Answered step by step

Verified Expert Solution

Question

1 Approved Answer

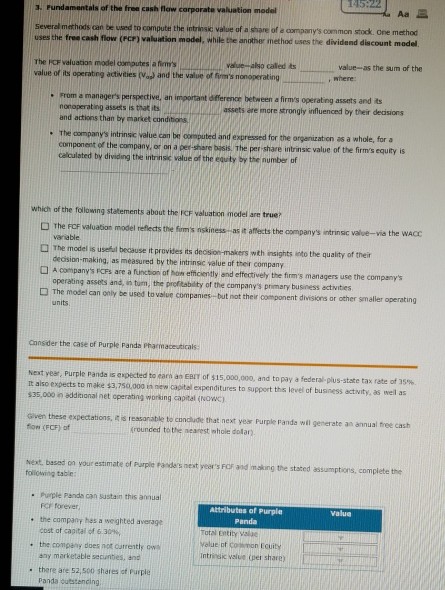

options for blanks in order 1.historical ,market, or intrinsic 2.enitity, excess, equity 3.liabilities,assets,equity 4. operating, nonoperating 5.common shares outstanding, prefered shares outstanding,common shareholders, debtholders A.

options for blanks in order

1.historical ,market, or intrinsic

2.enitity, excess, equity

3.liabilities,assets,equity

4. operating, nonoperating

5.common shares outstanding, prefered shares outstanding,common shareholders, debtholders

A. rundamuntels ar tne frone ash how corporatu veluation mede Severel mathots can t d t ompute the introsk valure of a stare of a campanys canmon stok one method (ecr) valuition modte another method uses the dividend discount model uses the free cash flow value-as the sum of the The KcF valuation model computes a fems value of its value also called ts operating activities Na) and the value of fipe's nonoperating , where: , rrom a manager's perspective, an important offerenoer between a firm's operating assets and ts nonoperating assets is mat its and actions than by market conditions sote assets are more strongly influenced by their decisions The company's intrinsic value can be oraputed and expressed for the orgenization as a component of the company. or on a pen share calculated by dividing the intrinsic value of the eouty by the number of busis. The per-share intrinsic value of the firm's equity is which of the following statements about the ICF valuation model are true? The reor vluad model nefands thr fims isaireses jas the firms nskiness -as it affects the company's intrinsic value-via the WACc variable a The model is useiul because it provites its deosion makers wth insights into the quality of their decision-making, as measured by the intrinsic value of their company A company's PCFs are a function of hon etficenitly and etfectively the firm's managers use the company's operaing assets and, n tum, the proftablity of the company's primary busness ectvites The model can only be used to value companies- but not their component divisions or cother smaller operating units Consder the case of Purple Fanda Pharmaceuticals Next year, Purple Panda is pected to earn an EBIT or $15,000,000, and to pay a federal-plus-state tax rate of 35% It also expects to make $3,750.000 in new caoitel expenditures to support ths level of business actvity, as well as s35,000 n additional net operating working capitel (Nowc oven these expectations. E s reasarable to cancludle that nest vear Furpie Pands wil generate an annual free cash ton (FCF) of (rounded to the mearest mhole dolar) Next, basad on your estimate of Purpie Pades mest year's FoF and making the stated assumptions, complete the ollowing table: ple Pands can sustain this annual FOr forever Attributes of Purple value Panda the company hes a weighted average the company does not currently . there are 52, 500 shares ot Purple Total Entiby valae volue of comion Ecui cost of capital of 6.30%, intrinsic velue (per sharg) any marketable secuntes. and Panda butstencing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started