Answered step by step

Verified Expert Solution

Question

1 Approved Answer

options are :Cash Flows, Present Discounted value,interest rate is based on the notion that a dollar paid in the future is less valuable than a

options are :Cash Flows, Present Discounted value,interest rate

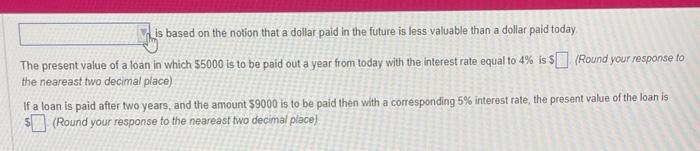

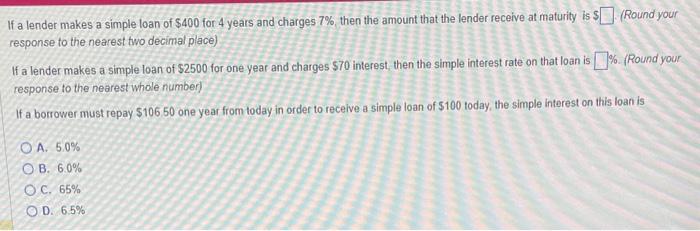

is based on the notion that a dollar paid in the future is less valuable than a dollar paid today The present value of a loan in which $5000 is to be paid out a year from today with the interest rate equal to 4% is $ (Round your response to the neareast two decimal place) If a loan is paid after two years, and the amount $9000 is to be paid then with a corresponding 5% interest rate, the present value of the loan is 5. (Round your response to the neareast two decimal place). If a lender makes a simple loan of $400 for 4 years and charges 7%, then the amount that the lender receive at maturity is $ (Round your response to the nearest two decimal place) If a lender makes a simple loan of $2500 for one year and charges $70 interest, then the simple interest rate on that loan is: \%. (Round your response to the nearest whole number) If a borrower must repay $106.50 one year from today in order to receive a simple loan of $100 today, the simple interest on this loan is A. 5.0% B. 6.0% C. 65% D. 6.5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started