Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a 5-year bond with a face value of $100 that pays an annual coupon of 6% and is currently rated BBB. The expected

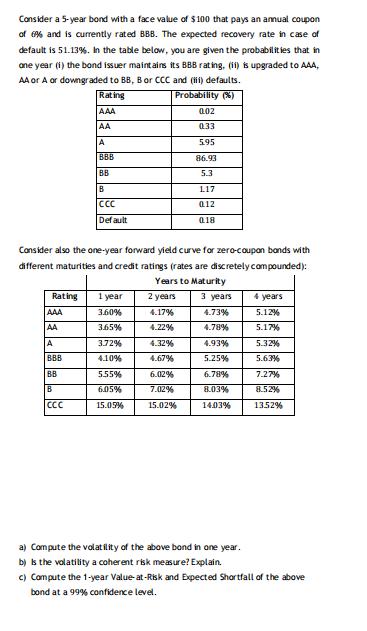

Consider a 5-year bond with a face value of $100 that pays an annual coupon of 6% and is currently rated BBB. The expected recovery rate in case of default is 51.13%. In the table below, you are given the probabilities that in one year (i) the bond issuer maintains its BBB rating, (ii) is upgraded to AAA, AA or A or downgraded to BB, B or CCC and (ii) defaults. Rating Probability (%) AAA AA A BBB BB Rating AAA AA A BBB BB B CCC Default B CCC Consider also the one-year forward yield curve for zero-coupon bonds with different maturities and credit ratings (rates are discretely compounded): Years to Maturity 2 years 3 years 4.17% 4.73% 4.22% 4.78% 4.32% 4.93% 4.67% 5.25% 6.02% 6.78% 7.02% 8.03% 15.02% 14.03% 1 year 3.60% 3.65% 3.72% 4.10% 002 0.33 5.55% 6.05% 15.05% 5.95 86.93 5.3 117 012 018 4 years 5.12% 5.17% 5.32% 5.63% 7.27% 8.5.2% 13.52% a) Compute the volatility of the above bond in one year. b) is the volatility a coherent risk measure? Explain. c) Compute the 1-year Value-at-Risk and Expected Shortfall of the above bond at a 99% confidence level.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Question Stepbystep explanation a The volatility of the above bond in one year can be calculated as follows Volatility 002 3602 033 3652 595 3722 8693 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started