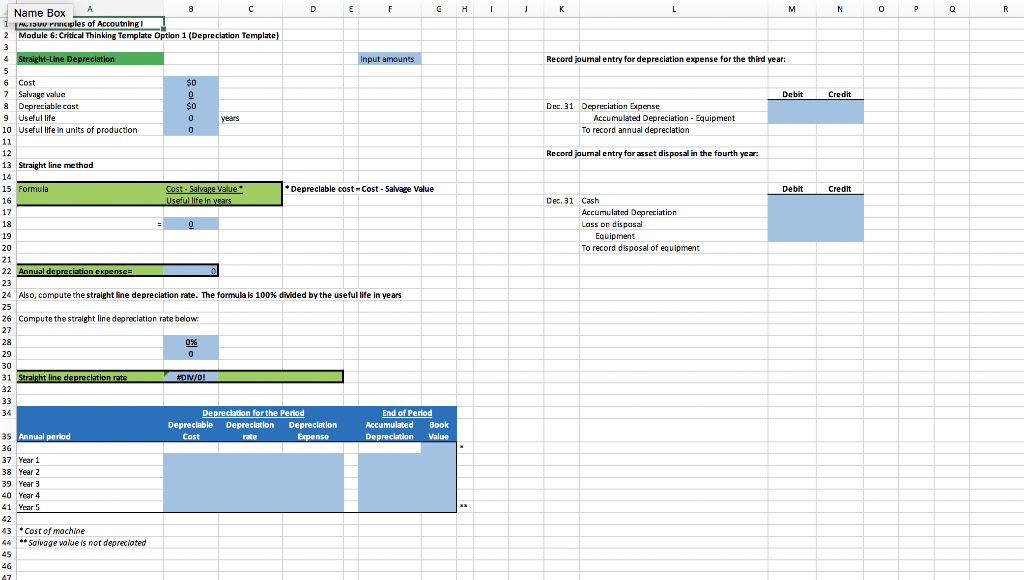

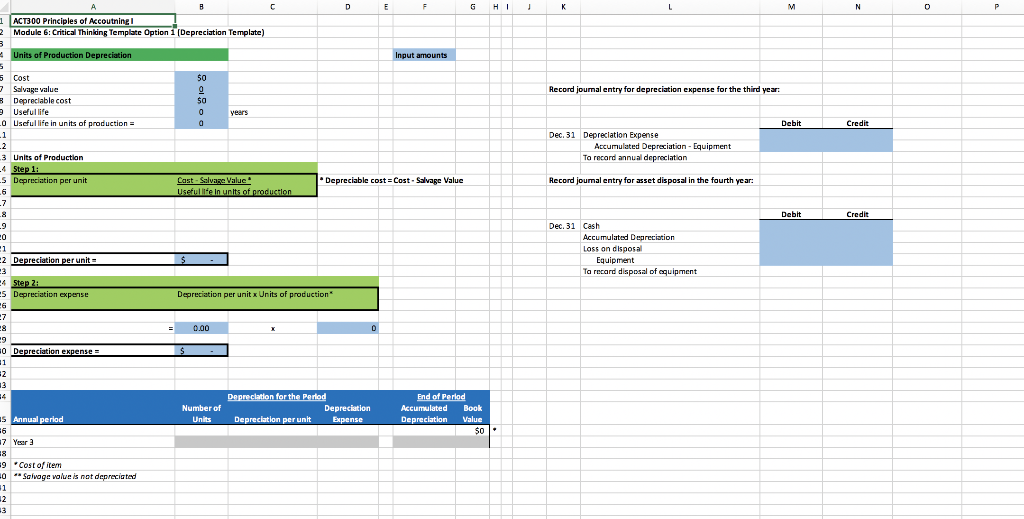

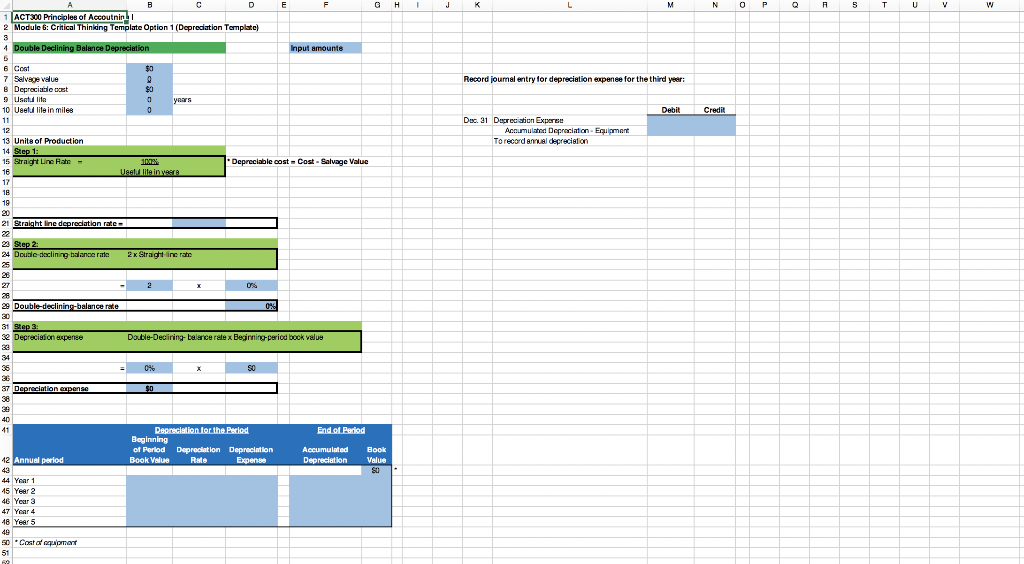

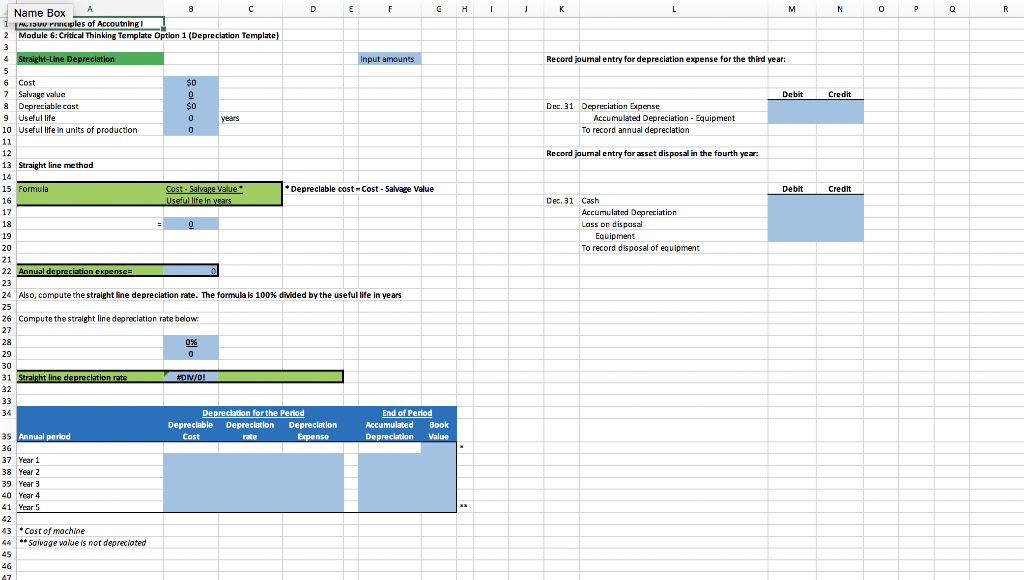

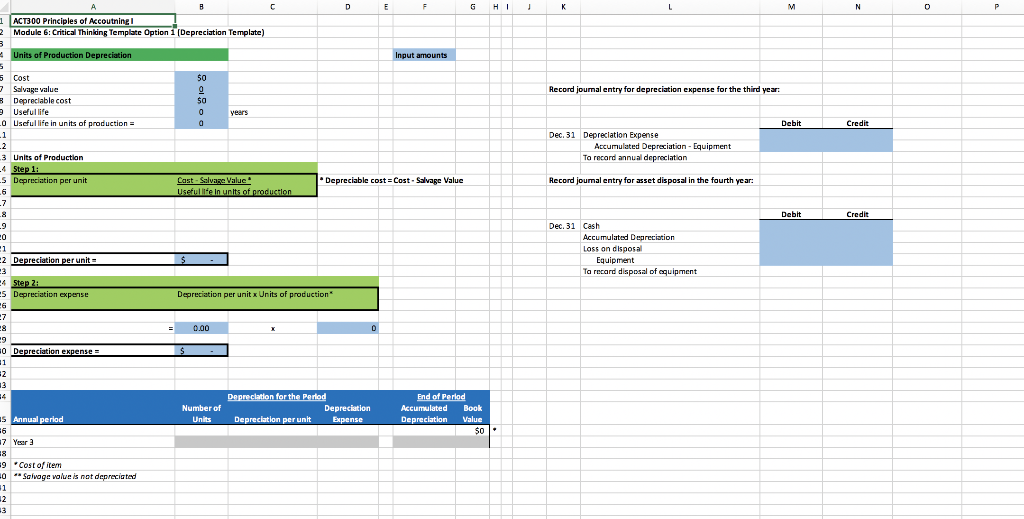

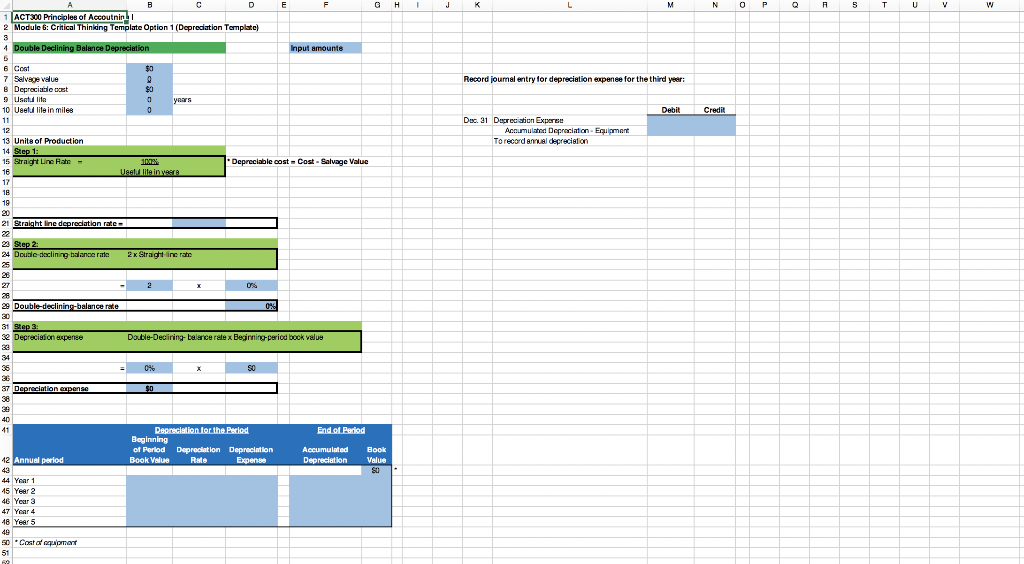

Two Brother's Moving Company purchased a group of new moving trucks for a total amount of $125,000. The vehicles are expected to last five years due to the heavy use and have a residual/scrap/salvage value of $10,000 at the end of that life. Usage of the vehicle is tracked in miles and the vehicles in total are expected to last 2,000,000 miles. During year one 750,000 miles were used, during year two 600,000 miles were used, during year three 500,000 miles were used, during year four no miles were used due to a temporary closing of the moving line of business, and during year five 150,000 miles were used. Using the depreciation template provided, determine the amount of depreciation expense for the third year under each of the following assumptions:

- The company uses the straight-line method of depreciation.

