Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Options and Futures Questions: Make the choice, A or B. Partial Hedge is not allowed, i.e. either choice should be on the entire 100,000 units.

Options and Futures Questions:

Options and Futures Questions:

Make the choice, A or B. Partial Hedge is not allowed, i.e. either choice should be on the entire 100,000 units.

In one paragraph, explain your rationale for the choice

Please turn in your response electronically on Blackboard in any desired format by the deadline

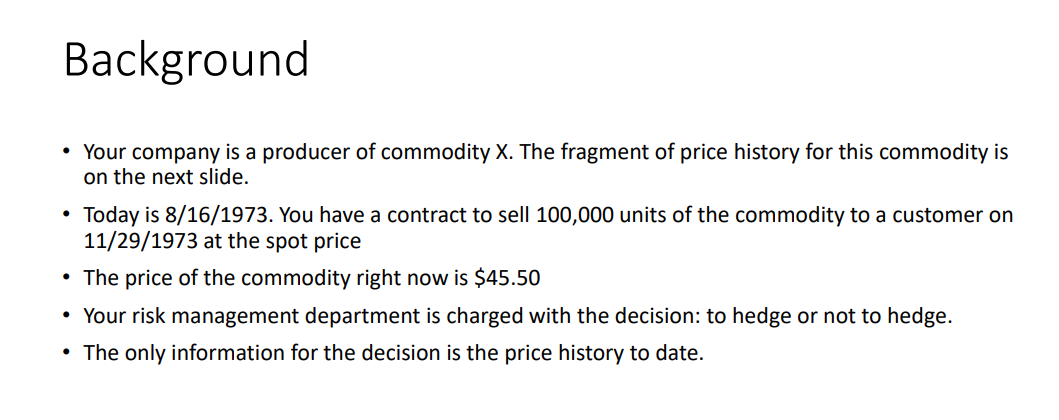

Background Your company is a producer of commodity X. The fragment of price history for this commodity is on the next slide. Today is 8/16/1973. You have a contract to sell 100,000 units of the commodity to a customer on 11/29/1973 at the spot price The price of the commodity right now is $45.50 Your risk management department is charged with the decision: to hedge or not to hedge. The only information for the decision is the price history to date. 8/16/73 $45.50 $47.00 $46.00 $45.00 $44.00 $43.00 $42.00 $41.00 $40.00 7/20/72 9/8/72 10/28/72 12/17/72 2/5/73 3/27/73 5/16/73 7/5/73 8/24/73 10/13/73 The Choice Choices: A. Let float (not hedge at all) B. Sell a swap to a dealer, currently quoted Bid 45.25 If you choose A, then on 11/29/1973, you will deliver the commodity and receive the spot price, being at the mercy of the market If you choose B, then on 11/29/1973, you will deliver the commodity and receive the spot price, and you will pay the spot price to the swap dealer and receive the fixed price from the dealer as a result, the spot price will be passed through, and your net price will be fixed $45.25 The Choice Basically, if you want to take the risk and stay exposed to the market price, choose A. If you are concerned about the price risk, and you want to fix your net price at $45.25, choose B. Remember that if the price turns out to be above $45.25, you will lose on the hedge (without the hedge, you would have received a better price) But if the price turns out to be below $45.25, you will gain on the hedge (without the hedge, you would have receive a worse price) Swap: Example 1 Suppose the spot price on 11/29/1973 turns out $50 If you choose option B (sell the swap to the dealer at the bid), then you will Pay $50 * 100,000 = $5,000,000 to the swap dealer Receive $45.25 * 100,000 = $4,525,000 from the swap dealer Lost on the hedge: (4,525,000 5,000,000) = -$475,000 Swap: Example 2 Suppose the spot price on 11/29/1973 turns out $40 If you choose option B (sell the swap to the dealer at the bid), then you will Pay $40 * 100,000 = $4,000,000 to the swap dealer Receive $45.25 * 100,000 = $4,525,000 from the swap dealer Gained on the hedge: (4,525,000 4,000,000) = $525,000 Background Your company is a producer of commodity X. The fragment of price history for this commodity is on the next slide. Today is 8/16/1973. You have a contract to sell 100,000 units of the commodity to a customer on 11/29/1973 at the spot price The price of the commodity right now is $45.50 Your risk management department is charged with the decision: to hedge or not to hedge. The only information for the decision is the price history to date. 8/16/73 $45.50 $47.00 $46.00 $45.00 $44.00 $43.00 $42.00 $41.00 $40.00 7/20/72 9/8/72 10/28/72 12/17/72 2/5/73 3/27/73 5/16/73 7/5/73 8/24/73 10/13/73 The Choice Choices: A. Let float (not hedge at all) B. Sell a swap to a dealer, currently quoted Bid 45.25 If you choose A, then on 11/29/1973, you will deliver the commodity and receive the spot price, being at the mercy of the market If you choose B, then on 11/29/1973, you will deliver the commodity and receive the spot price, and you will pay the spot price to the swap dealer and receive the fixed price from the dealer as a result, the spot price will be passed through, and your net price will be fixed $45.25 The Choice Basically, if you want to take the risk and stay exposed to the market price, choose A. If you are concerned about the price risk, and you want to fix your net price at $45.25, choose B. Remember that if the price turns out to be above $45.25, you will lose on the hedge (without the hedge, you would have received a better price) But if the price turns out to be below $45.25, you will gain on the hedge (without the hedge, you would have receive a worse price) Swap: Example 1 Suppose the spot price on 11/29/1973 turns out $50 If you choose option B (sell the swap to the dealer at the bid), then you will Pay $50 * 100,000 = $5,000,000 to the swap dealer Receive $45.25 * 100,000 = $4,525,000 from the swap dealer Lost on the hedge: (4,525,000 5,000,000) = -$475,000 Swap: Example 2 Suppose the spot price on 11/29/1973 turns out $40 If you choose option B (sell the swap to the dealer at the bid), then you will Pay $40 * 100,000 = $4,000,000 to the swap dealer Receive $45.25 * 100,000 = $4,525,000 from the swap dealer Gained on the hedge: (4,525,000 4,000,000) = $525,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started