Answered step by step

Verified Expert Solution

Question

1 Approved Answer

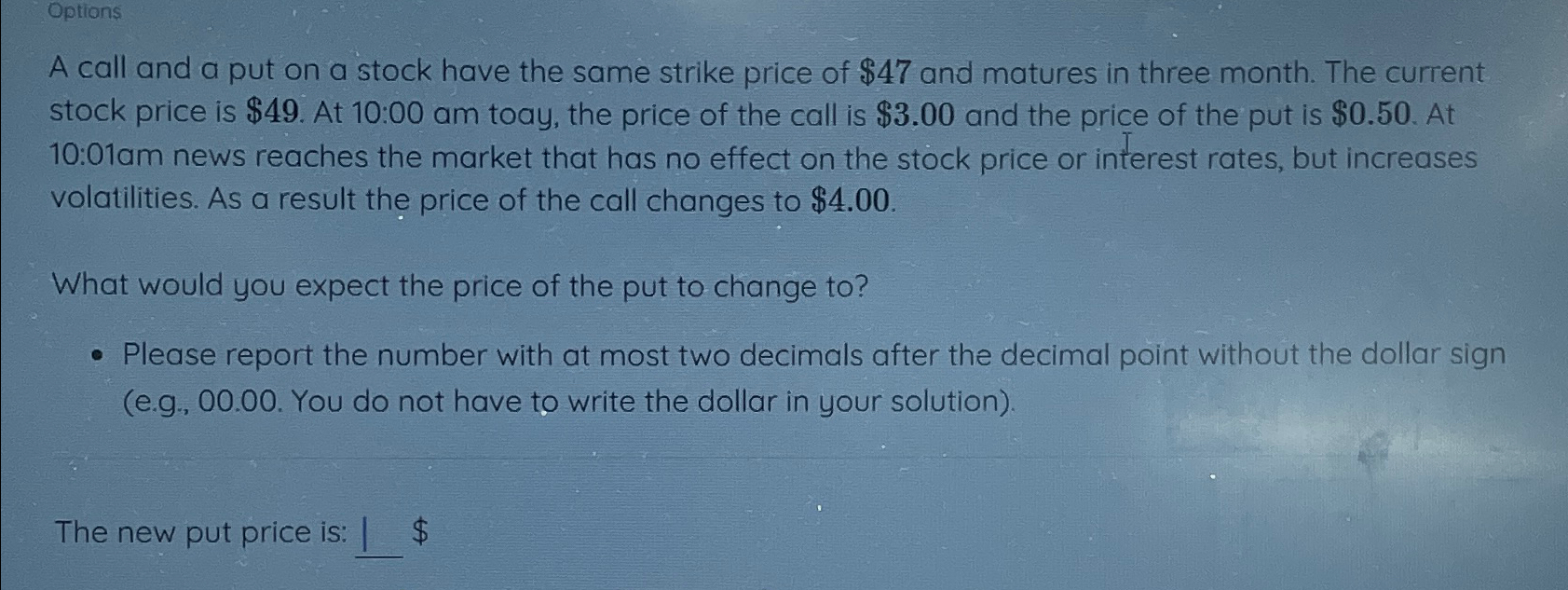

Options A call and a put on a stock have the same strike price of $ 4 7 and matures in three month. The current

Options

A call and a put on a stock have the same strike price of $ and matures in three month. The current stock price is $ At : am toay, the price of the call is $ and the price of the put is $ At :am news reaches the market that has no effect on the stock price or interest rates, but increases volatilities. As a result the price of the call changes to $

What would you expect the price of the put to change to

Please report the number with at most two decimals after the decimal point without the dollar sign eg You do not have to write the dollar in your solution

The new put price is: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started