Answered step by step

Verified Expert Solution

Question

1 Approved Answer

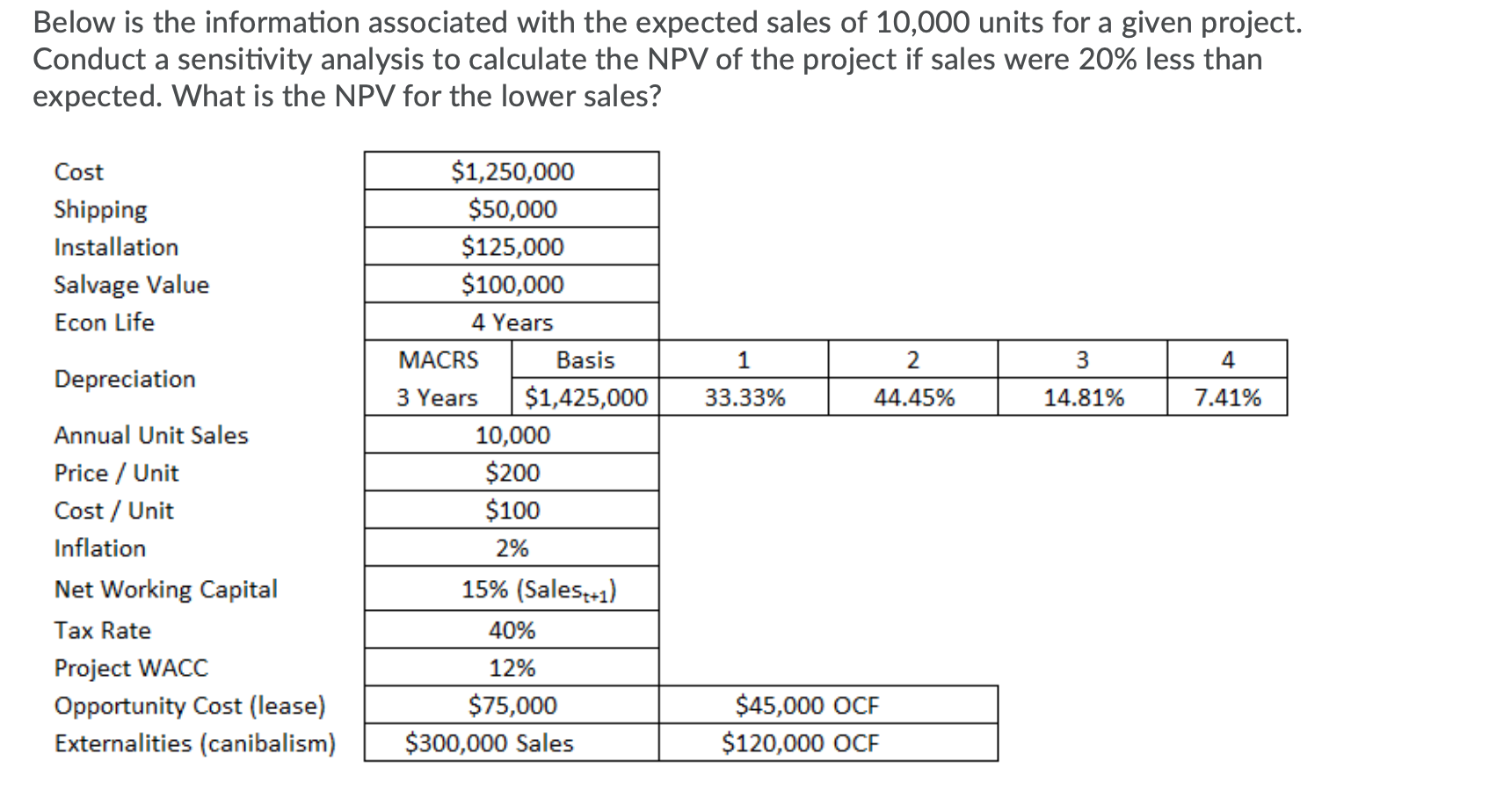

Option: A. 637,762 B. 285,719 C. -66,324 D. -7,651 Below is the information associated with the expected sales of 10,000 units for a given project.

Option:

A. 637,762

B. 285,719

C. -66,324

D. -7,651

Below is the information associated with the expected sales of 10,000 units for a given project. Conduct a sensitivity analysis to calculate the NPV of the project if sales were 20% less than expected. What is the NPV for the lower sales? Cost Shipping Installation Salvage Value Econ Life 1 2 3 4 Depreciation $1,250,000 $50,000 $125,000 $100,000 4 Years MACRS Basis 3 Years $1,425,000 10,000 $200 $100 2% 15% (Salest+1) 40% 33.33% 44.45% 14.81% 7.41% Annual Unit Sales Price / Unit Cost / Unit Inflation Net Working Capital Tax Rate Project WACC Opportunity Cost (lease) Externalities (canibalism) 12% $75,000 $300,000 Sales $45,000 OCF $120,000 OCEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started