Answered step by step

Verified Expert Solution

Question

1 Approved Answer

OPTIONS for 5: more/less 2nd dropdown: future/past 4. Dividend policy A firm's value depends on its expected free cash flow and its cost of capital.

OPTIONS for 5: more/less

2nd dropdown: future/past

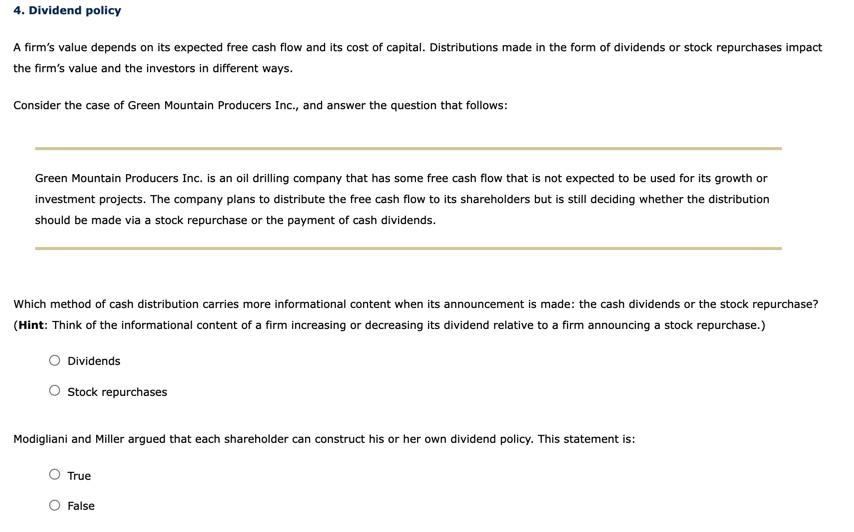

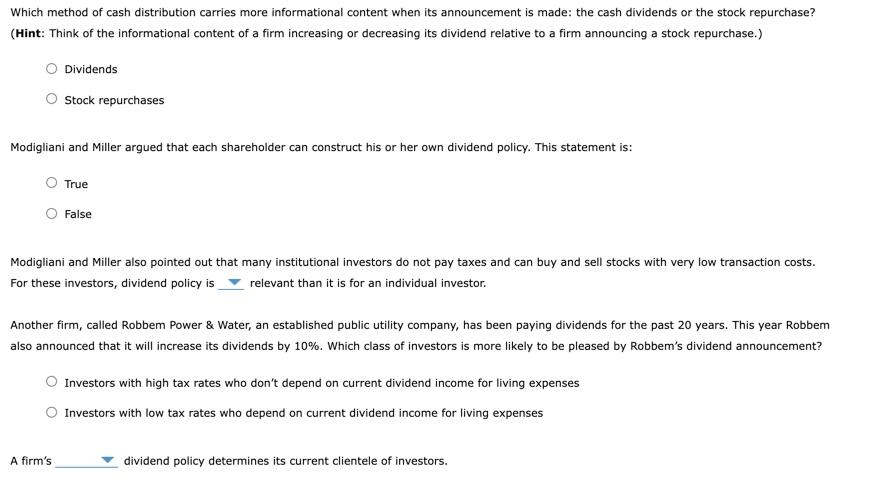

4. Dividend policy A firm's value depends on its expected free cash flow and its cost of capital. Distributions made in the form of dividends or stock repurchases impact the firm's value and the investors in different ways. Consider the case of Green Mountain Producers Inc., and answer the question that follows: Green Mountain Producers Inc. is an oil drilling company that has some free cash flow that is not expected to be used for its growth or investment projects. The company plans to distribute the free cash flow to its shareholders but is still deciding whether the distribution should be made via a stock repurchase or the payment of cash dividends. Which method of cash distribution carries more informational content when its announcement is made the cash dividends or the stock repurchase? (Hint: Think of the informational content of a firm increasing or decreasing its dividend relative to a firm announcing a stock repurchase.) Dividends Stock repurchases Modigliani and Miller argued that each shareholder can construct his or her own dividend policy. This statement is: o True O False Which method of cash distribution carries more informational content when its announcement is made: the cash dividends or the stock repurchase? (Hint: Think of the informational content of a firm increasing or decreasing its dividend relative to a firm announcing a stock repurchase.) Dividends Stock repurchases Modigliani and Miller argued that each shareholder can construct his or her own dividend policy. This statement is: True O False Modigliani and Miller also pointed out that many institutional investors do not pay taxes and can buy and sell stocks with very low transaction costs. For these investors, dividend policy is relevant than it is for an individual investor. Another firm, called Robbem Power & Water, an established public utility company, has been paying dividends for the past 20 years. This year Robbem also announced that it will increase its dividends by 10%. Which class of investors is more likely to be pleased by Robbem's dividend announcement? Investors with high tax rates who don't depend on current dividend income for living expenses Investors with low tax rates who depend on current dividend income for living expenses A firm's dividend policy determines its current clientele of investorsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started