Question: Option to delay Look back at the Malted Herring option in Section 22-2. How did the company's analysts estimate the present value of the project?

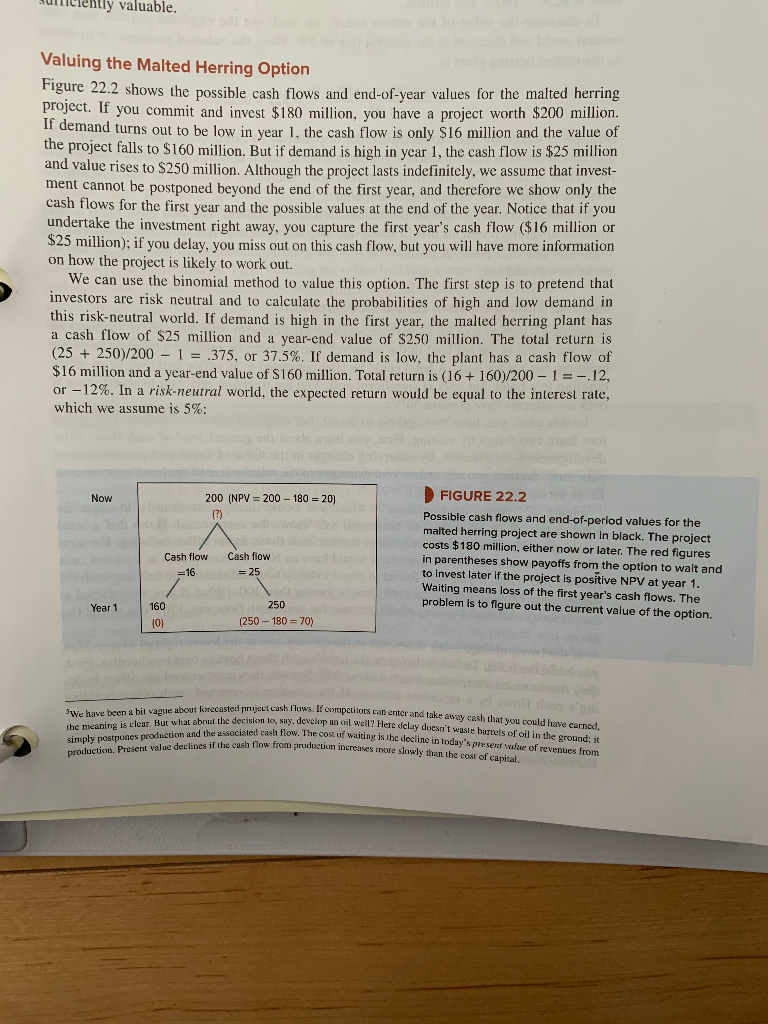

Option to delay Look back at the Malted Herring option in Section 22-2. How did the company's analysts estimate the present value of the project? It turns out that they assumed that the probability of low demand was about 45%. They then estimated the expected payoff as (.45 x 176) + (.55 x 275) = 230. Discounting at the company's 15% cost of capital gave a present value for the project of 230/1.15 = 200. a. How would this present value change if the probability of low demand was 55%? How would it change if the project's cost of capital was higher than the company cost of capital at, say, 20%? b. Now estimate how these changes in assumptions would affect the value of the option to delay. Juliently valuable. Valuing the Malted Herring Option Figure 22.2 shows the possible cash flows and end-of-year values for the malted herring project. If you commit and invest $180 million, you have a project worth $200 million. demand turns out to be low in year 1. the cash flow is only $16 million and the value of the project falls to $160 million. But if demand is high in year 1, the cash flow is $25 million and value rises to $250 million. Although the project lasts indefinitely, we assume that invest- ment cannot be postponed beyond the end of the first year, and therefore we show only the cash flows for the first year and the possible values at the end of the year. Notice that if you undertake the investment right away, you capture the first year's cash flow ($16 million or $25 million); if you delay, you miss out on this cash flow, but you will have more information on how the project is likely to work out. We can use the binomial method to value this option. The first step is to pretend that investors are risk neutral and to calculate the probabilities of high and low demand in this risk-neutral world. If demand is high in the first year, the malted herring plant has a cash flow of $25 million and a year-end value of $250 million. The total return is (25 + 250/200 - 1 = .375, or 37.5%. If demand is low, the plant has a cash flow of $16 million and a year-end value of $160 million. Total return is (16 + 160/200 - 1= -12, or -12%. In a risk-neutral world, the expected return would be equal to the interest rate, which we assume is 5%: Now 200 (NPV = 200 - 180 = 20) Cash flow =16 Cash flow = 25 FIGURE 22.2 Possible cash flows and end-of-period values for the malted herring project are shown in black. The project costs $180 million, either now or later. The red figures in parentheses show payoffs from the option to wait and to invest later if the project is positive NPV at year 1. Waiting means loss of the first year's cash flows. The problem is to figure out the current value of the option. Year 1 160 250 (250 - 180 = 70) SWe have been a bit vague about forecaster prijet cash flows. If the meaning is clear. But what about the decision to sold simply postpones production and the associated cash fl production Present value declines if the cash flow fro casteduject cash flows. If competitors can enter and take away cash that you could have care the decision to say, develop an oil well? Here delay doesn't kaste barrels of oil in the ground it sociated cash flow. The cost of waiting is be decline in today's presex ware of revenues from les