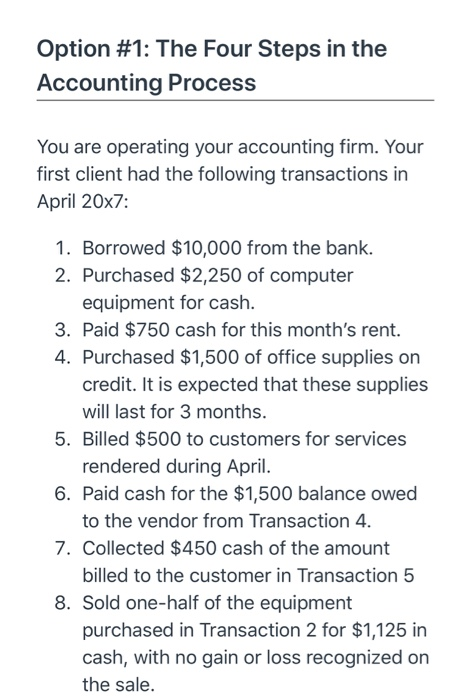

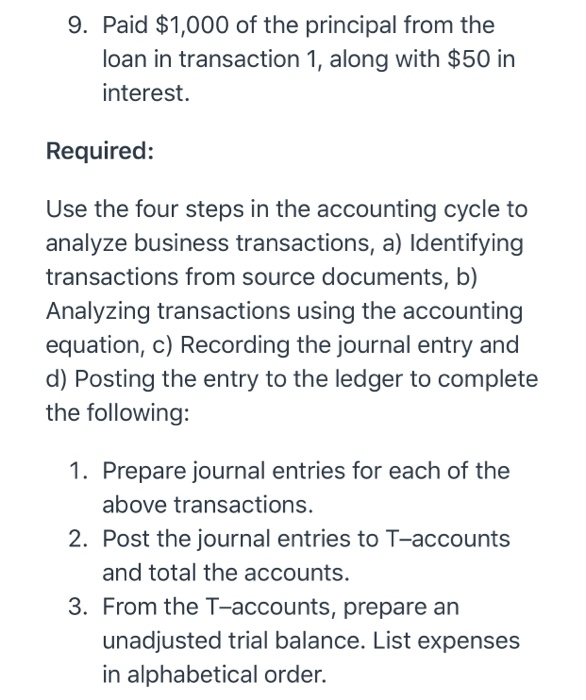

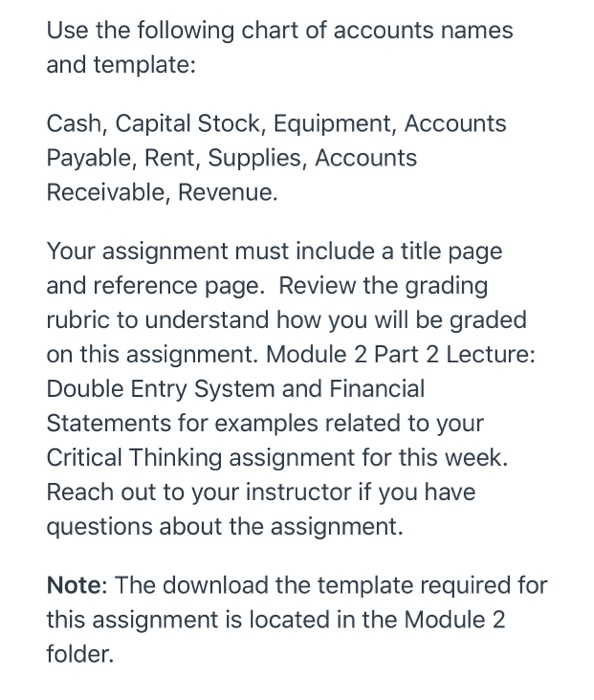

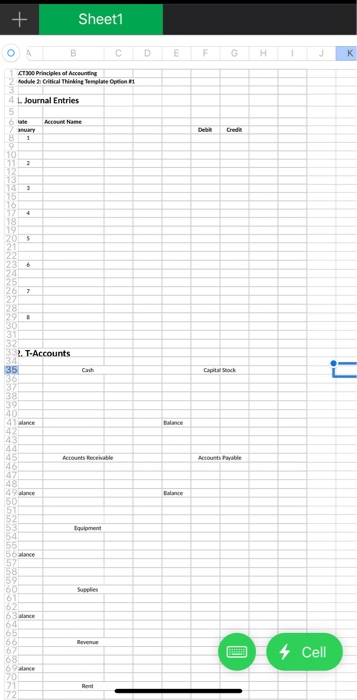

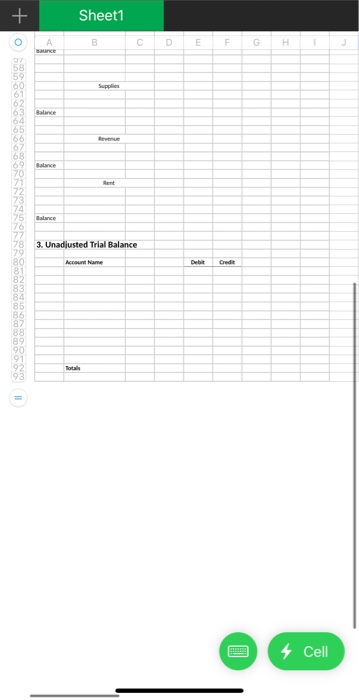

Option #1: The Four Steps in the Accounting Process You are operating your accounting firm. Your first client had the following transactions in April 20x7: 1. Borrowed $10,000 from the bank. 2. Purchased $2,250 of computer equipment for cash. 3. Paid $750 cash for this month's rent. 4. Purchased $1,500 of office supplies on credit. It is expected that these supplies will last for 3 months. 5. Billed $500 to customers for services rendered during April. 6. Paid cash for the $1,500 balance owed to the vendor from Transaction 4. 7. Collected $450 cash of the amount billed to the customer in Transaction 5 8. Sold one-half of the equipment purchased in Transaction 2 for $1,125 in cash, with no gain or loss recognized on the sale. 9. Paid $1,000 of the principal from the loan in transaction 1, along with $50 in interest. Required: Use the four steps in the accounting cycle to analyze business transactions, a) Identifying transactions from source documents, b) Analyzing transactions using the accounting equation, c) Recording the journal entry and d) Posting the entry to the ledger to complete the following: 1. Prepare journal entries for each of the above transactions. 2. Post the journal entries to T-accounts and total the accounts. 3. From the T-accounts, prepare an unadjusted trial balance. List expenses in alphabetical order. Use the following chart of accounts names and template: Cash, Capital Stock, Equipment, Accounts Payable, Rent, Supplies, Accounts Receivable, Revenue. Your assignment must include a title page and reference page. Review the grading rubric to understand how you will be graded on this assignment. Module 2 Part 2 Lecture: Double Entry System and Financial Statements for examples related to your Critical Thinking assignment for this week. Reach out to your instructor if you have questions about the assignment. Note: The download the template required for this assignment is located in the Module 2 folder. + Sheet1 O A B C D E F CT 300 Principles of Accounting duke 2 Critical Thinking Template prin 11 4 L Journal Entries 33. T-Accounts O Cell Sheet1 B C D E F G H I 3. Unadjusted Trial Balance