Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Options are: 1. Intermediary, Seller, Buyer 2. Intermediary, Seller, Buyer 3. Fill in the blank 4. Pay, lend, receive, borrow, ignore 5. Above, up to,

Options are:

Options are:

1. Intermediary, Seller, Buyer

2. Intermediary, Seller, Buyer

3. Fill in the blank

4. Pay, lend, receive, borrow, ignore

5. Above, up to, down to, below

6. Fill in the blank

7. Pay, lend, receive, borrow, ignore

8. Pay, lend, receive, borrow, ignore

9. Fill in the blank

10. Pay, lend, receive, borrow, ignore

11. Above, up to, down to, below

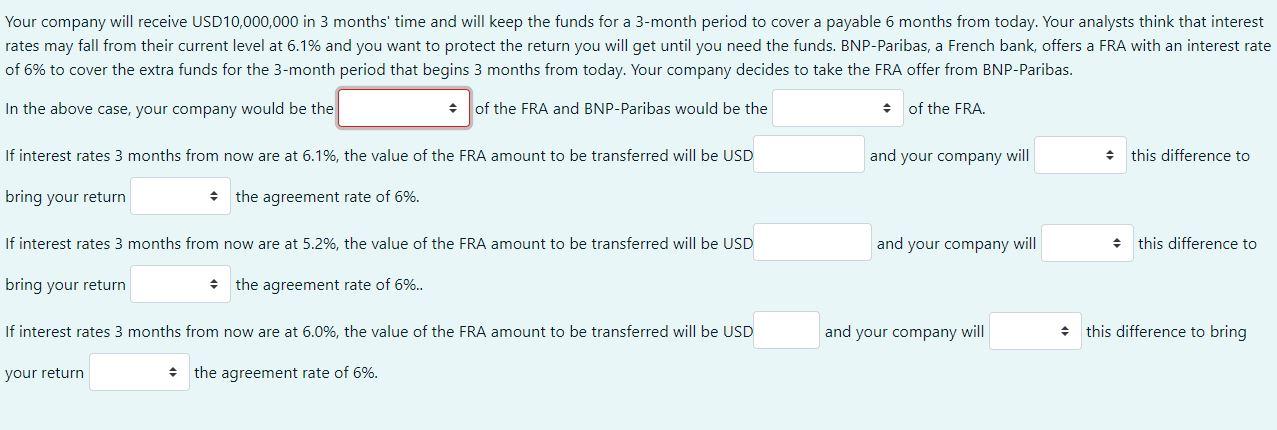

Your company will receive USD10,000,000 in 3 months' time and will keep the funds for a 3-month period to cover a payable 6 months from today. Your analysts think that interest rates may fall from their current level at 6.1% and you want to protect the return you will get until you need the funds. BNP-Paribas, a French bank, offers a FRA with an interest rate of 6% to cover the extra funds for the 3-month period that begins 3 months from today. Your company decides to take the FRA offer from BNP-Paribas. In the above case, your company would be the + of the FRA and BNP-Paribas would be the of the FRA If interest rates 3 months from now are at 6.1%, the value of the FRA amount to be transferred will be USD and your company will this difference to bring your return the agreement rate of 6%. If interest rates 3 months from now are at 5.2%, the value of the FRA amount to be transferred will be USD and your company will this difference to bring your return the agreement rate of 6%.. If interest rates 3 months from now are at 6.0%, the value of the FRA amount to be transferred will be USD and your company will this difference to bring your return the agreement rate of 6%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started