Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Options: A (Fixed/Variable) B (Increased/Decreased) C (Increased/Decreased) D (Multiple) F (Higher/Lower) While the agency conflicts between managers and shareholders tend to receive the most press,

Options:

A (Fixed/Variable)

B (Increased/Decreased)

C (Increased/Decreased)

D (Multiple)

F (Higher/Lower)

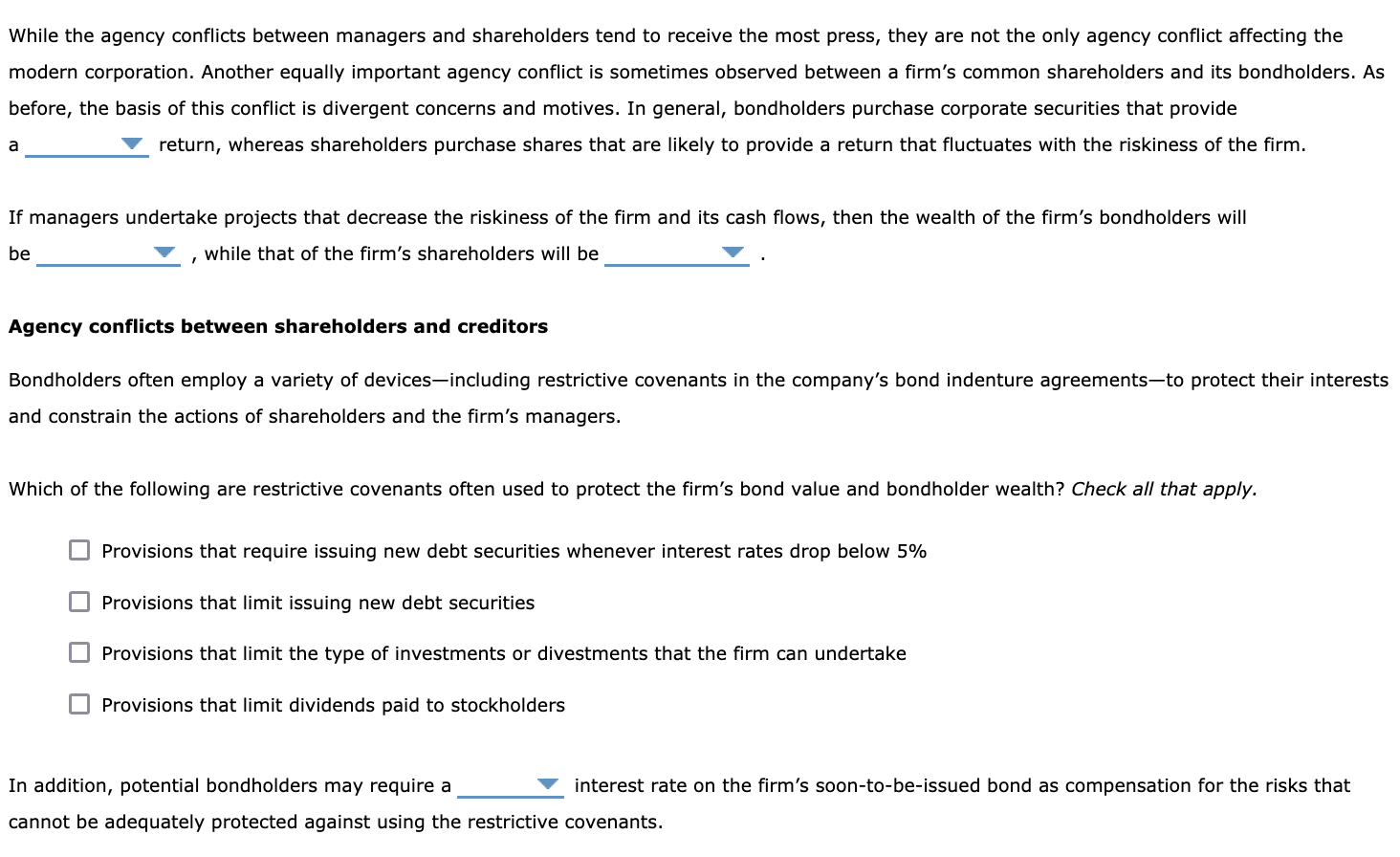

While the agency conflicts between managers and shareholders tend to receive the most press, they are not the only agency conflict affecting the modern corporation. Another equally important agency conflict is sometimes observed between a firm's common shareholders and its bondholders. As before, the basis of this conflict is divergent concerns and motives. In general, bondholders purchase corporate securities that provide a return, whereas shareholders purchase shares that are likely to provide a return that fluctuates with the riskiness of the firm. If managers undertake projects that decrease the riskiness of the firm and its cash flows, then the wealth of the firm's bondholders will be while that of the firm's shareholders will be Agency conflicts between shareholders and creditors Bondholders often employ a variety of devices including restrictive covenants in the company's bond indenture agreementsto protect their interests and constrain the actions of shareholders and the firm's managers. Which of the following are restrictive covenants often used to protect the firm's bond value and bondholder wealth? Check all that apply. O Provisions that require issuing new debt securities whenever interest rates drop below 5% Provisions that limit issuing new debt securities Provisions that limit the type of investments or divestments that the firm can undertake Provisions that limit dividends paid to stockholders In addition, potential bondholders may require a interest rate on the firm's soon-to-be-issued bond as compensation for the risks that cannot be adequately protected against using the restrictive covenants

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started