- The company uses the units-of-production method of depreciation.

- The company uses the double-declining-balance method of depreciation.

- Assuming straight line depreciation, prepare the journal entry for the third year.

- Assume the company sold the vehicles at the end of the fourth year for $50,000. Prepare journal entry for asset disposal in the fourth year.

- Assume you are the chief accountant of this company. Determine how you will choose, based on best industry practices, the depreciation method for them to use.

Your response to Question 3 should be at least one page and must include the title and reference pages.

M N O P Q R Name Box TALISUU Prociples of Accouting 2 Module 6: Critical Thinking Template Option 1 (Depreciation Template) 4 Straight-Line Depreciation Input amounts Record journal entry for depreciation expense for the third year: Debit Credit 6 Cost 7 Salvage value 8 Depreciable cast 9 Useful life 10 Useful life in units of production Dec. 31 Depreciation Expense Accumulated Depreciation - Equipment To record annual depreciation Record journal entry for asset disposal in the fourth year. 13 Straight line method Formula Depreciable cost-Cost - Salvage Value Debit Cost - Salvare Value Useful life in years Credit Dec, 31 Cash Accumulated Depreciation Loss on disposal Equipment To record disposal of equipment 21 22 Annual depreciation expense 24 Nso, compute the straight line depreciation rate. The formula is 100% diided by the useful life in years 26 Compute the straight line depreciation rate below: 0% Straight line depreciation rate NO! Depreciation for the Period Depreciable Depreciation Depreciation Cost rate Expense End of Period Accumulated Book Depreciation Value 35 Annual period 37 Year 1 38 Year 2 39 Year 3 40 Year 4 41 Year 5 43 Cost of machine 44 ** Salvage value is not depreciated 1 2 ACT300 Principles of Accoutningi Module 6: Critical Thinking Template Option 1 (Depreciation Template) Units of Production Depreciation Input amounts Record journal entry for depreciation expense for the third year: 5 Cost Salvage value Depreciable cost Useful life LO Useful life in units of production = Debit Credit Dec. 31 Depreciation Expense Accumulated Depreciation - Equipment Ta record annual depreciation 3 Units of Production -4 Step 1: s Depreciation per unit Cast - Salvage Value Usefullte in units of production *Depreciable cost = Cost - Salvage Value Record journal entry for asset disposal in the fourth year: DO Debit Credit Dec. 31 Cash Accumulated Depreciation Loss on disposal Equipment Ta recard disposal of equipment -2 Depreciation per unit Step 2: 5 Depreciation expense Depreciation per unit x Units of production MED = 0.00 TO 0 Depreciation expense S - Number of Units Depreciation for the Period Depreciation Depreciation per unit Expense End of Period Accumulated Book Depreciation Value $0 15 Annual period . 17 Yeer 3 9 LO Cost of item ** Salvage value is not depreciated 1 ACT300 Principles of Accoutnini 2 Module 6: Critical Thinking Template Option 1 (Depreciation Template) 4 Double Declining Balance Depreciation Input amounts Record journal entry for depreciation expense for the third year: 6 Cost 7 Selvevalue 8 Depreciable acest 9 Uselle 10 Ueel life in miles Debit Credit Dec 21 Depreciation Experte Accumulated Depreciation - Eulament To record annual depreciation 13 Units of Production 14 Step 1: 15 Straight Line Rae - Depreciable cost-Cost - Salvage Value Un 100% liten Double declining balance rate 2x Straight-liners 08 29 Double-declining-balance rate Step 3: Deprecision mpense Double-Declining balance relex Beginning-period book value wpense 30 End of Period Depreciation for the Period Beginning of Period Depreciation Depreciation Book Value Rule Expens 42 Annual period Accumulated Deprecation Book Value 44 Year 1 15 Year 2 46 Year 3 47 Year 4 48 Yeer 5 50 Cost of equipment