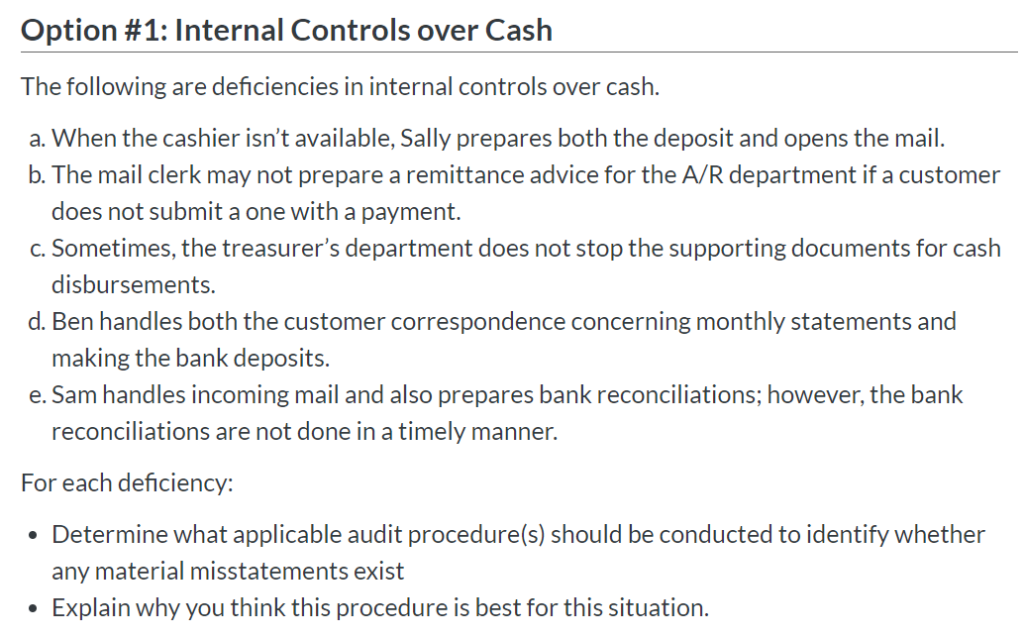

Option #1: Internal Controls over Cash The following deficiencies in internal controls over cash. are a. When the cashier isn't available, Sally prepares both the deposit and opens the mail. b. The mail clerk may not prepare a remittance advice for the A/R department if a customer does not submit a one with a payment. Sometimes, the treasurer's department does not stop the supporting documents for cash . disbursements. d. Ben handles both the customer correspondence concerning monthly statements and making the bank deposits. e. Sam handles incoming mail and also prepares bank reconciliations; however, the bank reconciliations are not done in a timely manner. For each deficiency: Determine what applicable audit procedure(s) should be conducted to identify whether any material misstatements exist Explain why you think this procedure is best for this situation. Consider each deficiency independently of the others. While each deficiency presents potential issues, identify two that stand out as the worse with your professional knowledge Explain your rationale. Also, how would you implement a change to improve those |deficiencies? Option #1: Internal Controls over Cash The following deficiencies in internal controls over cash. are a. When the cashier isn't available, Sally prepares both the deposit and opens the mail. b. The mail clerk may not prepare a remittance advice for the A/R department if a customer does not submit a one with a payment. Sometimes, the treasurer's department does not stop the supporting documents for cash . disbursements. d. Ben handles both the customer correspondence concerning monthly statements and making the bank deposits. e. Sam handles incoming mail and also prepares bank reconciliations; however, the bank reconciliations are not done in a timely manner. For each deficiency: Determine what applicable audit procedure(s) should be conducted to identify whether any material misstatements exist Explain why you think this procedure is best for this situation. Consider each deficiency independently of the others. While each deficiency presents potential issues, identify two that stand out as the worse with your professional knowledge Explain your rationale. Also, how would you implement a change to improve those |deficiencies