Answered step by step

Verified Expert Solution

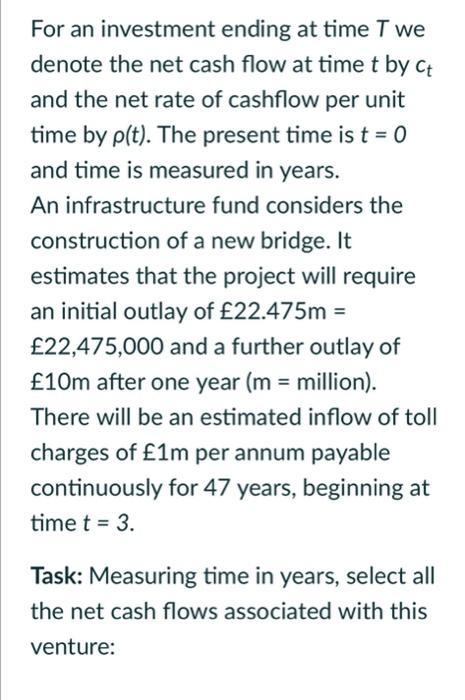

Question

1 Approved Answer

Options: 1: 2: 3: 4: 5: Previous question as mentioned Task (following on from the previous part): Assume that the fund may borrow or lend

Options:

1:

2:

3:

4:

5:

Previous question as mentioned

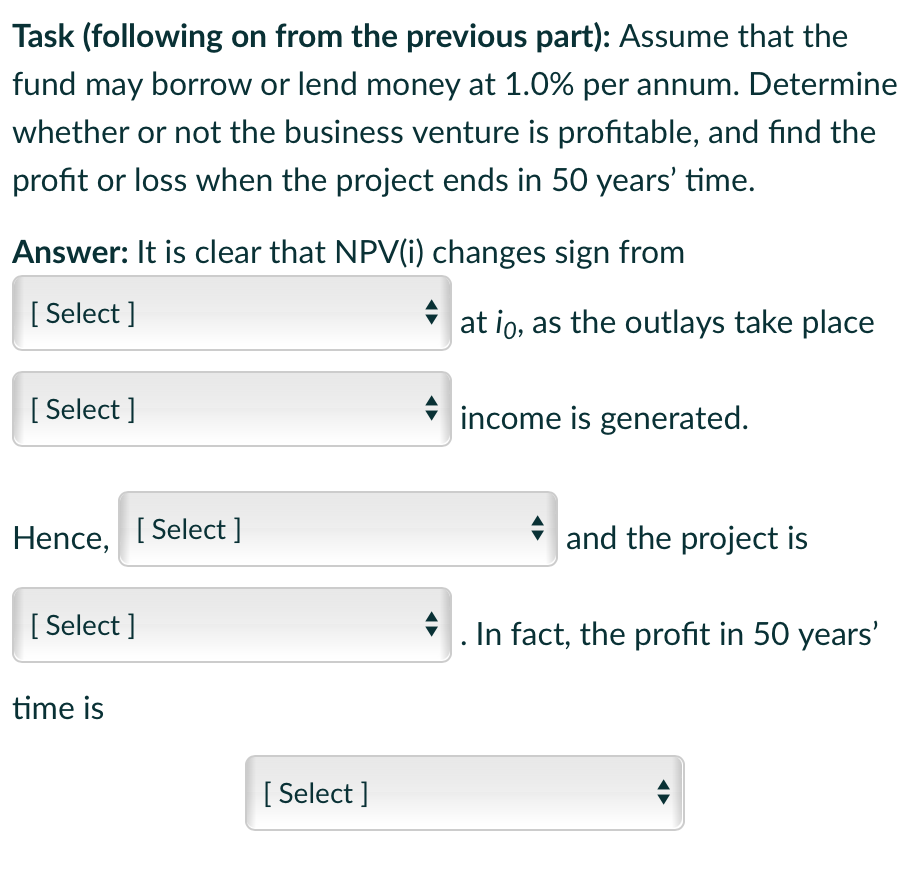

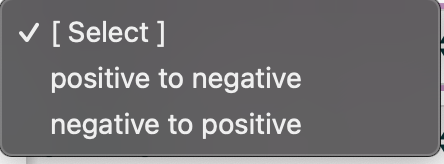

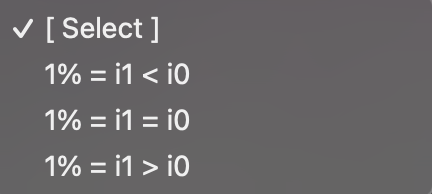

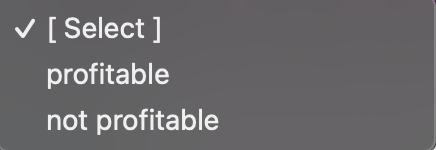

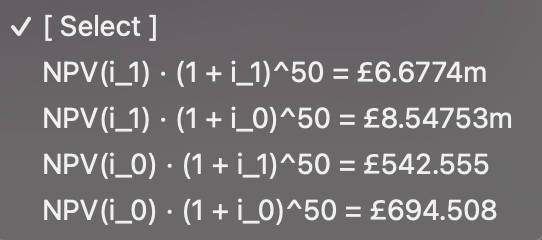

Task (following on from the previous part): Assume that the fund may borrow or lend money at 1.0% per annum. Determine whether or not the business venture is profitable, and find the profit or loss when the project ends in 50 years' time. Answer: It is clear that NPV(i) changes sign from [ Select] at io, as the outlays take place [ Select] income is generated. Hence, [Select ] and the project is [ Select ] . In fact, the profit in 50 years' time is [ Select] [Select ] positive to negative negative to positive [Select ] before after [Select ] 1% = i1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started