if the cash flow from pruductiun increases more slowly than the cost of capital Option to delay Look back at the Malted Herring option in Section 22-2. How did the company's analysts estimate the present value of the project? It turns out that they assumed that the probability of low demand was about 45%. They then estimated the expected payoff as (.45 x 176) + (.55 x 275) = 230. Discounting at the company's 15% cost of capital gave a present value for the project of 230/1.15 = 200. a. How would this present value change if the probability of low demand was 55%? How would it change if the project's cost of capital was higher than the company cost of capital at, say, 20%? b. Now estimate how these changes in assumptions would affect the value of the option to delay. Juliently valuable. Valuing the Malted Herring Option Figure 22.2 shows the possible cash flows and end-of-year values for the malted herring project. If you commit and invest $180 million, you have a project worth $200 million. demand turns out to be low in year 1. the cash flow is only $16 million and the value of the project falls to $160 million. But if demand is high in year 1, the cash flow is $25 million and value rises to $250 million. Although the project lasts indefinitely, we assume that invest- ment cannot be postponed beyond the end of the first year, and therefore we show only the cash flows for the first year and the possible values at the end of the year. Notice that if you undertake the investment right away, you capture the first year's cash flow ($16 million or $25 million); if you delay, you miss out on this cash flow, but you will have more information on how the project is likely to work out. We can use the binomial method to value this option. The first step is to pretend that investors are risk neutral and to calculate the probabilities of high and low demand in this risk-neutral world. If demand is high in the first year, the malted herring plant has a cash flow of $25 million and a year-end value of $250 million. The total return is (25 + 250/200 - 1 = .375, or 37.5%. If demand is low, the plant has a cash flow of $16 million and a year-end value of $160 million. Total return is (16 + 160/200 - 1= -12, or -12%. In a risk-neutral world, the expected return would be equal to the interest rate, which we assume is 5%: Now 200 (NPV = 200 - 180 = 20) Cash flow =16 Cash flow = 25 FIGURE 22.2 Possible cash flows and end-of-period values for the malted herring project are shown in black. The project costs $180 million, either now or later. The red figures in parentheses show payoffs from the option to wait and to invest later if the project is positive NPV at year 1. Waiting means loss of the first year's cash flows. The problem is to figure out the current value of the option. Year 1 160 250 (250 - 180 = 70) SWe have been a bit vague about forecaster prijet cash flows. If the meaning is clear. But what about the decision to sold simply postpones production and the associated cash fl production Present value declines if the cash flow fro casteduject cash flows. If competitors can enter and take away cash that you could have care the decision to say, develop an oil well? Here delay doesn't kaste barrels of oil in the ground it sociated cash flow. The cost of waiting is be decline in today's presex ware of revenues from les if the cash flow from pruductiun increases more slowly than the cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts