Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Options are today or in 60 days What are spot rates and forward rates? Sweet Dog Manufacturing, a U.S. company, produces and exports industrial machinery

Options are today or in 60 days

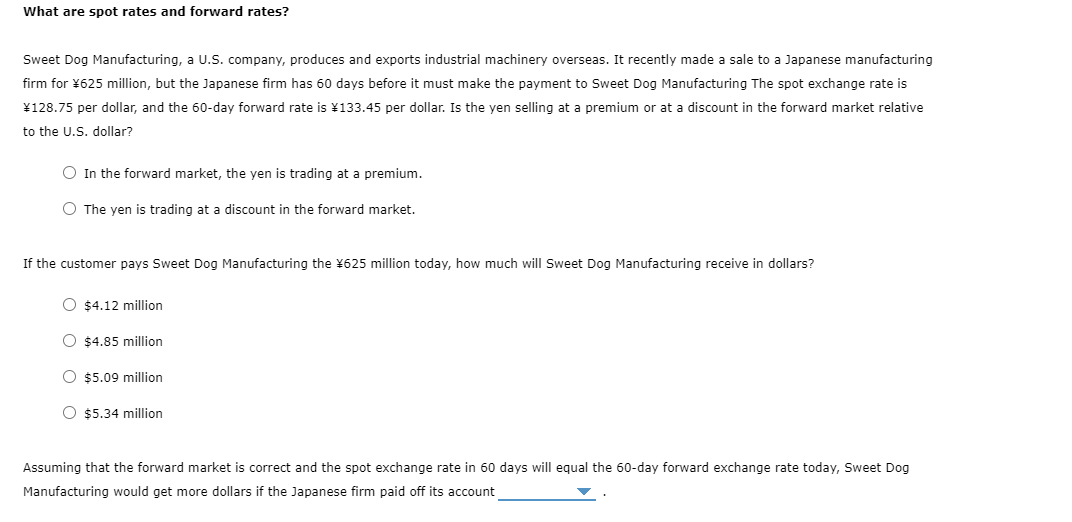

What are spot rates and forward rates? Sweet Dog Manufacturing, a U.S. company, produces and exports industrial machinery overseas. It recently made a sale to a Japanese manufacturing firm for 625 million, but the Japanese firm has 60 days before it must make the payment to Sweet Dog Manufacturing The spot exchange rate is 128.75 per dollar, and the 60 -day forward rate is 133.45 per dollar. Is the yen selling at a premium or at a discount in the forward market relative to the U.S. dollar? In the forward market, the yen is trading at a premium. The yen is trading at a discount in the forward market. If the customer pays Sweet Dog Manufacturing the 625 million today, how much will Sweet Dog Manufacturing receive in dollars? $4.12 million $4.85 million $5.09 milion $5.34 milion Assuming that the forward market is correct and the spot exchange rate in 60 days will equal the 60 -day forward exchange rate today, Sweet Dog Manufacturing would get more dollars if the Japanese firm paid off its accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started